● The Great Reversal: How America Gave Up on Free Markets

By Thomas Philippon

Summary via publisher (Belknap Press/Harvard University Press)

A leading economist argues that many key problems of the American economy are due not to the flaws of capitalism or the inevitabilities of globalization but to the concentration of corporate power. By lobbying against competition, the biggest firms drive profits higher while depressing wages and limiting opportunities for investment, innovation, and growth… American markets, once a model for the world, are giving up on healthy competition. Sector after economic sector is more concentrated than it was twenty years ago, dominated by fewer and bigger players who lobby politicians aggressively to protect and expand their profit margins. Across the country, this drives up prices while driving down investment, productivity, growth, and wages, resulting in more inequality. Meanwhile, Europe—long dismissed for competitive sclerosis and weak antitrust—is beating America at its own game.

US Payrolls Rose In October But 1-Year Trend Is Still Slipping

Companies added more workers than expected in October, according to the US Labor Department. The news is welcome, largely because the crowd was looking for a much-weaker gain. Good news, as far as it goes. But it’s premature to celebrate. Indeed, as The Capital Spectator projected, the one-year trend continued to edge down, reaffirming that the labor market appears to be caught in a gradual but persistent downturn.

Major Asset Classes | October 2019 | Performance Review

The old investing proverb that markets like to climb a wall of worry was reaffirmed in dramatic fashion last month. Indeed, all the major asset classes posted gains in October. In fact, the latest installment of across-the-board increases marks the third time so far this year that the crowd bid up prices in everything in a calendar month. (January and June also posted gains in every primary slice of the global markets.) Continue reading

Macro Briefing | 1 November 2019

House approves Trump impeachment rules in partisan vote: The Hill

Trump attacks Fed Chairman Powell a day after rate cut: CNBC

Economists expect hiring will slow in today’s Oct jobs report: Bloomberg

Private survey shows China’s mfg sector expanded in Oct: CNBC

Corporate profits are stronger than expected but still on track to weaken: WSJ

US jobless claims rise, but indicator still reflects strong labor market: Reuters

Chicago PMI fell to nearly four-year low in October: MW

Announced job cuts in US up 21% in October vs. September: CG&C

Wage inflation ticked higher in third quarter, but remains moderate: MStar

Consumer spending’s 1-year trend in US edged up in Sep, posting moderate gain:

Russia/Eastern Europe And US Stocks Lead Global Markets In 2019

All the world’s major equity regions continue to post year-to-date gains, but stocks in Eastern Europe/Russia, followed closely by US shares, are in the lead by a healthy margin, based on a set of exchanged-listed funds.

Macro Briefing | 31 October 2019

Chinese officials raise new doubts about a trade deal with the US: Bloomberg

China’s official manufacturing PMI dips deeper into recession in Oct: CNBC

House set for first floor vote on impeachment today: The Hill

Federal Reserve cuts its target rate 1/4 point to 1.5%-1.75% range: Bloomberg

Fed rate cut prompts dissents from two Fed officials: WSJ

US GDP growth in Q3 eased slightly to modest 1.9% gain: MW

US private employment’s 1-year growth trend slips to 8-year low in October: ADP

Tracking Macro Factors In Portfolio Strategies

Earlier this month I briefly reviewed a recent BlackRock report that highlighted that macroeconomic factors are typically driving investment strategy results. As a follow-up, let’s take a quick look at a basic real-world example of analyzing portfolios through a macroeconomic lens.

Macro Briefing | 30 October 2019

Democrats outline impeachment procedures: The Hill

UK to hold general election in Dec, perhaps breaking Brexit deadlock: Reuters

Fed expected to cut interest rates again today: CNBC

Key points to watch in today’s Q3 GDP report: MW

US pending home sales rose in Sep, marking 3rd gain in past 4 months: MW

Consumer Confidence Index for US slipped in Oct but still reflects optimism: CB

US home prices rose 3.2% in Aug vs. year-ago level, up from 3.1% in July: CNBC

US 10yr-3mo Treasury yield curve rises to 7-month high of +0.20%:

US Q3 GDP Growth Expected To Tick Lower In October 30 Update

Tomorrow’s preliminary estimate for third-quarter economic activity in the US is on track to edge lower, based on the median estimate for a set of nowcasts. The government’s first round of Q3 data (due on Oct. 30) will likely show a modest pace of growth. The report also looks set to show that the economic trend decelerated, if only slightly, for a second straight quarter.

Macro Briefing | 29 October 2019

White House official to testify on Trump re: nat’l security and Ukraine: Politico

House set to vote this week to formalize Trump impeachment: Fox

US stock market (S&P 500) closed at record high on Monday: CNBC

China’s slowdown appears to continue in early read on Oct data: Bloomberg

Oil market expected to face excess supply in 2020, IEA forecasts: CNBC

Is the economy’s influence fading as a factor in elections? NY Times

US imports and exports fell in September as trade deficit narrowed: Bloomberg

Texas mfg growth decelerated in October: Dallas Fed

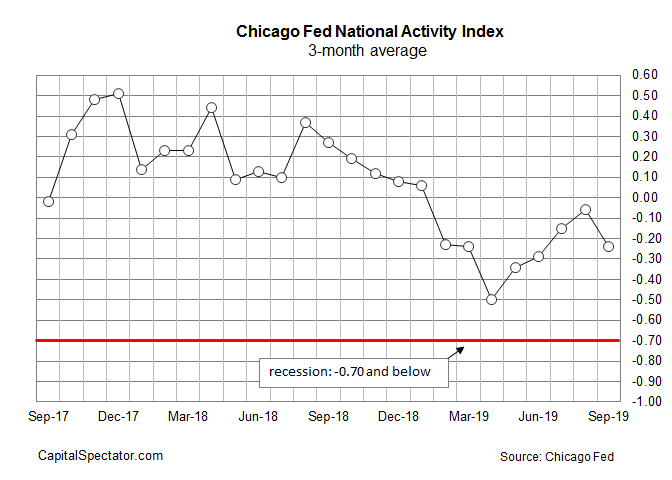

US growth, already at below-trend pace, eased further in Sep: Chicago Fed