Earlier this month we reviewed how recent performance for the S&P 500 Index stacked up relative to history. Let’s extend the analysis to risk. As we’ll see, deciding if risk is unusual, or not, depends on how you’re defining risk. As a result, there’s quite a bit more subjectivity in this corner or market analytics.

Continue reading

Macro Briefing | 16 January 2020

US and China sign trade deal that eases tensions: WSJ

A closer look at US goods that China pledged to buy in trade deal: CNBC

Key part of trade deal is already in doubt: Bloomberg

Senate begins to consider removal of President Trump: Reuters

Russia’s gov’t resigns, paving way for Putin to consolidate power: CNBC

Fed Beige Book: ‘modestly favorable’ outlook for 2020: MW

NY Fed Mfg Index ticks up, reflects modest growth in Dec: NY Fed

Business inflation expectations are steady at +1.9% in Jan: Atlanta Fed

VIX Index falls back to level that’s near 2-year low after recent increase:

It’s Been A Good Year So Far For (Most) Equity Markets

The broad upside momentum for most slices of the world’s equity markets has spilled over into 2020, at least so far. But the distribution of performance, as usual, is uneven. Here’s a quick look at how the bull run stacks up so far (through Jan. 14) for US and global stock markets, based on a set of exchange-traded funds.

Macro Briefing | 15 January 2020

Trump set to sign trade deal with China on Wednesday: Bloomberg

Expectations are muted for new US-China trade deal: CNBC

Senate prepares for impeachment trial: CNN

Iran rejects prospects for a new ‘Trump deal’ on nuclear capability: Reuters

Eurozone industrial output rebounded in Dec but trend still negative: FT

Softer-than-expected UK inflation suggests BoE will cut rates: Bloomberg

US Small Business Optimism fell in Dec but remains ‘historically strong’: NFIB

US core consumer inflation (s.a.) ticked down to +2.2 annual pace in Dec:

Will This Week’s Data Derail Moderate US Economic Optimism?

Economic pessimism for the US has had a rough ride in recent years. The macro trend has wobbled several times since the last official recession ended in 2009, but each time the economy righted itself and the expansion rolled on. But new doubts emerged in the second half of 2019 and the long knives of dark predictions returned anew. For now, the pessimists have been proven wrong, again. In fact, there are hints that growth may be picking up a bit. Key data releases later this week will stress test the case for optimism. Here’s a quick review of what’s on the docket for economic reports in the days ahead.

Macro Briefing | 14 January 2020

US Defense Sec: US has right to strike Iranian proxies in Iraq, Iran: NPR

US Treasury ends ‘currency manipulator’ label for China ahead of trade deal: BBC

GOP senators not likely to dismiss Trump charges ahead of trial: Reuters

US-Eurozone trade talks in focus next week: Bloomberg

US budget deficit topped $1 trillion in 2019–seven-year high: CNBC

India’s inflation spikes to five-year high due to food prices: Reuters

BlackRock: climate change at center of firm’s investment strategy: Fortune

Economic woes deepen in Iran as public’s tolerance wears thin: NY Times

US Dollar Index’s downside bias appears to be strengthening:

Emerging Markets Stocks’ Months-Long Rally Rolled On Last Week

Another week, another gain for shares in emerging markets, which posted the strongest increase for the major asset classes over the trading week through January 10, based on a set of exchange traded funds.

Macro Briefing | 13 January 2020

Iranian protests raise pressure on government: CNN

US-China trade war had limited impact on US economy in 2019: WSJ

Will China flex military muscles after Taiwan’s election? Reuters

Trump wants to restart talks with North Korea: Axios

UK GDP fell 0.3% in November, marking fourth month with no growth: CityAM

US employment growth slowed in Dec after strong gain in Nov: Reuters

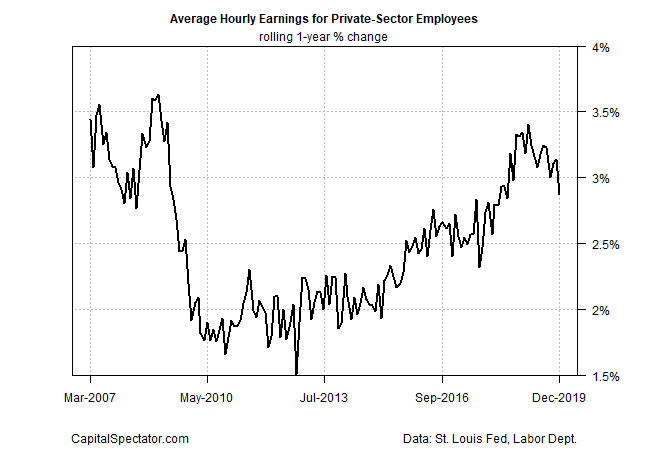

US wage growth in Dec eased to 2.9% annual pace–slowest in over a year:

Book Bits | 11 January 2020

● Risk, Choice, and Uncertainty: Three Centuries of Economic Decision-Making

By George G. Szpiro

Summary via publisher (Columbia U. Press)

At its core, economics is about making decisions. In the history of economic thought, great intellectual prowess has been exerted toward devising exquisite theories of optimal decision making in situations of constraint, risk, and scarcity. Yet not all of our choices are purely logical, and so there is a longstanding tension between those emphasizing the rational and irrational sides of human behavior. One strand develops formal models of rational utility maximizing while the other draws on what behavioral science has shown about our tendency to act irrationally. In Risk, Choice, and Uncertainty, George G. Szpiro offers a new narrative of the three-century history of the study of decision making, tracing how crucial ideas have evolved and telling the stories of the thinkers who shaped the field.

US Employment Growth’s 1-Year Pace Slows To 9-Year Low

A softer gain in hiring was expected for December, but today’s report from the US Labor Department was weaker than economists forecast. Companies added 139,000 workers last month–moderately lower vs. the 150,000 consensus point forecast via Econoday.com. That’s still a respectable gain, although it’s no match for November’s blowout surge of 243,000 new jobs in the private sector.