Advocates of small-cap equities keep talking about the possibility of a revival for these shares, but year-to-date results suggest otherwise, based on a set of exchange-traded funds.

Macro Briefing | 21 November 2019

Sondland says Trump directed Ukraine pressure campaign: Politico

US-China trade deal may be at risk if Trump signs Hong Kong bill: CNBC

China invites Americans for new trade talks: WSJ

Fed minutes show more rate cuts are unlikely: MW

Charles Schwab reportedly in talks to acquire TD Ameritrade: CNBC

OECD: Europe’s QE monetary policy deepens pain of negative rates: Bloomberg

German exports to US rose in Q3: Reuters

Israel fails to form a government; new elections (again) are likely: NPR

Share of Americans moving falls below 10% — lowest since 1947: NY Times

US commercial lending 1yr growth rate fell to +4.7% in Oct, lowest in 1-1/2 years:

US Business Cycle Risk Report | 20 November 2019

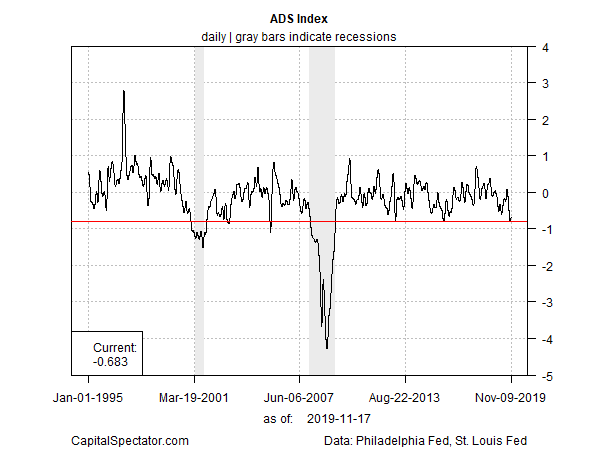

US economic growth has slowed but signs that the macro trend is stabilizing suggest that the recent downshift won’t lead to a recession in the immediate future. Nonetheless, the expansion appears to be increasingly vulnerable. Another round of shocks, expected or otherwise, could push the economy over the edge. For the moment, however, the numbers show that slow growth prevails.

Macro Briefing | 20 November 2019

Are US-China trade talks at an impasse? WSJ

China criticizes US after Senate passes bill supporting Hong Kong protesters: CNBC

Don’t overlook the brewing US-Europe trade conflict, says analyst: MW

Sluggish earnings for retailers raise questions about holiday season: WSJ

Gordon Sondland is key witness in today’s impeachment hearing: Reuters

All eyes on Lagarde, ECB’s chief, in her first policy speech on Friday: BBG

Israel launches airstrike on Syria: Reuters

Atlanta Fed’s GDPNow Q4 GDP estimate ticks up but +0.4% is still worrisome

US housing starts picked up in October, rising 8.5% vs. year-earlier level:

Stock Market’s Optimism Vs. Worrisome Economic Data

Judging by the US stock market, the economic outlook is optimistic in no trivial degree. The S&P 500 Index rose for a fifth straight day on Monday (Nov. 18), ticking up to another record high. Taking a cue from the party atmosphere on Wall Street, Goldman Sachs’ chief equity strategist expects the sluggish US economy will improve in 2020.

Macro Briefing | 19 November 2019

US shifts policy and backs Israeli on settlements in West Bank: WSJ

Dems release new transcripts ahead of today’s impeachment hearings: The Hill

Fed Chairman Powell met with Trump on Monday: USA Today

Pimco: US and China may sign ‘phase one’ trade deal before Christmas: CNBC

Goldman Sachs expects US economic growth to pick up in 2020: CNBC

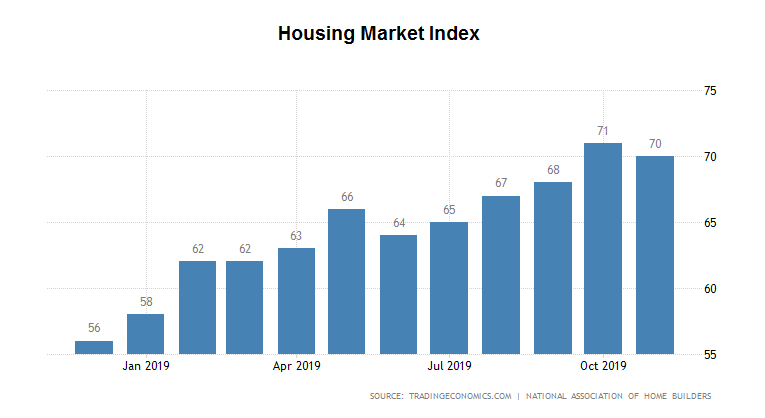

US home builder sentiment remains near post-recession high in November: CNBC

US Real Estate Investment Trusts Topped Market Gains Last Week

US real estate investment trusts (REITs) rallied last week, posting the strongest gain for the major asset classes, based on a set of exchange-traded funds. US REITs also continue to lead global markets with the highest one-year return as well.

Continue reading

Macro Briefing | 18 November 2019

Hints of progress emerge in US-China trade talks: Bloomberg

China’s presses ahead with efforts to decouple from the US dollar: CNBC

Industrial production for US fell more than expected in October: Reuters

Import prices continued to fall in October for US: MarketWatch

US retail sales rebounded in October: MW

NY Fed Mfg Index: slow growth continues in November: NY Fed

US Q4 GDP nowcasts weakened sharply via Atlanta Fed and NY Fed estimates

US economic growth slowed substantially in latest ADS Index profile: Philly Fed

Book Bits | 16 November 2019

● Willful: How We Choose What We Do

By Richard Robb

Summary via publisher (Yale University Press)

Why do we do the things we do? The classical view of economics is that we are rational individuals, making decisions with the intention of maximizing our preferences. Behaviorists, on the other hand, see us as relying on mental shortcuts and conforming to preexisting biases. Richard Robb argues that neither explanation accounts for those things that we do for their own sake, and without understanding these sorts of actions, our picture of decision-making is at best incomplete. Robb explains how these choices made seemingly without reason belong to a realm of behavior he identifies as “for-itself.”

Technology’s Lead Widens Over Rest of US Equity Sectors

Tech has been a strong performer for most of the year, but in recent weeks its outperformance has accelerated over the rest of the major US equity sectors, based on a set of exchange traded funds.

Continue reading