The government bond market had been more or less flatlining since since President Trump on Apr. 2 announced “Liberation Day” and rolled out US tariffs, which sparked concern about inflation. But in recent days a new headwind is weighing on fixed income securities: a US government budget bill (that was approved by the House this morning), which is expected to significantly raise an already hefty federal deficit in the years ahead.

Macro Briefing: 22 May 2025

US 30-year Treasury yield jumps to 5.09%, the highest level since late-2023. “It goes without saying that if Trump is, in fact, looking to the Treasury market as a barometer of investors’ approval of the action in Washington [with regards to the current debate over the federal spending bill], then the recent sell-off that brought 30-year yields from as low as 4.65% earlier this month to 5.095% is without question a troubling development,” said Ian Lyngen, an interest rate strategist at BMO Capital Markets.

Markets Still Expect Fed To Keep Rates Steady For Near Term

Uncertainty about inflation, the economy, and trade policy continue to blur the macro outlook, which in turn supports expectations that the Federal Reserve will leave interest rates unchanged at the next several policy meetings.

Macro Briefing: 21 May 2025

Policy uncertainty has a ‘meaningful’ impact on the US economic outlook, said St. Louis Federal Reserve Bank president Alberto Musalem. “To the extent that the economy requires capital expenditure to continue to occur, that it requires hiring to continue to occur, and if all those decisions have been somewhat paused because of the uncertainty, it would affect the economic outlook I would expect.” An index tracking policy uncertainty has spiked recently, but is starting to fall, although it remains elevated vs. the pre-tariff period.

US Q2 GDP Still Looks Set To Rebound After Q1 Decline

US economic output remains on track to rebound in the second quarter following the slight decline in Q1, based on the median estimate for a set of GDP nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 20 May 2025

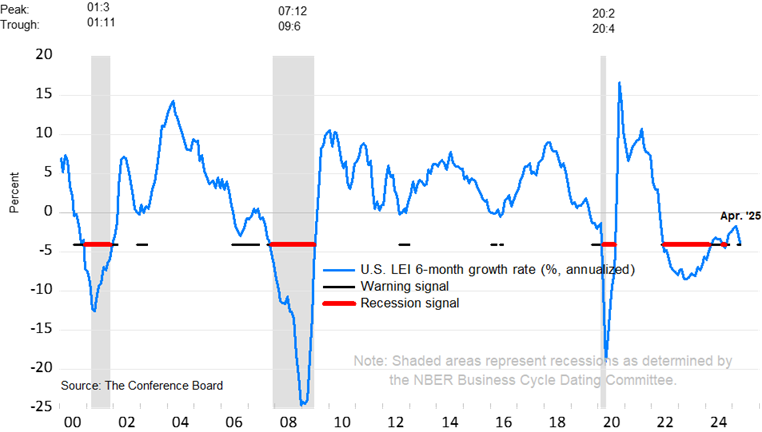

The US Leading Economic Index fell sharply in April, dropping for a fifth straight month, the Conference Board reported. “The US LEI registered its largest monthly decline since March 2023, when many feared the US was headed into recession, which did not ultimately materialize,” said Justyna Zabinska-La Monica, senior manager, business cycle indicators, at the consultancy. The six-month growth rate for the index declined further in April, but remained slightly above the recession signal threshold.

All The Major Asset Classes Posting Gains In 2025 After Latest Rally

Market sentiment has been a wild ride in recent months, but for the moment investors are breathing a sigh of relief, based on a set of ETFs tracking the major asset classes for year-to-date returns through Friday’s close (May 16).

Macro Briefing: 19 May 2025

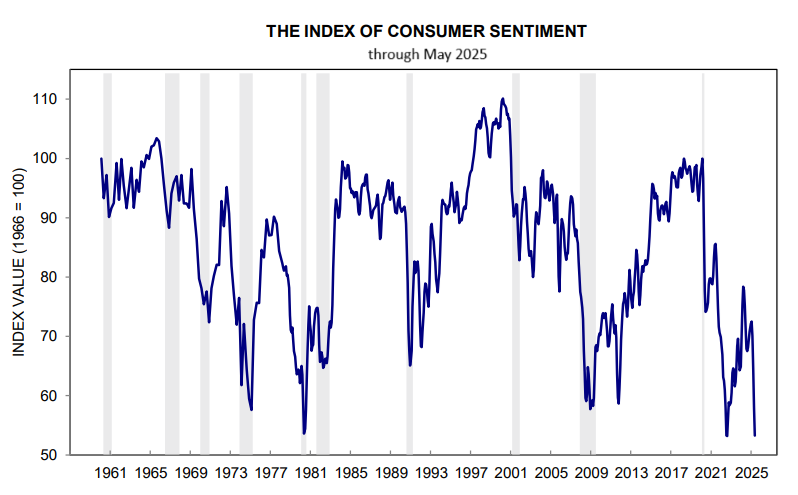

US Consumer Sentiment Index dropped to second-lowest level on record in May, based on polling by the University of Michigan. The caveat is that most of the survey was conducted before the US and China agreed to a 90-day pause on most tariffs. “Tariffs were spontaneously mentioned by nearly three-quarters of consumers, up from almost 60% in April; uncertainty over trade policy continues to dominate consumers’ thinking about the economy,” Joanne Hsu, director of the Surveys of Consumers, advised.

Book Bits: 17 May 2025

● Capitalism and Its Critics: A History: From the Industrial Revolution to AI

● Capitalism and Its Critics: A History: From the Industrial Revolution to AI

John Cassidy

Review via The New York Times

Trump makes a few cameo appearances in John Cassidy’s new book, “Capitalism and Its Critics,” for his demonstrated ability to brag about his riches while tapping into growing discontent with the global capitalist system. Some of the critics Cassidy features in this book wanted to replace capitalism entirely; others, like Trump, have sought to preserve a core of self-interest while remaking capitalism’s rules. Rejecting a world financial order fueled by free trade and a bedrock American dollar, the president has been promoting a grab bag that includes both tariffs and crypto — a Trumpian hybrid of the very old and the very new.

Research Review | 16 May 2025 | Asset Allocation

Rethinking the Stock-Bond Correlation

Thierry Roncalli (Amundi Asset Management & University of Evry)

February 2025

The stock-bond correlation is a basics of finance and is related to some of the fundamentals of asset management. However, understanding the stock-bond correlation is not easy. In this presentation, we answer the following questions What is the natural sign of the stock-bond correlation? Why do some investors prefer a positive stock-bond correlation while others prefer a negative stock-bond correlation? How does the stock-bond correlation relate to the theory of risk premia? What is the leverage effect of correlation? What are the conditions for negative stock-bond correlation? What are the implications for strategic asset allocation (SAA) and tactical asset allocation (TAA)?