Early projections for US economic output in the first quarter point to extension of the rebound that started in last year’s Q3. A set of nowcasts point to GDP growth that’s currently on track to speed up modestly from the pace of growth reported for 2020’s final quarter.

Macro Briefing: 16 February 2021

* Pelosi announces plan for commission to investigate Capitol riot

* US debt ceiling issue unresolved in Biden’s $1.9 trillion relief program

* China considers restricting rare earths exports to US defense industry

* Severe winter weather triggers emergency declarations in at least seven states

* Winter weather lifts US crude oil benchmark above $60 a barrel

* Daily change in new US Covid-19 deaths falls to three-month low

* Biden and Fed don’t see inflation risk as a challenge

* Bitcoin rally raises price to record $50,000

* 30-year Treasury yield rises above 2%–highest in a year:

Emerging Markets Stocks Continue To Lead Major Asset Classes

Shares in emerging markets were again the top weekly performer for the major asset classes, based on a set of exchange traded funds. Commodities and foreign stocks in developed markets were close second- and third-place winners in last week’s trading through Friday, Feb. 12.

Macro Briefing: 15 February 2021

* Arctic freeze in Texas unleashes power blackouts

* US coronavirus infection rate falls to lowest since October

* Support grows for Capitol riot inquiry after Trump acquittal

* Myanmar protests continue after Feb. 1 military coup

* Investor demand for corporate debt driving a Wall Street lending boom

* Afghanistan is near tipping point as Taliban’s control of country advances

* Japan’s economy continues expanding in Q4, signaling resiliency

* Japan’s Nikkei 225 stock index rebounds to new high (30 years later)

* Eurozone industrial production fell more than expected in December

* US consumer sentiment falls to 6-month low in Feb as inflation outlooks rises:

Book Bits: 13 February 2021

● This Is How They Tell Me the World Ends:

● This Is How They Tell Me the World Ends:

The Cyberweapons Arms Race

Nicole Perlroth

Review via The Washington Post

The U.S. government is paying hackers for vulnerabilities it finds in software and hardware used by corporations and governments. Once they’ve bought those vulnerabilities, they’re turning them into cyberweapons employed in attacking or spying on adversaries.

That’s the moral, political and economic dilemma explored by “This Is How They Tell Me The World Ends: The Cyberweapons Arms Race,” a new book out today by New York Times cybersecurity reporter Nicole Perlroth.

The ETF Portfolio Strategist: 12 Feb 2021

In this issue:

- Stocks rise as Treasury yields tick higher

- Is the tide finally turning in favor of global asset allocation?

Programming note: Starting with this issue, ETF-PS will separate reporting on our portfolio strategy benchmarks from the proprietary strategies, which will be updated in an upcoming issue.

Equities rally as the reflation trade starts to pinch bonds: US equities rose for a second week, based on Vanguard Total US Stock Market (VTI). The fund gained 1.7% at Friday’s close (Feb. 12), marking the first back-to-back weekly gain this year and propelling VTI to a new record high.

Research Review | 12 February 2021 | Equity Factor Risk

Why Are High Exposures to Factor Betas Unlikely to Deliver Anticipated Returns?

Chris Brightman (Research Affiliates) et al.

January 11, 2021

By choosing investment strategies that intentionally create exposure to factor betas, investors may be obtaining uncompensated risks. We show across a wide variety of factors and geographical markets that factors constructed from fundamental characteristics have earned high returns, whereas those constructed from statistical betas have earned returns close to zero. When designing factor-based investment strategies, investors should seek exposure to the fundamental characteristics that define a factor and use statistical measures of factor betas to manage factor risks. Conversely, seeking to gain exposure to factor betas is a misguided means of obtaining the returns available from factor investing.

Macro Briefing: 12 February 2021

* House committee approves Biden’s $1.9 trillion relief program

* Biden says US has new deals to secure 200 million more vaccine doses

* Vaccine rollouts are improving across the US

* Trump’s legal team’s defense begins today in Senate impeach trial

* Fed’s Daly expects central bank bond buying to continue through 2021

* Eurozone headed for political battle over sharply higher debt levels

* Pondering how tech innovations will unleash a surge in productivity\

* UK GDP fell a record 9.9% in 2020 but rebounded in December

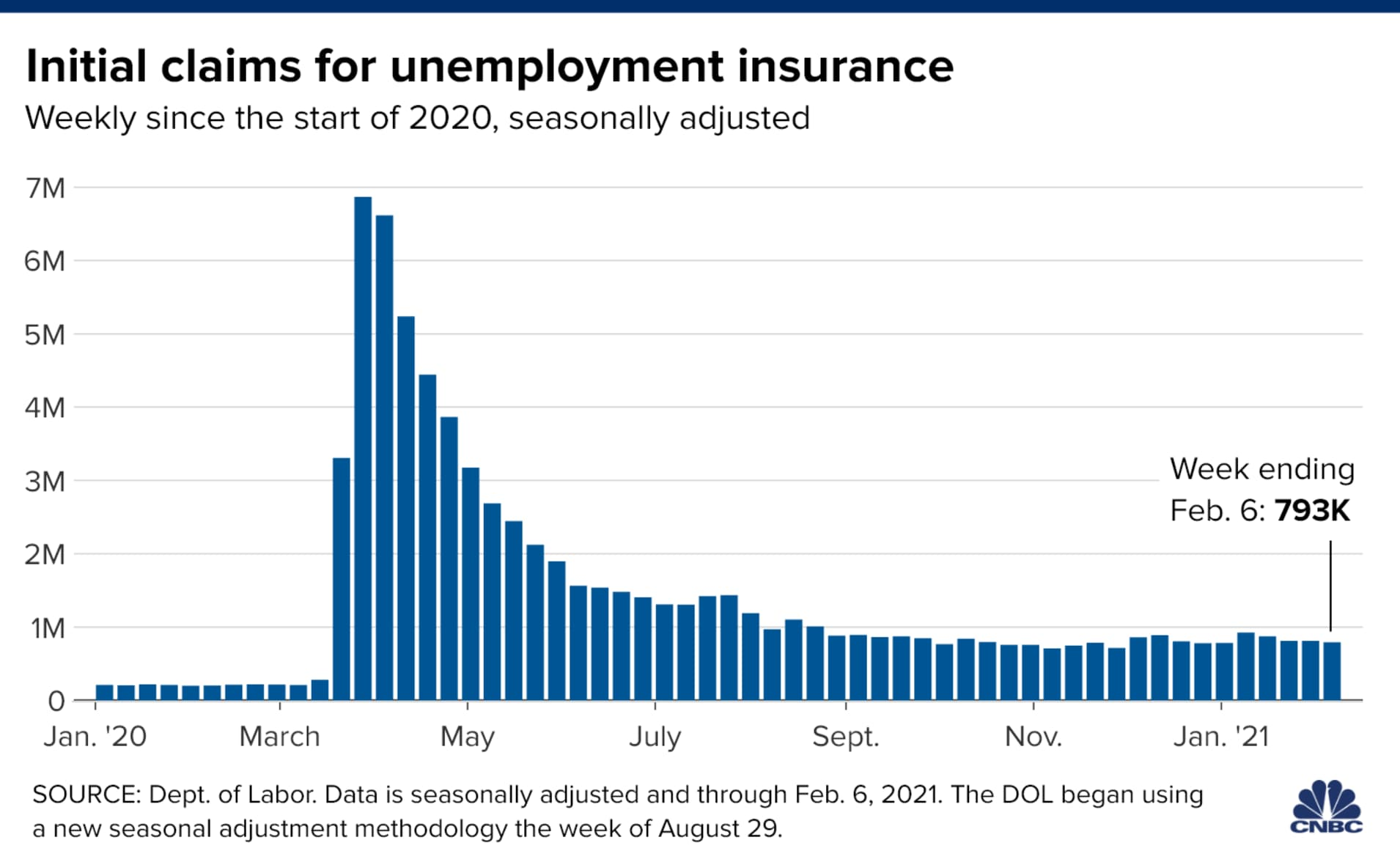

* US jobless claims signal stronger pandemic-related headwinds:

Small-Cap Risk Leads US Equity Factor Returns Year To Date

Small-capitalization shares are having a good year. It’s only mid-February, but year-to-date results continue to show a strong performance edge in favor of smaller stocks in the US equity space, based on a set of exchange traded funds through yesterday’s close (Feb. 10).

Macro Briefing: 11 February 2021

* President Biden discussed ‘fundamental concerns’ with China’s President Xi

* Dems press charges against Trump in second day of Senate impeachment trial

* Biden approves US sanctions on Myanamar’s military leaders after coup

* Biden team: US may not reach herd immunity until Thanksgiving at earliest

* Fed’s Powell reaffirms central bank’s commitment to ultra-low interest rates

* How a value shop used behavioral bias analytics to survive the value drought

* Rise of green energy will be painful for oil-producing nations, report advises

* Signaling end of era, Shell says its oil output will fall in years ahead

* Inflation isn’t a near-term issue, analyst predicts

* One-year trend in US consumer inflation remains modest in January: