Looking at a select set of recent economic releases suggests the US economy is humming along, providing room for the Federal Reserve to let current monetary policy glide forward on autopilot. But a closer look at key trends in the Treasury market and the monetary base – along with the economic challenges roiling China and increasingly spilling out to the global economy – suggest the future may be more uncertain and risky than widely assumed with respect to evaluating the case for rate changes.

Macro Briefing | 19 February 2020

China faces increased risk of an economic crisis: CNBC

Sanders leads by wide margin in new national poll: CNBC

Trump announces multiple pardons and commutations: Politico

China expels 3 Wall Street Journal reporters: NY Times

The global economy is closing its doors to China amid virus outbreak: WSJ

Hong Kong faces first back-to-back annual recession: Bloomberg

Is Bloomberg LP for sale? It is if Mike Bloomberg is elected president: WSJ

NY Fed manufacturing Index rises to 9-month high in February: MW

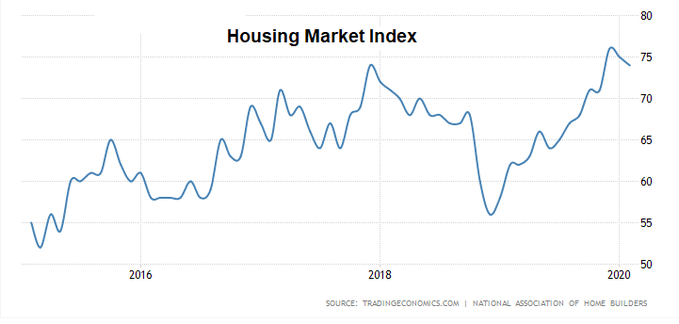

US home builder sentiment dipped in February but remains strong: NAHB

US Economic Growth Expected To Slow In First Quarter

US economic activity is expected to ease in the first quarter, based on the median for a set of nowcasts compiled by The Capital Spectator. The current estimate reflects the softest quarterly gain in over a year, although the anticipated increase is still strong enough to keep the economic expansion alive in early 2020.

Continue reading

Macro Briefing | 18 February 2020

China to grant tariff exemptions on 696 US goods: Reuters

How fast will China’s economy rebound from coronavirus outbreak? Bloomberg

Coronavirus blowback could impact 50,000 firms, new research estimates: CNBC

Despite Brexit turmoil, UK employment rose in fourth quarter: Bloomberg

HSBC, Europe’s biggest bank, plans to cut 35,000 jobs: WSJ

German economic sentiment fell sharply in Feb, driven by coronavirus risk: ZEW

Apple doesn’t expect to meet quarterly revenue target due to coronavirus: BBG

WTO’s trade barometer anticipates “further weakening” of trade in Q1: WTO

US Real Estate Investment Trusts Surged Last Week

Real estate is hot – sizzling, in fact, based on last week’s trading activity. In relative and absolute terms, REITs in the US delivered a spectacular run for the trading week ended Friday (Feb. 14) — the strongest gain by far for the major asset classes, based on a set of proxy ETFs.

Continue reading

Macro Briefing | 17 February 2020

Coronavirus risk on the world’s cruise ships in focus Reuters

Fierce storm is pummeling western Europe: CBS

Japan’s economy fell sharply in Q4: Bloomberg

Iran’s hardliners expected to gain power after this week’s elections: Reuters

Munich security conference highlights divergence between US and Europe: Politico

Tech investing: Nothing succeeds like success: WSJ

Consumer sentiment in US rose to highest level in nearly 2 years: Bloomberg

US industrial production continued to contract in January: MW

Retail sales rose moderately in January: CNBC

US commercial & industrial loans 12-month change slips to 2-year low in January:

Book Bits | 15 February 2020

● The Information Trade: How Big Tech Conquers Countries, Challenges Our Rights, and Transforms Our World

By Alexis Wichowski

Summary via publisher (HarperCollins)

In this provocative book about our new tech-based reality, political insider and tech expert Alexis Wichowski considers the unchecked rise of tech giants like Facebook, Google, Amazon, Apple, Microsoft, and Tesla—what she calls “net states”— and their unavoidable influence in our lives. Rivaling nation states in power and capital, today’s net states are reaching into our physical world, inserting digital services into our lived environments in ways both unseen and, at times, unknown to us. They are transforming the way the world works, putting our rights up for grabs, from personal privacy to national security.

Continue reading

Research Review | 14 February 2020 | Business Cycle Risk

A New Index of the Business Cycle

William B. Kinlaw (State Street Global Markets), et al.

January 2020

The authors introduce a new index of the business cycle that uses the Mahalanobis distance to measure the statistical similarity of current economic conditions to past episodes of recession and robust growth. Their index has several important features that distinguish it from the Conference Board’s leading, coincident, and lagging indicators. It is efficient because as a single index it conveys reliable information about the path of the business cycle. Their index gives an independent assessment of the state of the economy because it is constructed from variables that are different than those used by the NBER to identify recessions. It is strictly data driven; hence, it is unaffected by human bias or persuasion. It gives an objective assessment of the business cycle because it is expressed in units of statistical likelihood. And it explicitly accounts for the interaction, along with the level, of the economic variables from which it is constructed.

Continue reading

Macro Briefing | 14 February 2020

Attorney General Barr criticizes Trump for tweets re: Justice Dept: ABC

CDC director: coronavirus is “probably with us beyond this season”: CNN

Tension rising between Turkish and Russian-backed Syrian forces: NBC

Eurozone GDP growth slowed in Q4, weaker than previously estimated: Reuters

Is Europe’s largest economy prepared for trade and coronavirus risks? BBG

US core consumer inflation firmed up in January: CNBC

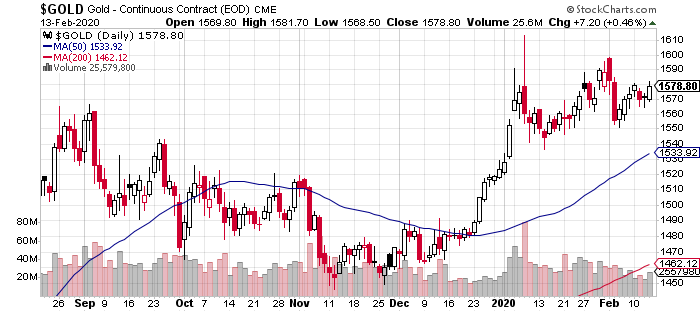

Gold price edges up as gold-standard advocate’s Fed nomination stumbles: THill

Treasury Market Flashes New Warning As Real Yields Go Negative

It happened before, in 2012-2013, but the US economy muddled through a soft patch. Is it different this time? It’s a question worth pondering as the global economy struggles to model the spreading coronavirus that’s weighing on China and, increasingly, reverberating in economies around the world. The European Commission today, for example, advises that coronavirus is a “key downside risk” for the bloc’s economy.