US coronavirus cases passes 11 million mark: RTRS

Health officials warn of risks from Trump’s transition delays: POLT

China extends economic influence with new Asia-Pacific trade pact: BBC

Asia-Pacific trade deal is a win for China, say analysts: CNBC

China’s economy appears to be accelerating in Q4: WSJ

Trump plans hard-line moves against China before he leaves office: BBG

Japan’s economy rebounded sharply in Q3 after a deep slump: NIK

UK Prime Minister is self-isolating after possible Covid-19 exposure: CNBC

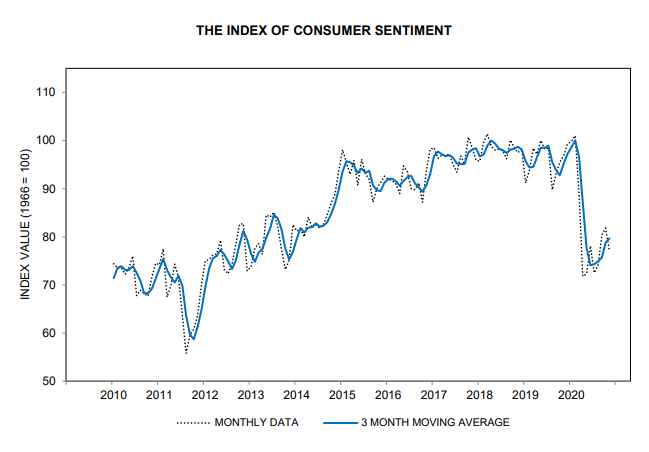

US consumer sentiment pulled back in early November: RTRS

Book Bits: 14 November 2020

● Beyond Diversification: What Every Investor Needs to Know About Asset Allocation

Sebastien Page

Summary via publisher (McGraw-Hill)

Asset allocation is the key to investing performance. Unfortunately, no single approach works perfectly—developing the right balance requires a clear-eyed look at the many models available to you, various investing methodologies, and your or your client’s level of risk tolerance. And that’s where this important guide comes in. Written by a leading allocation expert from T. Rowe Price, Beyond Diversification provides the knowledge, insights, and approaches you need to make the best allocation decisions for your goals. This deep dive into the how’s and why’s of asset allocation is organized by the three decisive components of a successfully allocated portfolio.

The ETF Portfolio Strategist: 13 Nov 2020

Small-Caps Rally: Stocks of the small-cap variety in the US have been trailing their large-cap brethren this year, but Mr. Market threw out the script this week. That, at least, is the narrative for this week’s strong rally in the lesser realm of capitalization — a rally that suggests that a rotation into smaller firms may be at hand.

Research Review | 13 November 2020 | Factor Investing

Resurrecting the Value Premium

David Blitz (Robeco) and Matthias X. Hanauer (Technische Universität München)

October 15, 2020

The prolonged poor performance of the value factor has led to doubts about whether the value premium still exists. Some have noted that the observed returns still fall within statistical confidence intervals, but such arguments do not restore full confidence in the value premium. This paper adds to the literature by showing that the academic value factor, HML, has not only suffered setbacks in recent years but has, in fact, been weak for decades already. However, we show that the value premium can be resurrected using insights that are well documented in the literature or common knowledge among practitioners. In particular, we include more powerful value metrics, apply some basic risk management, and make more effective use of the breadth of the liquid universe of stocks. Our enhanced value strategy also suffers in recent years, but this is largely explained by an extreme widening of valuation multiples similar to the late nineties. We conclude that a solid value premium is still clearly present in the cross-section of stock returns.

Macro Briefing: 13 November 2020

US election security officials: ‘no evidence’ voting systems were compromised: UST

China congratulates Biden on winning election: CNN

China warns of response after Pompeo says Taiwan not part of China: RTRS

Trump orders ban on US investments in ‘Chinese military companies’: BBC

UK, EU and US condemn China for crackdown on Hong Kong lawmakers: NPR

Report: temps to keep rising even if greenhouse emissions fall to zero: UST

Central bankers warn that economic risks remain high: NYT

Worldwide deaths from measles rose to 23-year high in 2019: NYT

Eurozone Q3 GDP rebound revised down: RTRS

Business inflation expectations tick up to still-modest 1.9% outlook: AF

Consumer inflation in the US was flat in October: BBG

US jobless claims fell to pandemic low but remain unusually high: CNBC

How Unusual Is The Current Drought For The Value Factor?

The value factor has fallen on hard times in recent years, prompting debate about whether this risk premium can recover as technology-fueled growth stocks eat the world. The counterpoint is that value and growth have long traded leadership positions and eventually value wins the race. Is it different this time? Unclear. While we’re waiting for Mr. Market to render a verdict, let’s explore the value-growth dance through a rolling-one-year-return lens for perspective.

Macro Briefing: 12 November 2020

US coronavirus cases and hospitalizations continue to accelerate: CNN

Biden advisor considers new lockdown to control pandemic: CNBC

Trump’s legal strategy: block certification of Biden win in states: WSJ

Georgia will conduct hand recount of presidential election ballots: CNBC

UK economy rebounded in Q3 with 15.5% surge in GDP: CNBC

Eurozone industrial output unexpectedly fell in September: Reuters

Central banks face crucial challenges as covid crisis roils economies: BBG

10-year Treasury yield continues to rise, edging up to 8-month high — 0.98%

US Coronavirus Risk Is Rising

It’s going to be a rough winter. The resurgence of Covid-19 across the US suggests that the next several months may bring the toughest challenge yet for the country.

Macro Briefing: 11 November 2020

Biden transition continues as Trump refuses to concede: WSJ

US reports record Covid-19 cases and hospitalizations on Tuesday: AP

US states offer no support for narrative that election was stolen: NYT

Upbeat vaccine news boosts expectations for global economic rebound: WSJ

Hong Kong’s pro-democracy lawmakers resign in protest: Reuters

Obamacare expected to withstand new challenge in Supreme Court: CNBC

Economic challenges are lurking for Biden presidency: Politico

China increasing puts fintech in the regulatory crosshairs: BBG

A leading candidate for Treasury Sec: Lael Brainard, a Fed governor: Fortune

Small business sentiment in US holds steady in Sep at pandemic high: NFIB

US job openings picked up in Sep but trend still slipping: Reuters

A New Burst Of Reflation Pricing In The Treasury Market

The bond market gave reflation a new run of consideration yesterday (Nov. 9) as Treasury yields shot higher. Was it a reaction to news over the weekend that Joe Biden won the Electoral College vote? Meanwhile, Pfizer’s announcement on Monday that an experimental COVID-19 vaccine is 90%-plus effective helped set reflationary hearts aflutter. It’s still too early to declare that a decades-long disinflationary trend has run out of road, but the possibility that regime shift has arrived, or is near, has traction… again.

Continue reading