White House refuses to cooperate with House’s impeachment inquiry: WSJ

Poll: 3 in 10 Republicans support impeachment inquiry: The Week

Turkish military begins crossing into Syria: Bloomberg

China remains willing to discuss a partial trade deal with US: CNBC

New IMF chief: global economy slowing due to US-China trade war: NYT

Fed Chair Powell says US expansion is “sustainable”: Reuters

Small Business Optimism Index for US dipped in Sep but still upbeat: NFIB

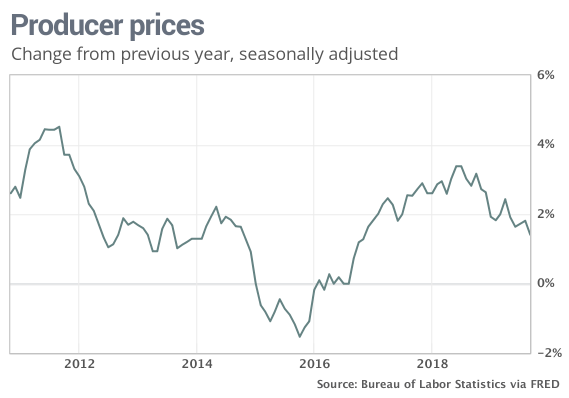

US wholesale inflation trend falls to 1.4% in Sep, lowest in nearly 3 years: MW

Managing Expectations: US Equity Factor Correlations | 8 Oct 2019

What are you expecting from equity factor ETFs? A number of research studies over the years encourage multi-factor exposure for enhance risk-adjusted return for a US equity allocation. At the core of this recommendation is the idea that different factors exhibit low correlation to one another. Value moves to the beat of its own drummer vis-à-vis momentum, which is relatively independent of the low-volatility factor, and so on.

Macro Briefing | 8 October 2019

Republicans condemn Trump’s plan to pull troops from Syria: WSJ

US blacklists Chinese companies, raising doubts for upcoming trade talks: Reuters

Johnson’s gov’t is preparing for collapse in Brexit talks: BBG

N. Korea looking for ‘major concessions’ from US in nuclear talks: CNBC

US federal debt rises to 7-year high (as % of GDP): The Hill

German industrial output rose in Aug but annual trend still deeply negative: BBG

Is the impeachment battle enhancing prospects for NAFTA trade deal? NY Times

US consumer credit’s growth rate edged lower in August: MW

China’s gold reserves have surged in 2019: Bloomberg

Bonds In Emerging Markets Topped Asset Class Returns Last Week

After meandering for a month, emerging-market bonds came alive in October’s first week of trading. This slice of global fixed-income securities posted the strongest increase last week for the major asset classes, based on a set of exchange traded funds.

Macro Briefing | 7 October 2019

US troops start Syrian withdrawal after Trump’s call with Erdogan: NY Times

China narrows scope for upcoming trade talks with US: MW

Second whistleblower raises impeachment risk for Trump: AP

Republicans defend Trump as Ukraine crisis deepens: Politico

Esther George, voting member of Fed, says no need for a rate cut: Fox

United Auto Workers: GM talks ‘have taken a turn for the worse’: CNBC

US payrolls rose modestly in Sep as jobless rate falls to 50-year low: CNBC

German industrial orders fell in Aug, marking another recession warning: Reuters

Treasury market’s implied inflation forecast fell to 3-year low last week:

Book Bits | 5 October 2019

● Non-Consensus Investing: Being Right When Everyone Else Is Wrong

By Rupal J. Bhansali

Summary via publisher (Columbia U. Press)

At a time when many proclaim the death of active investing, Rupal J. Bhansali, global contrarian, makes a clarion call for its renaissance. Non-consensus thinking has resulted in breakthrough successes in science, sports, and Silicon Valley. Bhansali shows how to apply it to the world of investing to improve one’s odds of achieving above-average returns with below-average risks. Her upside-down investment approach focuses on avoiding losers instead of picking the winners, asking the right questions instead of knowing the right answers, and scoring upset victories to achieve the greatest bang for one’s research buck.

Hiring At US Companies Remained Modest In September

Private payrolls in the US increased 114,000 in September, slightly below an upwardly revised gain of 122,000 in the previous month, the Labor Department reports. The latest round of hiring is strong enough to minimize fears that a recession is imminent, but still weak enough to raise questions about where the economy’s headed in the fourth quarter.

Will Slow US Growth Slip Into Recession?

It’s the number-one economic question these days, but the answer will remain elusive for several weeks at least, perhaps several months. What we do know is that output has slowed recently and appears to be dipping further. Determining when, exactly, the economy begins to contract can only be known with certainty in hindsight. For now, it’s clear that the risk of a new downturn has increased, but the slow-growth scenario remains the likely path until further notice. What might push the trend over to the dark side? Let’s consider a short list of indicators for perspective.

Macro Briefing | 4 October 2019

Moderately stronger job growth expected for today’s Sep payrolls data: Reuters

Fed Vice Chairman Clarida: labor market is “very healthy”: Reuters

Federal Reserve under growing pressure for another rate cut: Bloomberg

Global growth slowed in Sep, close to stagnation, via PMI data: IHS Markit

Factory orders in US fell slightly in August: Reuters

US jobless claims rise but continue to reflect low pace of layoffs: MW

Job cuts in US fell 22% in September vs. previous month: CG&C

US Services PMI reflects virtually stagnant business activity in Sep: IHS Markit

ISM’s US services sector weakened in Sep, falling to 3-year low: ISM

Trade-War Risk Continues To Rise, Threatening US Economy

At what point does economic resilience give way to political reality? No one’s really sure, but the Trump administration continues to press its trade-war policy and the macro blowback continues to mount. Let’s be clear: the United States economy continues to expand at a moderate pace and the risk of recession remains low for the immediate future. But investors are waking up to the fact that the White House’s policy on trade, if it continues, will probably be a critical catalyst that triggers the country’s first recession in a decade.