The recent bull run in the major asset classes continued last week as foreign high-yield bonds and US real estate investment trusts (REITs) shared first place for performance, based on a set of exchange traded funds for the five trading days through Friday’s close (Dec. 4).

Continue reading

Macro Briefing: 7 December 2020

* Details on pandemic relief package expected from negotiators today

* Biden picks California Attorney General Xavier Becerra for top US health post

* China’s trade surplus widened to a record in November

* Sterling’s losses against US dollar continue as Brexit talks founder

* Car sales drive German industrial output sharply higher in October

* Slowdown in US payrolls threatens economic recovery

* US Treasury market’s implied inflation forecast rises to highest since May 2019:

Book Bits: 5 December 2020

● Less is More: How Degrowth Will Save the World

Jason Hickel

Review via Commonweal Magazine

In his recent book, Less is More: How Degrowth Will Save the World, the anthropologist Jason Hickel attempts to translate the main arguments of degrowthers into an accessible manifesto. He insists both that continued global expansion is incompatible with human and ecological flourishing, and that a future beyond growth need not be an austere one. Abundance can persist long after growth ends.

The ETF Portfolio Strategist: 4 Dec 2020

Bullish Momentum Accelerates For Latin America Equities: Stocks listed across Mexico and South America are on a tear. Although this slice of global equities remains the only major region still nursing year-to-date losses, recent history is another story as the upside run for iShares Latin America 40 (ILF) continues pick up speed.

Fat Tails Everywhere? Profiling Extreme Returns: Part V

Everyone talks about fat tails in markets, but how do you model it in an effort to estimate what may be lurking in the future? There are many possibilities, along with lots of statistical baggage. The main challenge is that trying to squeeze reality into one distribution to capture how markets actually work is challenging, to say the least. But the head of global multi-asset strategies at T. Rowe Price outlines a simple and arguably better approach in a new book on asset allocation.

Macro Briefing: 4 December 2020

House speaker and Senate majority leader resume talks on stimulus deal: CNBC

Moderna: vaccine has ‘potential’ to offer longer-term immunity: MW

Biden and three former presidents pledge to publicly take a vaccine: USAT

Should US policymakers stop worrying and learn to love debt? NYT

Softest gain in 6 months expected for today’s November payrolls report: RTRS

Demand for inflation-protected securities surges: FT

German factory orders rose in Oct, level above pre-crisis level: BBG

Global growth ticked lower in November but remained “solid”: IHSM

US jobless claims fell last week, perhaps due to Thanksgiving holiday: WSJ

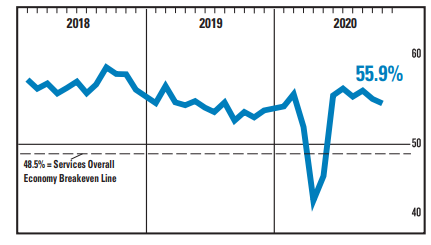

US Services PMI: sector growth accelerated to five-year high in November: IHSM

Conflicting with PMI, ISM Non-Mfg Index reflects softer growth in November: ISM

Does The Return Of The Reflation Trade Have Legs?

The Treasury market’s inflation forecast broke above its pre-pandemic high this week, fueling speculation that a new era of firmer pricing pressure is dawning. Maybe, but there are still good reasons to remain cautious before declaring that inflation is at a critical turning point. There’s a case for reviving the pre-pandemic outlook for roughly 2% inflation, but expecting a substantially hotter run still relies heavily on guesswork and dismissing the secular trends — an aging demographic, disinflationary pressure via technology, and other factors — that have prevailed over the past 20 years.

Continue reading

Macro Briefing: 3 December 2020

Negotiations in Congress continue for coronavirus-stimulus bill: WSJ

US posts record number of Covid-19 hospitalizations: BBC

Americans face ‘rough’ winter due to surging coronavirus, CDC chief warns: RTRS

House passes bill that may delist Chinese firms from US stock exchanges: CNBC

China services sector growth accelerated in November: RTRS

Eurozone economic activity contracted in Nov, PMI survey data shows: IHSM

UK economic activity contracted in Nov via PMI survey data: BBG

Survey: economic fear rises sharply among Republicans after election: NYT

Fed Beige Book: US economic rebound gathered momentum recently: WSJ

US companies hired fewer workers than expected in November: BBG

Risk Premia Forecasts: Major Asset Classes | 2 December 2020

The expected risk premium estimate rose for The Global Market Index (GMI), increasing to an annualized 5.3% in today’s revision. That’s a relatively sizable jump relative to last month’s forecast. The estimate represents a long-run projection for the index’s performance over the “risk-free” rate via a risk-based model (details below).

Macro Briefing: 2 December 2020

UK approves Pfizer-BioNTech coronavirus vaccine: CNBC

Trump may veto defense bill over social media protections: AP

Biden says he won’t immediately remove Trump’s tariffs on China: CNBC

Biden’s economic team recommends quick action on stimulus: NYT

Global manufacturing increased in Nov at fastest pace since Jan 2018: IHSM

10-year Treasury yield rises sharply, near 1%: BBG

German retail spending rose more than expected in October: RTRS

US construction spending rebounded in October: MW

US Mfg PMI signaled continued acceleration in growth: IHSM

US ISM Mfg Index: sector growth slowed in November: RTRS