US now leads world in reported coronavirus cases: WSJ

Massive coronavirus relief bill awaits approval in House today: Reuters

Who will get stimulus checks in the $2 trillion bill awaiting approval? USA Today

US national debt is set to soar: NY Times

US dollar on track for worst week since 2009: Bloomberg

Endless quantitative easing is crushing traditional bond strategies: BBG

Short-covering and rebalancing may explain this week’s rebound in stocks: MW

US jobless claims posted massive increase last week: CNBC

Will Trillions Of Dollars In Stimulus Raise Inflation?

Before the coronavirus shock, inflation in the US appeared tame by the standard measures. But the macroeconomic earth has shifted in recent weeks to combat the fallout from Covid-19. The Federal Reserve has announced unlimited asset purchases and is running ultra-dovish monetary policy. Meanwhile, the federal government is about to roll out a new $2 trillion stimulus package. It all adds up to what is perhaps the most ambitious effort in history to grease the economy’s wheels (or at least prevent collapse). Is this herculean effort also laying the groundwork for higher or even soaring inflation?

Macro Briefing | 26 March 2020

$2 trillion US economic stimulus package expected to become law today: Politico

What’s in the massive stimulus bill? TH

Pressure builds on Trump for gov’t intervention for ventilator output: BBG

US jobless claims filings expected to surge in today’s report: Reuters

What are the risks to Trump’s preference for reopening US by Easter? CNN

Should you expect to become immune to coronavirus at some point? NY Times

Economic assumptions upended amid coronavirus crisis: BBG

Consumer sentiment in Germany suffers dramatic decline: AF

US durable goods orders rose in Feb, but coronavirus damage lies ahead: MW

World trade’s 1-year trend fell deeper into the red in January: CPB

Econometric GDP Models Struggle With Coronavirus Fallout

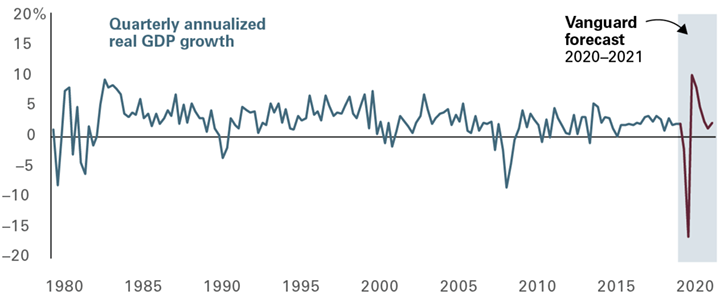

The widespread disruption from the coronavirus pandemic is obvious to everyone, but economic nowcasting and forecasting models are only just beginning to reflect the damage to what had been a moderately expanding US economy. Thanks to the lag in economic data, which can arrive as long as two to three months after the fact, formerly robust methodologies for tracking the US macro trend have become hopelessly out of date in recent weeks. But reality is quickly catching up with previously sunny estimates.

Macro Briefing | 25 March 2020

Congress and White House agree on $2 trillion coronavirus rescue package: CNBC

Trump wants US to return to work by Easter: CNN

US Composite PMI in March reflects sharp economic contraction: IHS Markit

German economy could fall 20% this year, new survey advises: Reuters

Global economy suffers as coronavirus spreads, survey data show: IHS Markit

US stocks posted the biggest gain on Tuesday since the Great Depression: Fortune

Gold surges and Goldman Sachs expects the rally to continue: MW

Managing Expectations By Simulating S&P 500 Drawdowns

The US stock market tumbled again yesterday, falling to a 3-1/2-year low, thanks to expanding coronavirus threat. The economic outlook is grim, at least for the near term, and so the market is attempting to price in this stark change. The result, not surprisingly, is a sobering, rapid fall from grace for stocks, which a bit more than a month ago reached a record high, based on the S&P 500. For the novice investor, the sharp slide in the market may appear to be off the charts. In fact, we’ve been here before, based on drawdown data. Perhaps new records for bear markets will be set in the weeks and months ahead, but for the moment it’s useful to consider how the current drawdown stacks up vs. history. In addition, running simulations on drawdowns adds another dimension of risk analytics to consider what’s possible.

Macro Briefing | 24 March 2020

As Congress haggles over stimulus bill, economic outlook darkens: Politico

Will Trump reopen the economy, against the advice of medical experts? BBC

Fed rolls out major expansion of lending operations for corporates, munis: WSJ

Should Fed emergency lending go beyond banks? Bloomberg

Eurozone economic activity collapses in March, via PMI survey data: IHS Markit

Coronavirus woes offer business upside to technology companies: NY Times

Chicago Fed National Activity rebounded in Feb, but March data will be ugly: CF

Vanguard expects a “sharp but short contraction” for US economy: Vanguard

The Last Defense: 1-Year Trends Go Red, Except For US Bonds

As risk-off sentiment deepens around the world due to the coronavirus pandemic, red ink has spread to nearly every corner of the major asset classes. For the one-year trend, however, there are still two slices of global markets holding on to modest gains, US bonds, based on a set of exchange-traded funds.

Macro Briefing | 23 March 2020

Senate fails to advance latest version of economic stimulus bill: CBS

Fed officials: more policy moves are available to fight economic slide: BBG

Central banks offer record sums to keep financial system afloat: Reuters

China reports drop in new coronavirus cases on Monday: Reuters

S. Korea reports lowest number of new cases since peak of 4 wks ago: BBC

69 drugs on the short list that offer hope for treating covid-19: NY Times

How the gov’t can promote a “V” shaped economic recovery: NY Times

Will coronavirus become a seasonal problem? WSJ

S&P 500 drawdown fell to -32% on Friday:

Book Bits | 21 March 2020

● Radical Uncertainty: Decision-Making Beyond the Numbers

By John Kay and Mervyn King

Review via The Telegraph

That ripping sound you may have heard lately is the noise of economists around the world tearing up carefully-honed forecasts, thanks to the rapidly spreading coronavirus.

For former Bank of England Governor Mervyn King and the senior economist John Kay, the all-too-rapid redundancy of the investment banks’ glossy brochures merely underline the folly of such prognostications in the first place.

In their new book, Radical Uncertainty, the pair turn a critical gaze on their own economics profession and find it badly wanting. They paint an unsparing picture of a discipline enslaved by its models, pretending to knowledge it cannot possibly have, and losing public trust as a consequence.