For the first time since February, shares of US companies rose for a second calendar week through the close of trading on Apr. 17. The rally echoed similar gains in foreign shares, based on a set of exchange-traded funds.

Macro Briefing | 20 April 2020

Protests against coronavirus restrictions spread across US: Reuters

US governors: testing still isn’t enough to lift restrictions: CNN

Have US markets priced in risk of a second wave of infections? CNBC

Treasury Sec. and Democrats: close to small-business funding agreement: WSJ

Oil prices resume decline, falling below $15 a barrel — 21-year low: CNBC

US Leading Economic Index in March suffered largest monthly loss in 60 years: CB

Gov Cuomo: NY appears ‘past the plateau’ of coronavirus cases: NY Times

Global gov’t spending as % of economy reaches highest since World War II: FT

Book Bits | 18 April 2020

● The Money Hackers: How a Group of Misfits Took on Wall Street and Changed Finance Forever

By Daniel P. Simon

Summary via publisher (HarperCollins)

Every day, businesses, investors, and consumers are grappling with the seismic changes technology has brought to the banking and finance industry. The Money Hackers is the dramatic story of fintech’s major players and explores how these disruptions are transforming even money itself.

Whether you’ve heard of fintech or not, it’s already changing your life. Have you ever “Venmoed” someone? Do you think of investing in Bitcoin-even though you can’t quite explain what it is? If you’ve deposited a check using your iPhone, that’s fintech. And if you’ve gone to a bank branch and discovered it has been closed and shuttered for good, odds are that’s because of fintech too. The Money Hackers focuses on some of fintech’s most powerful disruptors — a ragtag collection of financial outsiders and savants-and uses their incredible stories to explain not just how the technology works, but how the Silicon Valley thinking behind the technology, ideas like friction, hedonic adaptation, democratization, and disintermediation, is having a drastic effect on the entire banking and finance industry.

Continue reading

US Business Cycle Risk Report | 17 April 2020

The economic data is catching up with reality, although the gap between the formal reports and what’s unfolding in the real world remains huge. For the high-frequency numbers that capture the blowback from the coronavirus in close to real time, the results are painfully clear. In particular, the soaring applications for jobless claims in recent weeks speaks volumes about the economic rampage that’s unfolding across America. In the past four weeks, more than 22 million workers have lost jobs—a loss that reverses all the employment gains in the past decade.

Macro Briefing | 17 April 2020

Trump outlines guidelines for states to emerge from shutdown: Reuters

US coronavirus deaths spiked higher on Thursday: WSJ

Experimental drug for treating coronavirus offers encouraging test results: STAT

US-China economic breakup more likely as coronavirus crisis rolls on: WSJ

France’s Macron warns of EU’s collapse as ‘political project’: FT

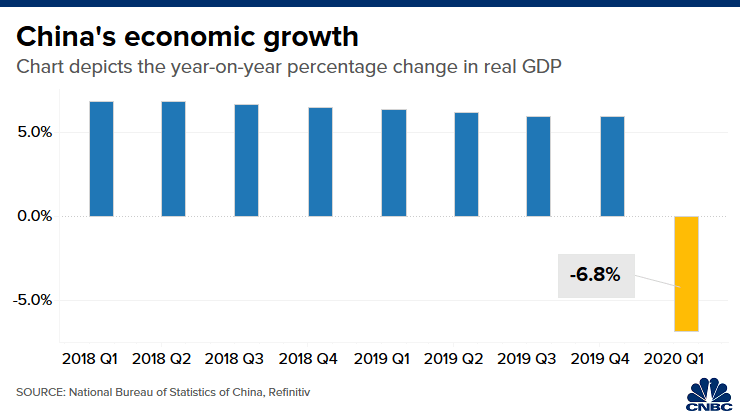

The sharp economic downturn in China is a warning for the world: NY Times

US housing construction fell sharply in March: Bloomberg

Philly Fed Mfg Index falls to lowest reading ever in April: Philly Fed

US jobless claims continued to rise by the millions last week: CNBC

China’s economy contracts by a hefty 6.8% in the first quarter: CNBC

Is A ‘V’ Recovery Still Possible For The US Economy?

The deep recession triggered by the coronavirus is the worst downturn since the Great Depression, but the hope is that the rebound will be equally swift and strong–a ‘V’ recovery. Unfortunately, the outlook for this best-case scenario is precarious.

Macro Briefing | 16 April 2020

Global debt is soaring, posing a risk after pandemic fades: WSJ

Surge in US jobless claims filings expected to continue in today’s update: Reuters

Fed’s Beige Book paints grim economic profile for US: Barron’s

Business inflation expectation fell sharply in April: Atlanta Fed

US industrial output plummets 5.4% in March–biggest decline since 1946: MW

NY Fed Mfg Index falls to a record low in April: NY Fed

Homebuilder sentiment posts biggest monthly decline in data’s 35yr history: CNBC

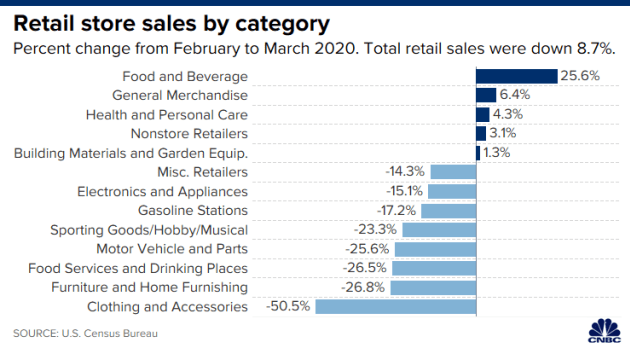

US headline retail sales collapsed in March although some segments rose: CNBC

Long Treasuries Continue To Enjoy Monster Gains In 2020

The extraordinary gains in long Treasuries so far this year is a sight to behold. In the rush to safety this year, US debt has been a clear winner and within this space long maturities have left the rest of the fixed-income realm in the dust, based on a set of exchange-traded funds through yesterday’s close (Apr. 14).

Macro Briefing | 15 April 2020

Trump suspends US funding for World Health Organization: Politico

US resists IMF plan to support emerging economies’ finances: FT

IEA estimates that a decade of oil-demand growth will evaporate in 2020: CNBC

Social distancing may need to last longer than widely expected: Reuters

IMF expects worst global recession since Great Depression: NY Times

Record drop expected for retail sales in today’s report for March: Reuters

Gold rises to 8-year high: Bloomberg

Managed Futures ETFs Are Having A Good Year So Far

There have been few places to hide from this year’s dramatic crash in stock markets around the world. Cash, US Treasuries and a select group of government bonds in foreign markets have been a rare source of safety. For funds that held risk assets, managed futures strategies have also been an island of calm, at least for some portfolios, including several of the largest ETFs in this niche.