Trump administration says US troops are being withdrawn from Syria: BBC

Trump’s withdrawal from Syria ignores advice from advisers: Reuters

UK and Europe preparing for no-deal Brexit in March: CNBC

US population grew at slowest pace in over 80 years: NY Times

Fed raises rates despites signs of softer US growth: CNN

US and foreign stock markets fall sharply after Fed rate hike: Bloomberg

Foreign policy experts: cyber attack on US is a high risk for 2019: CFR

Fed trims 2019 US GDP growth forecast to median +2.3%: Federal Reserve

Current account deficit for US widened in Q3, representing 2.4% of GDP: MW

US existing home sales in Nov post biggest annual decline in over 7 years: WSJ

China’s gov’t aid to Latin America dwarfs US support: GZeroMedia

Short-Term Maturities Top US Bond Performances In 2018

The return of risk-off trading in late-2018 has revived demand for the safe haven of bonds, but only short-term maturities are posting year-to-date gains, based on a set of exchange-traded funds covering US fixed-income markets.

Continue reading

Macro Briefing: 19 December 2018

British government prepares for ‘no-deal’ Brexit: Reuters

White House backs down from gov’t shutdown threat over border wall: The Hill

US pledges $10 bill for Central America to stem tide of migration: Fox

Fed expected to raise rates today: Bloomberg

FedEx says global growth is slowing: CNBC

Crude oil (WTI) on Tues fell to lowest price since Aug 2017: Reuters

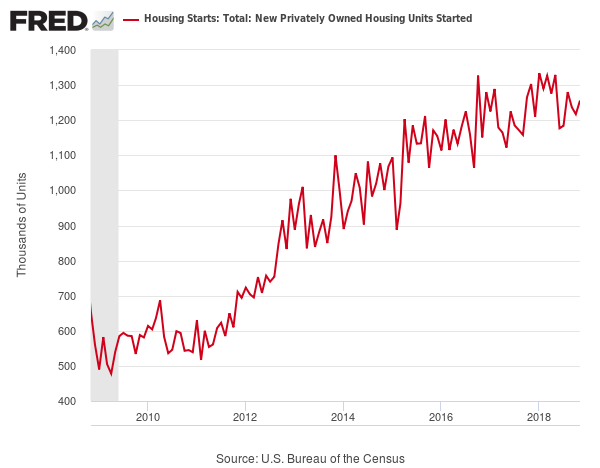

US housing starts rebounded in Nov, supported by multi-family units: Reuters

Moderate Slowdown Expected For US GDP Growth In Q4

The falling US stock market paints a worrisome outlook, but the latest nowcasts for US GDP in the fourth quarter continue to project a softer-but-still healthy pace of economic activity, based on estimates compiled by The Capital Spectator.

Continue reading

Macro Briefing: 18 December 2018

Xi calls for China to ‘stay the course’: CNBC

World stocks fall on Tues as Fed appears set to raise rates: Reuters

S&P 500 dropped to 14-mo low on Monday: Reuters

German business confidence eased for 4th straight month in Dec: Investing.com

US consumer demand for credit declined for year through Oct: Reuters

NY Fed manufacturing index fell to 19-month low in Dec: MW

Researchers: politicians caused pay ‘collapse’ for bottom 90% of workers: WaPo

US home builder confidence dropped to 3-1/2 year low in Dec: MW

Major Asset Classes Posted Mixed Results Last Week

The headlines focused on the sharp losses in US and European stocks last week, but performances across the major asset classes delivered a mixed picture, based on a set of exchange traded products.

Continue reading

Macro Briefing: 17 December 2018

White House prepares for government shutdown: LA Times

China tightens control on economic data as economy weakens: SCMP

US on Monday criticizes China’s ‘unfair competitive practices’: Reuters

Saudi Arabia blasts US Senate resolutions on Khashoggi, Yemen: Reuters

Eurozone inflation in Nov eases more than initially estimated: MW

Oil giant ConocoPhillips supports tax on carbon emissions: Axios

US private-sector output in Nov rose at slowest pace since May 2017: IHS Markit

Rise in inventories for US in Oct may add to Q4 economic growth: Reuters

Industrial output in US for Nov picked up to strongest gain in 3 months: MW

All major investment markets have lost ground in 2018: NY Times

US retail spending’s 1-year change ticked down to 4.2% in Nov:

There’s Only One (Sane) Solution Left For UK’s Brexit Mess

It’s the worst alternative, except when compared to everything else, which is why Britain should take the get-out-of-Brexit-free card offered by the European Court of Justice (EOJ). Last week, ECJ judges ruled that Britain can unilaterally cancel Brexit. Wouldn’t that run afoul of the 2016 referendum that delivered a 52%-to-48% win in favor of leaving the European Union? No, because the UK can revoke its plans to leave the EU and announce a commitment to develop a new Brexit going forward. The new plan, ideally, would have the benefit of agreement between Parliament and Prime Minister Theresa May (or her successor). At that point, assuming it ever comes, Britain can present the plan to the EU and begin fresh negotiations with Brussels.

Continue reading

Book Bits | 15 December 2018

● Shadow Networks: Financial Disorder and the System that Caused Crisis

By Francisco Louçã and Michael Ash

Summary via publisher (Oxford University Press)

The 2007-08 financial crisis surprised many economists and the public. But how did the crisis come about, why was it so deep, and why has the clean-up been so slow and painful? Many accounts of the crisis focus on renegade activity in marginal financial sectors. Shadow Networks challenges this pervading view and sets out to demonstrate that, far from a dissident branch, the shadow finance that initiated the crisis is tightly networked with, and highly profitable for, bank-based finance. The collapse was not an accident, but baked into the system of finance from the start. Shadow Networks traces the complex web of power that caused crisis and gives vivid descriptions of the actors in the quarter century leading up to 2007 to explain how the now decade-long crisis took shape.

Continue reading

US Financial Markets Stress Index Ticks Up To 2-1/2 Year High

An estimate of financial stress in US financial markets edged up last week to the highest level since April 2016, based on the St. Louis Fed Financial Stress Index (STLFSI). Although the benchmark remains well below zero, which implies a below-average level of stress, the steady rise in recent months suggests that financial conditions are on a path of becoming less favorable for markets and the economy in 2019.

Continue reading