This week’s delayed fourth-quarter report on US gross domestic product (GDP) remains on track to confirm that US economic growth continued to slow. The Bureau of Economic Analysis is expected to report (on Thursday, Feb. 28) that the expansion moderated for a second straight quarter, based on a set of nowcasts. The release will also reveal that recession risk remained low for the US at the close of 2018, although preliminary data for 2019 suggests that growth will continue to decelerate.

Continue reading

Macro Briefing: 26 February 2019

India launches air strike in Pakistan-controlled Kashmir: Fox

Congress inching closer to rebuking Trump’s emergency declaration: Politico

VP Pence announces new sanction’s on Venezuela’s Maduro regime: CBS

UK Prime Minister May set to rule out no-Brexit deal: Reuters

N. Korea’s Kim arrives in Vietnam for meeting with Trump: Reuters

Texas mfg activity slows in Feb but outlook remains positive: Dallas Fed

US wholesale inventories rose a strong 1.1% in December: MW

Chicago Fed Nat’l Activity Index: US economic growth slowed in Jan: Chicago Fed

Across-The-Board Gains For The Major Asset Classes Last Week

Led by a strong increase in emerging-market stocks, a buying spree lifted all corners of global markets last week, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 25 February 2019

Trump says he’ll delay tariff increase for Chinese goods: WSJ

Beijing is cautiously optimistic on prospects for US-China trade deal: SCMP

Will a US-China trade deal stop the global economic slowdown? CNBC

Trump and Kim may formally declare end to 1950-53 Korean War: NY Times

NABE survey: more than 75% of economists expect recession by 2021: Bloomberg

US stock market volatility (VIX Index) fell to 5-month low on Friday:

Book Bits | 23 February 2019

● Bubbles and Crashes: The Boom and Bust of Technological Innovation

By Brent Goldfarb and David A. Kirsch

Summary via publisher (Stanford University Press)

Financial market bubbles are recurring, often painful, reminders of the costs and benefits of capitalism. While many books have studied financial manias and crises, most fail to compare times of turmoil with times of stability. In Bubbles and Crashes, Brent Goldfarb and David A. Kirsch give us new insights into the causes of speculative booms and busts. They identify a class of assets—major technological innovations—that can, but does not necessarily, produce bubbles. This methodological twist is essential: Only by comparing similar events that sometimes lead to booms and busts can we ascertain the root causes of bubbles.

Continue reading

China, Emerging Markets Lead 2019 Rebound For Global Equities

Across-the-board gains continue to mark this year’s results for global equity markets, based on a set of exchange-traded funds that track the world’s major regions and countries. At the top of the performance list so far in 2019: stocks in China, Latin America and Africa.

Continue reading

Macro Briefing: 22 February 2019

Trump to meet with China’s top trade negotiator today: Bloomberg

Existing home sales in US fell to 3-year low in Jan: Reuters

Mortgage rates fall to 1-year low, suggesting possibility of housing rebound: MW

US core durable goods orders fell in December: CNBC

US jobless claims retreat, suggesting labor market remains strong: MW

Leading Economic Index for US ticked lower in Jan: CB

Philly Fed Index goes negative in Feb–first time in 3 years: MW

PMI survey data: US economic growth picked up in Feb: IHS Markit

US Business Cycle Risk Report | 21 February 2019

The US economic trend continues to slow, but the deceleration – so far – has been gradual and non-threatening in terms of raising recession risk to a critical level. In other words, moderate growth prevails, albeit with a downside bias. If the deceleration rolls on, the potential for trouble may become elevated in the second half of 2019.

Continue reading

Macro Briefing: 21 February 2019

US and China lay groundwork to end trade war: Reuters

House plans to block Trump’s emergency declaration: Politico

UK’s prime minister (still) searching for solution to Brexit impasse: Bloomberg

Japan’s government: economy still recovering at ‘moderate pace’: MNI

Iran’s foreign minister: a conflict with Israel is possible: Reuters

Eurozone growth remains ‘muted’ in February via PMI survey data: IHS Markit

China may be planning to launch a more aggressive round of stimulus: CNBC

Fed minutes: policymakers see little risk to leaving rates steady: Reuters

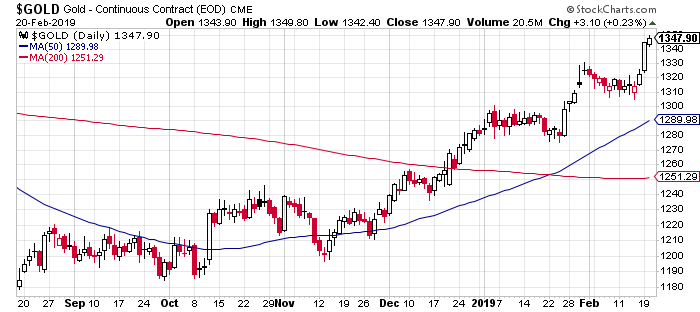

Gold price jumps to 10-month high: MarketWatch

Junk, Long-Term Corporates Still Leading 2019 Bond Market Rally

The bull run in US bonds shows no sign of slowing, based on year-to-date performances for a set of exchange-traded funds. All the major slices of fixed-income markets are posting gains through yesterday’s close (Feb. 19), with junk bonds leading the field by a solid margin.

Continue reading