The US stock market has climbed a wall of worry this year, led by technology and real estate shares. The two sectors have been red hot for most of 2019 and that’s still true by wide margins, based on a set of exchange traded funds.

Macro Briefing | 11 October 2019

Turkey pounds Syrian Kurds in third day of military offensive: Reuters

Iranian tanker struck by missiles off coast of Saudi Arabia: CNBC

US-China trade talks set to continue on Friday after encouraging start: WSJ

Brussels meeting hints at possible UK-EU deal on Brexit: BBC

Jobless claims fell last week, pointing to ongoing US labor mkt growth: Reuters

10yr-3mo Treasury yield curve briefly turned positive on Thursday: MW

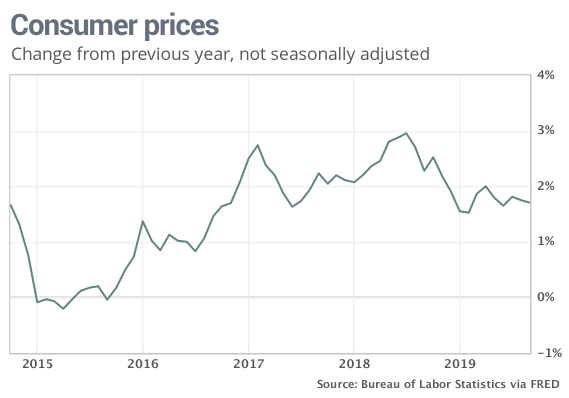

Low headline consumer inflation in Sep suggests another Fed rate cut: MW

US Treasury Market’s Inflation Forecast Slips To 4-Year Low

Ahead of today’s September report on US consumer inflation, the Treasury market’s implied inflation forecast via 5-year maturities quietly ticked down to 1.24% in Wednesday’s trading (based on daily data via Treasury.gov). The crowd’s estimate of future pricing pressure for 5-year Notes marks the lowest level since February 2016. Although market-based estimates of future inflation should be viewed cautiously, the latest dip is a reminder that a downside bias continues to prevail in this corner of economic expectations.

Macro Briefing | 10 October 2019

Turkey invades northeastern Syria; US says it didn’t approve the assault: BBC

Turkey’s Syria invasion ends fight against ISIS: Foreign Affairs

United States’ and China’s top trade negotiators set to meet today: Reuters

US considers a currency deal as part of China trade negotiations: Bloomberg

Fed officials considered rising recession risk at bank’s Sep meeting: The Hill

US Q3 GDP growth estimate slips to weak +1.7% in GDPNow model: Atlanta Fed

Falling German imports in Aug highlight recession risk: Reuters

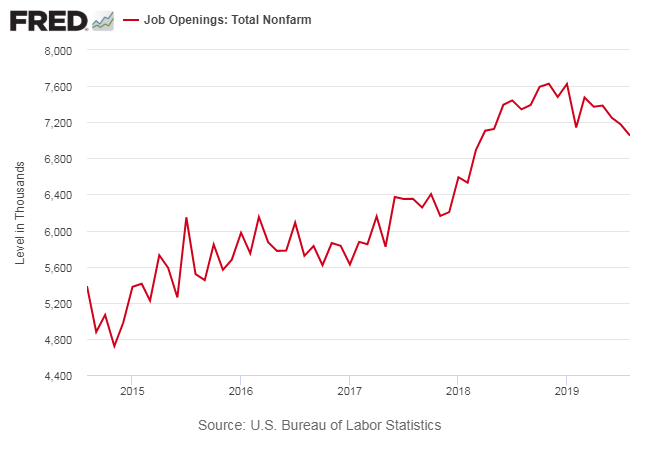

US job openings fell to a 1-1/2 year low in August: Reuters

US Q3 GDP Growth Expected To Match Q2’s Modest Gain

This month’s upcoming estimate of third-quarter economic growth for the US is on track to stabilize at a modest pace, matching the gain in Q2, based on the median estimate for a set of revised nowcasts. Recession risk remains low for now, but today’s update also reaffirms that a rebound in growth is unlikely any time soon.

Macro Briefing | 9 October 2019

White House refuses to cooperate with House’s impeachment inquiry: WSJ

Poll: 3 in 10 Republicans support impeachment inquiry: The Week

Turkish military begins crossing into Syria: Bloomberg

China remains willing to discuss a partial trade deal with US: CNBC

New IMF chief: global economy slowing due to US-China trade war: NYT

Fed Chair Powell says US expansion is “sustainable”: Reuters

Small Business Optimism Index for US dipped in Sep but still upbeat: NFIB

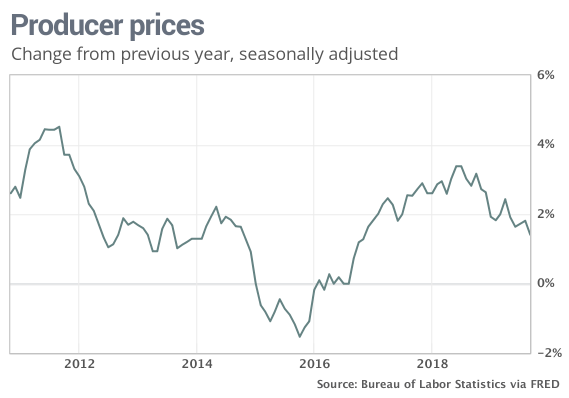

US wholesale inflation trend falls to 1.4% in Sep, lowest in nearly 3 years: MW

Managing Expectations: US Equity Factor Correlations | 8 Oct 2019

What are you expecting from equity factor ETFs? A number of research studies over the years encourage multi-factor exposure for enhance risk-adjusted return for a US equity allocation. At the core of this recommendation is the idea that different factors exhibit low correlation to one another. Value moves to the beat of its own drummer vis-à-vis momentum, which is relatively independent of the low-volatility factor, and so on.

Macro Briefing | 8 October 2019

Republicans condemn Trump’s plan to pull troops from Syria: WSJ

US blacklists Chinese companies, raising doubts for upcoming trade talks: Reuters

Johnson’s gov’t is preparing for collapse in Brexit talks: BBG

N. Korea looking for ‘major concessions’ from US in nuclear talks: CNBC

US federal debt rises to 7-year high (as % of GDP): The Hill

German industrial output rose in Aug but annual trend still deeply negative: BBG

Is the impeachment battle enhancing prospects for NAFTA trade deal? NY Times

US consumer credit’s growth rate edged lower in August: MW

China’s gold reserves have surged in 2019: Bloomberg

Bonds In Emerging Markets Topped Asset Class Returns Last Week

After meandering for a month, emerging-market bonds came alive in October’s first week of trading. This slice of global fixed-income securities posted the strongest increase last week for the major asset classes, based on a set of exchange traded funds.

Macro Briefing | 7 October 2019

US troops start Syrian withdrawal after Trump’s call with Erdogan: NY Times

China narrows scope for upcoming trade talks with US: MW

Second whistleblower raises impeachment risk for Trump: AP

Republicans defend Trump as Ukraine crisis deepens: Politico

Esther George, voting member of Fed, says no need for a rate cut: Fox

United Auto Workers: GM talks ‘have taken a turn for the worse’: CNBC

US payrolls rose modestly in Sep as jobless rate falls to 50-year low: CNBC

German industrial orders fell in Aug, marking another recession warning: Reuters

Treasury market’s implied inflation forecast fell to 3-year low last week: