● The Velvet Rope Economy: How Inequality Became Big Business

By Nelson D. Schwartz

Review via Vox

This is the opening scene of Nelson D. Schwartz’s new book The Velvet Rope Economy: How Inequality Became Big Business, which explains how everything Americans purchase — travel, leisure, education, and health care — suddenly got really good for the wealthy and a lot worse for the rest of us.

Income inequality has risen since the 1970s, and at the same time, companies have begun to cater to the only demographic whose prospects are growing. Fancy new sports stadiums with separate doors for box seat holders, VIP airport terminals, Uber Copters, and the privatization of everything from high school sports to firefighter squads are all examples of what Schwartz dubs the “velvet rope economy.”

US Payrolls Continued Rising At Strong Pace In February

Coronavirus risk is lurking, but if the US economy’s vulnerable it’s not obvious in today’s payrolls report for February. Hiring by American firms remained strong last month: private payrolls increased 228,000, the Labor Department reports. The gain is near the best increase in recent history and lifted the one-year trend to a 13-month high.

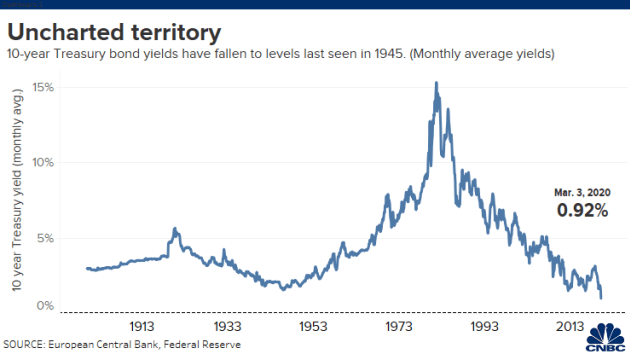

Will US Treasury Yields Go Negative?

The relatively high and positive yields in US government bonds have been an outlier in global markets, but coronavirus blowback appears on track to wipe away that spread (or at least make a hefty dent). Rates are still positive across the Treasury curve in early trading on Friday (Mar. 6), but downside momentum rolls on and as the global risk-off trade accelerates the prospect of below-zero yields in US is becoming increasingly plausible at some point in the near future.

Macro Briefing | 6 March 2020

Global coronavirus cases nears 100,000: NY Times

Cruise ship in limbo off Calif. coast awaits coronavirus results: CNN

Russia and Turkey announce deal to end attacks in Syria: NY Times

OPEC seeks large cut in oil production to deal with coronavirus: Reuters

Bonds and gold rally as stocks sink as risk-off trade resumes: WSJ

Announced job cuts in US fell 16% in Feb. from previous month: CG&C

US jobless claims remain low–no sign yet of coronavirus impact: MW

US factory orders dropped more than expected in January: Reuters

10-yr Treasury yield falls under 0.8% in early Friday trading–a record low:

Should You React To The Surge In Stock Market Volatility?

The coronavirus that’s roiling world markets and raising questions about the economic outlook has triggered a familiar shock to stocks: higher volatility. Is this a reason to change your asset allocation, rebalance the portfolio or modify risk management decisions? Maybe, but maybe not. There is no generic answer for everyone because every investor is different due to risk tolerance, time horizon, investment objectives, and so on. But while customized advice and analysis isn’t appropriate here, it can’t hurt to review some basic points for volatility as a risk metric.

Macro Briefing | 5 March 2020

Considering the case for why the Fed may cut rates again: WSJ

California declares state of emergency due to coronavirus: Reuters

Opec expected to call for big cut in oil production to counter falling prices: CNBC

Global economy contracted in February, according to survey data: IHS Markit

Coronavirus impact on US economy shows up in Fed Beige Book reoprt: MW

US services sector growth picked up in Feb via ISM Non-Mfg Index: ISM

US Services PMI shows mild contraction in Feburary: IHS Markit

US private hiring slowed in Feb but continued to rise at healthy pace: ADP

Fed Cuts Rates As Global Coronavirus Risk Continues To Rise

It’s unclear if yesterday’s emergency 50-basis-point cut in interest rates by the Federal Reserve will help immunize the US economy against coronavirus-related blowback. Meanwhile, a rise in reported cases of covid-19 on a global basis remains the baseline forecast, based on today’s update of CapitalSpectator.com’s modeling (see today’s revised outlook below).

Macro Briefing | 4 March 2020

Joe Biden enjoys stunning comeback in Super Tuesday voting: CNN

Fed cuts target interest rate by 1/2 point to combat coronavirus: CNBC

China services economy effectively ground to a half in Feb: IHS Markit

Japan slipped into recession in February via PMI survey data: IHS Markit

Eurozone shows a bit of resilience with modest growth in Feb: IHS Markit

10-year Treasury yield falls under 1.0%–a new record low: CNBC

Risk Premia Forecasts: Major Asset Classes | 3 March 2020

The Global Market Index (GMI) is expected to earn an annualized risk premium of 4.5% over the long run in today’s revised estimate (before factoring in a “risk-free” rate). The new projection reflects a downgrade from last month’s 5.0% forecast and no change from the year-ago estimate.

Macro Briefing | 3 March 2020

World finance officials consider economic response to coronavirus: Reuters

World’s top-3 central banks look set to respond to coronavirus: Reuters

World Health Organization chief: we’re in “uncharted territory”: CNN

Global manufacturing sector fell into deep recession in February: IHS Markit

US construction spending rose in January to record level: AP

US Mfg PMI: modest growth continued to weaken in February: IHS Markit

US manufacturing sector barely expanded in February via ISM survey data: ISM