California is first state to issue statewide stay-at-home order: CNN

Will the federal govt’s $1 trillion stimulus be enough? Politico

Search for coronavirus vaccine has become a global competition: NY Times

The stock market could bottom before the coronavirus epidemic peaks: MW

Some safe-haven assets aren’t as safe as assumed in this crisis: Mstar

Will small businesses survive the coronavirus crisis? NY Times

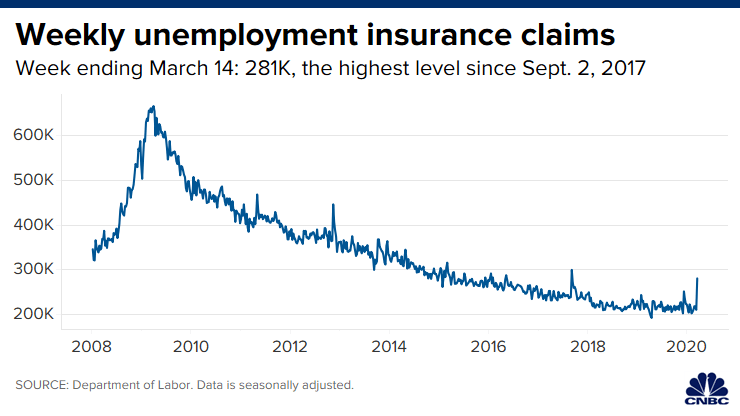

Trump administration attempting to suppress surging jobless claims data: WSJ

Fed expected to significantly ramp up bond purchases: WSJ

Is the Fed considering a tool known as yield curve control? Reuters

US jobless claims surged last week as coronavirus layoffs spread: CNBC

US Business Cycle Risk Report | 19 March 2020

The global coronavirus pandemic is creating havoc in economies around the world and the US is no exception. In the wake of this crisis, the standard modeling techniques have become worthless for estimating current conditions and estimating the near-term. The only thing that’s certain is that a significant shock is unfolding in real time—a shock that’s not being picked up, yet, in the economic data that’s been published to date. But there will be blood. The key questions for the recession: how deep and how long? Unclear. Since we’re heading into an unprecedented period in modern times, uncertainty is extraordinarily high. Nonetheless, let’s run through the numbers, if only as an academic exercise to profile the US economy as it was on the eve of the deluge.

Macro Briefing | 19 March 2020

US gov’t working on large economic stimulus bill: Bloomberg

A virus recession will create an unprecedented shock for the global economy: BBG

Coronavirus pandemic will test limits of how much debt US gov’t can bear: WSJ

Layoffs rising at US businesses as coronavirus spreads: WSJ

China reports no new local infections–a positive milestone: NY Times

Credit crisis looms as investors dump lesser grades of corporate credit: Reuters

Fed offers emergency lending to support money market mutual funds: WSJ

New US housing construction fell in Feb–ahead of coronavirus disruption: MW

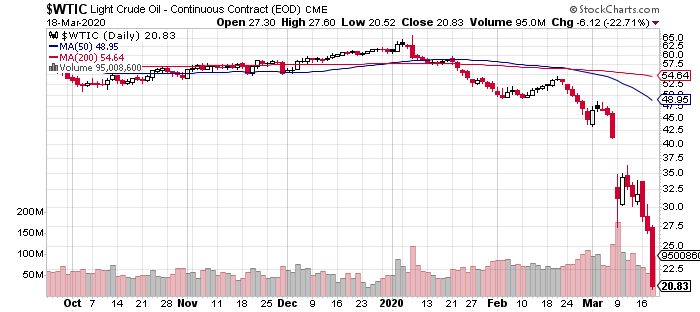

US crude oil benchmark collapses to just over $20 a barrel on Wednesday:

US Bond Returns Vary Dramatically So Far In 2020

The upheaval in global financial markets this year is unleashing profound effects on US fixed-income assets—negative and positive. Depending on the slice of the bond market, year-to-date results vary from strong gains to deep losses, based on a set of exchange-traded funds.

Macro Briefing | 18 March 2020

Trump seeks $1 trillion economic stimulus for ailing US economy: Reuters

Treasury Sec. Mnuchin: policy mistakes could result in 20% jobless rate: CNN

Fed to reopen short-term lending resource to large financial institutions: WSJ

Biden wins Tues primaries, effectively becoming Democratic nominee: WSJ

Worst rout in credit mkts since global financial crisis is spreading: BBG

Surging US dollar is new risk factor for emerging market economies: BBG

Crude oil falls to 17-year low: Reuters

Is Boeing (largest US manufacturer) at risk of going under? NY Times

US industrial production rebounds in Feb, ahead of coronavirus blowback: MW

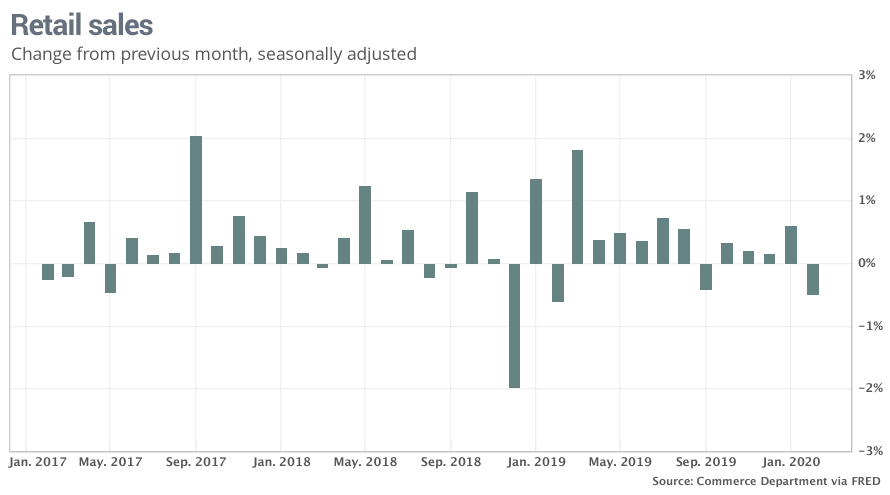

US retail spending unexpectedly dropped in Feb–first decline in 5 months: MW

A Brief Tour Of The Dark US Economic Outlook

The published data suggest moderate growth remains intact, but the rear-view mirror has rarely been so meaningless for assessing the likely path of the economic trend in the months ahead. As the coronavirus blowback spreads, the US economy is slowing, and in many sectors grinding to a halt. The result, of course, is that a recession appears inevitable, perhaps a severe one. The optimistic view is that the downturn will be short and the bounce-back will be strong. But economists are now in agreement: output will probably contract.

Macro Briefing | 17 March 2020

Trump shifts tone, says coronavirus may last through summer: BBC

US economy may be grinding to a halt as coronavirus spreads: NY Times

Is the US at risk of a depression? Reuters

Morgan Stanley: global recession is now the base case: Bloomberg

Amazon to add 100,000 workers amid surge in online ordering: WSJ

Reported coronavirus infections understate actual data, study shows: NY Times

Germany’s ZEW Economic Sentiment Index collapsed in the March update: ZEW

NY Fed Mfg Index falls sharply in March, reflecting contractio in sector: NY Fed

US stock mkt (S&P 500) drawdow approaches -30% after Monday’s sharp slide:

Nowhere To Hide Last Week

The coronavirus blowback that’s roiling the world cut into every facet of the major asset classes last week, based on a set of exchange traded funds. Another challenging week awaits, as sharp losses in overseas markets and US futures trading (ahead of New York’s open for stocks) on Monday suggest.

Macro Briefing | 16 March 2020

Fed announces rate cut to near zero: WSJ

Central banks announce emergency policy measures: Reuters

US stock futures drop sharply on Monday, hitting “limit down”: CNBC

Goldman Sachs Predicts US GDP will drop 5% in Q2: Bloomberg

America confronts shutdown: CNN

Biden and Sanders debate with coronavirus as backdrop: CNBC

US Consumer Sentiment Index fell in March “due to… coronavirus” UoM

10yr Treasury yield falling again on Monday as risk-off trade accelerates:

Book Bits | 14 March 2020

● Pharma: Greed, Lies, and the Poisoning of America

By Gerald Posner

Review via The Intercept

As the new coronavirus spreads illness, death, and catastrophe around the world, virtually no economic sector has been spared from harm. Yet amid the mayhem from the global pandemic, one industry is not only surviving, it is profiting handsomely.

“Pharmaceutical companies view Covid-19 as a once-in-a-lifetime business opportunity,” said Gerald Posner, author of “Pharma: Greed, Lies, and the Poisoning of America.” The world needs pharmaceutical products, of course. For the new coronavirus outbreak, in particular, we need treatments and vaccines and, in the U.S., tests. Dozens of companies are now vying to make them.