The possibilities for quantifying risk in portfolio analytics seem to be limited only by the imagination of researchers. Indeed, you can find dictionaries that wade through an ever-lengthening list of indicators. But any short list of robust metrics surely deserves to include drawdown, which offers a powerful combination of relevance and simplicity. A new research paper reminds, however, that drawdown comes in several flavors and so investors need to think carefully when deploying this metric in the quest to identify genuinely skillful portfolio results.

Macro Briefing | 8 November 2019

Michael Bloomberg may enter presidential race: Politico

US will reportedly forgo new tariffs on European autos: Bloomberg

Reports of easing tensions in US-China trade war lift stock market: WSJ

China’s imports and exports fell by less than expected in October: CNBC

10-year Treasury rate rises the most since Trump’s election: CNBC

US consumer credit in September rose at slowest pace in 15 months: MW

Last week’s drop in US jobless claims continue to signal healthy labor market: MW

Bull Market In US Bonds Still Running Hot In 2019

Fixed-income investing has been a winner in no small degree this year. Throwing money at almost any slice of US bonds has been a winning decision, based on a set of exchange-traded funds. Notably, favoring bigger duration risks has delivered bigger returns.

Macro Briefing | 7 November 2019

US and China agree to scrap tariffs in phases: Reuters

US tariff collections rose to a record $7 billion in September: WSJ

Global growth continues to slow, close to stagnant pace in Oct: IHS Markit

German industrial output continued to fall in September: Bloomberg

European Commission trims outlook for eurozone economic growth: Bloomberg

IMF downgrades Eurozone economic outlook: IMF

US worker productivity fell in Q3 — first drop in 3 years: Bloomberg

Inflation Expectations At Record Low As Treasury Forecast Rises

Confused about the outlook for US inflation? Yesterday’s conflicting news on this front isn’t helping.

Macro Briefing | 6 November 2019

Democrats prevail in key races in Virginia and Kentucky: Reuters

Atlanta Fed’s GDPNow model: weak 1.0% US growth expected for Q4: AF

German manufacturing orders rose more than expected in Sep: Reuters

Eurozone Composite PMI: weak growth prevailed in October: IHS Markit

Japan Composite PMI signals recession for first time in 3 years: IHS Markit

Falling US imports suggest softer economic growth ahead: WSJ

Growth in US services sector picked up in Oct, rising at moderate pace: CNBC

US Services PMI: slowest rise in sector activity in Oct in over 3 years: IHS Markit

US job openings fell to 18-month low in September: CNBC

Risk Premia Forecasts: Major Asset Classes | 5 November 2019

The expected risk premium for the Global Market Index continued to tick higher in October, rising to an annualized 4.8%. The estimates marks a fractional gain over the last month’s estimate. Compared with the estimate from 12 months earlier, today’s revised long-term risk premia projection for GMI has also edged up — from a 4.5% estimate in October 2018 (see table below). GMI is an unmanaged market-value-weighted portfolio that holds all the major asset classes (except cash). The forecast for this passive benchmark represents the ex ante premium over the expected “risk-free” rate for the long term.

Macro Briefing | 5 November 2019

US and China consider paring trade tariffs for initial trade deal: WSJ

China’s President Xi says he has ‘confidence’ in Hong Kong leader: BBC

OPEC trims oil-demand forecast, citing “stress” in world economy: CNBC

US formally begins exiting Paris climate agreement: Reuters

UK services sector remained stagnant in October: IHS Markit

Eurozone producer price inflation fell to 3yr low: -1.2% in Sep: Eurostat

Slightly stronger modest growth expected for ISM Non-Mfg Index in October

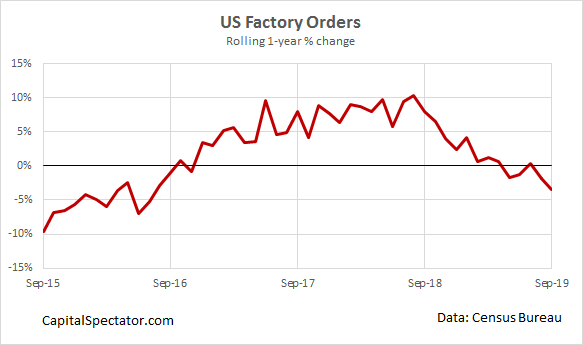

US factory orders fell 3.5% in Sep vs. year-ago level–weakest in 3 years:

US Stocks Led Most Global Markets Higher Last Week

Equities in the United States edged out the rest of the world for the trading week’s performances ended Friday, Nov. 1, based on a set of exchange-traded funds that represent the major asset classes.

Continue reading

Macro Briefing | 4 November 2019

US and China signal progress on trade talks: Bloomberg

South East Asian countries to sign Asia Pacific trade pact in 2020: CNBC

The Senate may in play for Dems in 2020 election: The Hill

Iran moves further away from compliance with nuclear pact: Reuters

US equity market’s rally is the world’s top performer: WSJ

Eurozone mfg recession will act as ‘severe drag’ on Q4 GDP: IHS Markit

US economic modeling favors Trump’s re-election: Bloomberg

US payrolls rose more than expected in October: Reuters

Mild recession for US manufacturing continued in Oct via ISM data: MW

PMI data for Oct reflect modest increase in US manufacturing activity: IHS Markit

Construction spending in US rose 0.5% in Sep, more than forecast: TT

US stock market volatility (VIX Index) remains close to 3-month low: