After record-shattering changes in gross domestic product in the previous two quarters, US economic activity in the fourth quarter appears on track to deliver a comparatively “normal” increase, according to recent nowcasts of gross domestic product (GDP) from several sources.

Macro Briefing: 18 November 2020

Fed chairman: resurgent virus is a threat to the economy: WSJ

Trump orders faster drawdown of US troops in Afghanistan and Iraq: BBG

Trump fires Dept of Homeland cybersecurity chief: CNBC

Data suggest Covid-19 immunity lasts for years: NYT

Controversial Fed nominee Judy Shelton is blocked in Senate: CNBC

US FDA approves first home-testing kit for coronavirus: RTRS

Industrial output in US rebounded in October: MW

US home builder sentiment rises to a new record high in Nov: RD

US import prices were surprisingly weak in October: CNBC

US retail sales growth slowed in October: RTRS

US Equity Sector Rotation In Progress?

Traders appear to be placing new bets on the reflation trade through equity sector bets in energy, basic materials and industrials stocks, based on a set of exchange traded funds. It’s too early to know if this is a sustainable shift, but the change in tone in recent days is too hard to ignore.

Macro Briefing: 17 November 2020

Trump considered bombing Iran last week: NYT

Trump blocks incoming Biden staff on multiple fronts: PLTC

Several US states impose new Covid-19 restrictions: Reuters

Moderna says its coronavirus vaccine is 94.5% effective: CNN

Pfizer to launch pilot delivery program for vaccine in four US states: RTRS

Judy Shelton’s Fed confirmation in doubt as GOP support wanes: MW

Amazon launches online pharmacy: CNBC

US retail sales expected to post 6th monthly gain in today’s Oct report: WSJ

Hungary and Poland block European Union budget: BBC

NY Fed Mfg Index: manufacturing sector growth slowed in November: MSTAR

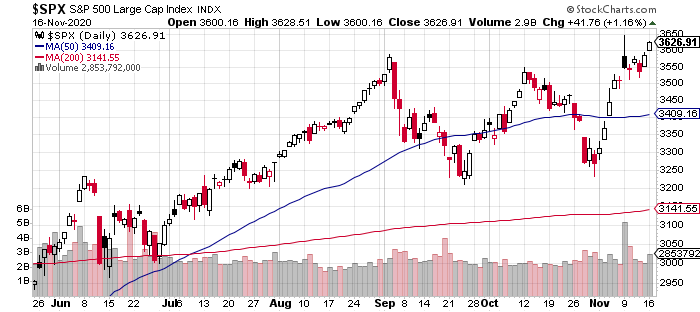

US stock market (S&P 500) rallies to new record high:

Property Shares Led Broad Rally In Global Markets Last Week

Real estate shares surged last week, in the US and abroad, posting the strongest gains for the major asset classes, based on a set of exchange-traded funds.

Macro Briefing: 16 November 2020

US coronavirus cases passes 11 million mark: RTRS

Health officials warn of risks from Trump’s transition delays: POLT

China extends economic influence with new Asia-Pacific trade pact: BBC

Asia-Pacific trade deal is a win for China, say analysts: CNBC

China’s economy appears to be accelerating in Q4: WSJ

Trump plans hard-line moves against China before he leaves office: BBG

Japan’s economy rebounded sharply in Q3 after a deep slump: NIK

UK Prime Minister is self-isolating after possible Covid-19 exposure: CNBC

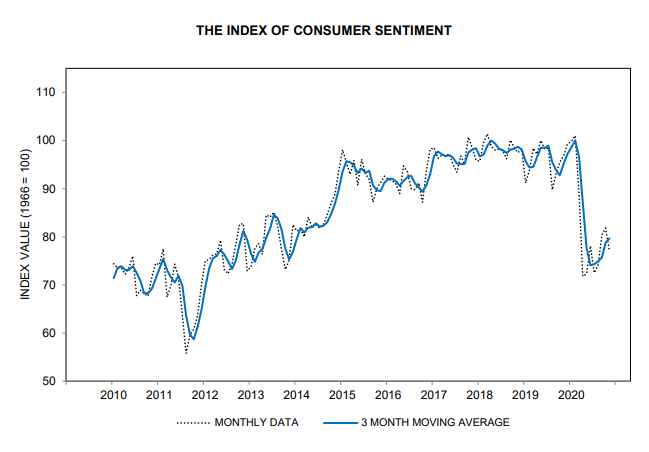

US consumer sentiment pulled back in early November: RTRS

Book Bits: 14 November 2020

● Beyond Diversification: What Every Investor Needs to Know About Asset Allocation

Sebastien Page

Summary via publisher (McGraw-Hill)

Asset allocation is the key to investing performance. Unfortunately, no single approach works perfectly—developing the right balance requires a clear-eyed look at the many models available to you, various investing methodologies, and your or your client’s level of risk tolerance. And that’s where this important guide comes in. Written by a leading allocation expert from T. Rowe Price, Beyond Diversification provides the knowledge, insights, and approaches you need to make the best allocation decisions for your goals. This deep dive into the how’s and why’s of asset allocation is organized by the three decisive components of a successfully allocated portfolio.

The ETF Portfolio Strategist: 13 Nov 2020

Small-Caps Rally: Stocks of the small-cap variety in the US have been trailing their large-cap brethren this year, but Mr. Market threw out the script this week. That, at least, is the narrative for this week’s strong rally in the lesser realm of capitalization — a rally that suggests that a rotation into smaller firms may be at hand.

Research Review | 13 November 2020 | Factor Investing

Resurrecting the Value Premium

David Blitz (Robeco) and Matthias X. Hanauer (Technische Universität München)

October 15, 2020

The prolonged poor performance of the value factor has led to doubts about whether the value premium still exists. Some have noted that the observed returns still fall within statistical confidence intervals, but such arguments do not restore full confidence in the value premium. This paper adds to the literature by showing that the academic value factor, HML, has not only suffered setbacks in recent years but has, in fact, been weak for decades already. However, we show that the value premium can be resurrected using insights that are well documented in the literature or common knowledge among practitioners. In particular, we include more powerful value metrics, apply some basic risk management, and make more effective use of the breadth of the liquid universe of stocks. Our enhanced value strategy also suffers in recent years, but this is largely explained by an extreme widening of valuation multiples similar to the late nineties. We conclude that a solid value premium is still clearly present in the cross-section of stock returns.

Macro Briefing: 13 November 2020

US election security officials: ‘no evidence’ voting systems were compromised: UST

China congratulates Biden on winning election: CNN

China warns of response after Pompeo says Taiwan not part of China: RTRS

Trump orders ban on US investments in ‘Chinese military companies’: BBC

UK, EU and US condemn China for crackdown on Hong Kong lawmakers: NPR

Report: temps to keep rising even if greenhouse emissions fall to zero: UST

Central bankers warn that economic risks remain high: NYT

Worldwide deaths from measles rose to 23-year high in 2019: NYT

Eurozone Q3 GDP rebound revised down: RTRS

Business inflation expectations tick up to still-modest 1.9% outlook: AF

Consumer inflation in the US was flat in October: BBG

US jobless claims fell to pandemic low but remain unusually high: CNBC