The slide in global markets in recent weeks has cut prices near and far, but the steepest declines for the trailing five-year return – a proxy for the value factor – are still linked with the dive in commodities. That was true for the deep-value list in October and the profile is intact in today’s update, which reflects trading through yesterday (Nov. 14).

Continue reading

Macro Briefing: 15 November 2018

Death toll rises to 56 in Northern California’s fire: NBC

Liability costs from California fires threaten electric utility PG&E: CNN

China outlines trade concessions to US ahead of G20 meeting: Bloomberg

Two UK ministers quit after May announces cabinet backs Brexit deal: Reuters

Israel’s political turmoil creates challenges for US Mideast peace plan: Bloomberg

Fed Chairman Powell is “happy about the state of the economy right now”: MW

Business inflation trend in Nov ticked down to annual 2.2% pace : Atlanta Fed

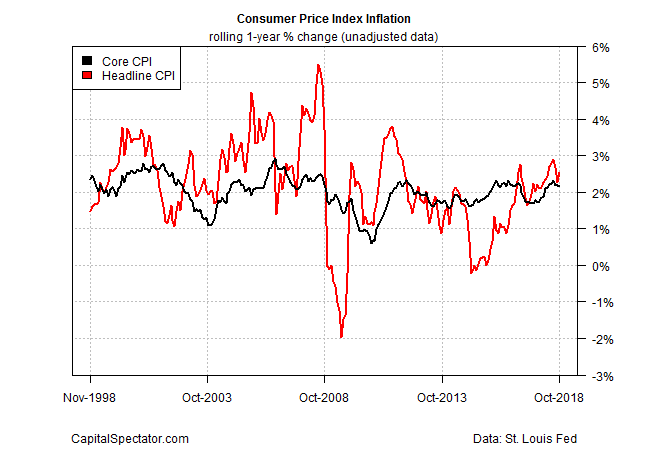

US consumer inflation trend edged up in Oct as core inflation slipped: MW

Behavioral Risk Is Highest In The Early Years Of A New Investment

It’s old news that managing expectations is usually the main challenge in finding success with an investment strategy. To paraphrase Pogo in the quest to earn a respectable return through time, we’ve met the enemy of prudent behavior and he is us. Less obvious is the tendency for this behavioral risk to go to extremes early on in the period immediately following the establishment of a new investment. By comparison, a decade or more into the holding period — assuming you make it that far — is relatively safe from a behavioral perspective.

Continue reading

Macro Briefing: 14 November 2018

UK and EU reach provisional agreement on Brexit: CNBC

Democratic gains rise a week after mid-term elections: NY Times

China’s retail spending trend slows as industrial output picks up: Reuters

German economy shrank in Q3, first decline since 2015: Bloomberg

Japan’s economy contracted in Q3 due to natural disasters: Japan Times

Several bearish factors continue to weigh on crude oil prices: MW

Spain will ban all gas-powered cars by 2040: Gizmodo

Analysts expect headline consumer inflation to rise 0.3% in Oct vs. Sep’s 0.1%: MNI

US small business optimism held near record high in Oct: NFIB

US Economic Output Running Well Above Potential GDP Estimate

The recent run of strong growth in GDP is welcome news, but from the perspective of policymakers there are signs that the economy may be approaching its maximum output capacity. In turn, this analysis provides the Federal Reserve with another reason to continue squeezing monetary policy.

Continue reading

Macro Briefing: 13 November 2018

Audio recording seems to link Khashoggi killing to Crown Prince: NY Times

Democrat wins US Senate race in Arizona: CBS

Lawsuits and accusations swirl as Florida recount battle deepens: WaPo

N. Korea maintains secret missile bases, defying promises to US: Reuters

Gaza launches barrage of rockets at Israel: CNN

Amazon chooses New York and Northern Virginia for HQ2 locations: WSJ

SF Fed President: more rate hikes needed with full US employment: MNI

Moody’s: global credit conditions expected to weaken in 2019: P&I

US gasoline prices slide for a fifth straight week: 24/7 Wall Street

Expect rise in number of economic surprises for the US: Vanguard

Crude oil falls for 12th straight session, longest decline on record: Bloomberg

US REITs Led Last Week’s Partial Rebound In Asset Classes

Roughly half of the major asset classes posted gains last week, led by a strong increase in US real estate investment trusts (REITs), based on a set of exchange-traded products.

Continue reading

Macro Briefing: 12 November 2018

A grim milestone for deaths in California’s fires: BBC

At WWI ceremony in France a warning: ‘old demons are rising again’: Time

Is climate change becoming too complex and divisive to solve? Axios

Global oil producers close to cutting production: Fox Business

Does Australia’s long-running expansion hold lessons for US policy? Bloomberg

US dollar close to 17-month high in early trading on Monday: Reuters

China says it will further open up its economy: Reuters

The vote recounts in Florida, Georgia and Arizona are razor close: NY Times

US wholesale inflation surged in Oct, highest pace in over 6 years: CNBC

US wholesale inventories in Sep rose a bit more than previously estimated: CNBC

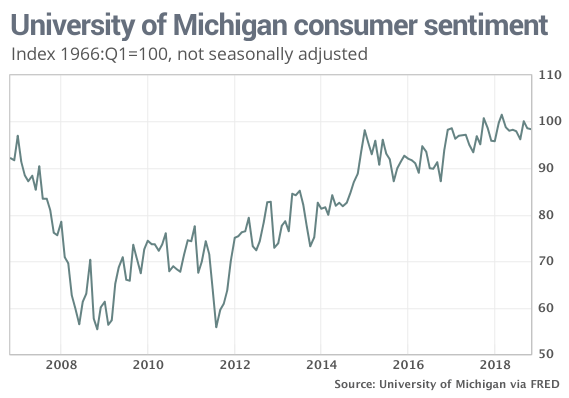

US Consumer Sentiment Index for Nov still reflects upbeat economic outlook: MW

Book Bits | 10 November 2018

● Merger Masters: Tales of Arbitrage

By Kate Welling and Mario Gabelli

Summary via publisher (Columbia University Press)

Merger Masters presents revealing profiles of monumentally successful merger investors based on exclusive interviews with some of the greatest minds to practice the art of arbitrage. Michael Price, John Paulson, Paul Singer, and others offer practical perspectives on how their backgrounds in the risk-conscious world of merger arbitrage helped them make their biggest deals. They share their insights on the discipline that underlies their fortunes, whether they practice the “plain vanilla” strategy of announced deals, the aggressive strategy of activist investment, or any strategy in between on the risk spectrum. Merger Masters delves into the human side of risk arbitrage, exploring how top practitioners deal with the behavioral aspects of generating consistent profits from risk arbitrage.

Continue reading

Is The Treasury Market Predicting That US Inflation Has Peaked?

The Federal Reserve left interest rates unchanged yesterday, but the central bank continued to signal that a hike at next month’s policy meeting remains a possibility. The reasoning is that the US economy continues to post solid growth. But a closer look at the numbers suggests that the pace of expansion is slowing. There are also hints that the reflation trend over the past year or so may be rolling over. If so, the case could be weakening for more policy tightening.

Continue reading