The recent turmoil in emerging markets hasn’t deterred the Federal Reserve from lifting interest rates at next month’s monetary policy meeting, according to analysts, Fed funds futures, and the recent trend in inflation-adjusted base money supply.

Continue reading

Macro Briefing: 16 August 2018

Senior Chinese officials to visit US for trade talks: Politico

Trump revokes former CIA Director Brennan’s security clearance: The Hill

US retail spending up more than expected in July: LA Times

Growth in US industrial output slowed sharply in July: CNBC

NY Fed Mfg Index posted solid gain for August: NY Fed

Business inflation expectations remain steady at 2.1% for Aug: Atlanta Fed

US builder confidence in Aug fell to lowest level in 2018: HousingWire

Productivity in US jumped to highest level in over 3 years in Q2: MW

Benchmark 10yr Treasury yield trending lower again, dipping to one-month low:

An Analyst Says Asset Allocation “In Serious Decline.” Really?

A Forbes columnist last week warned that asset allocation is falling on hard times. Rob Isbitts, founder and chief investment officer of Sungarden Investment Research, writes that “if you started investing in a typical asset allocation strategy any time since mid-2012, your returns have been progressively worse.” Using a set of BlackRock asset allocation ETFs as evidence, he says the standard asset allocation strategy has “lost its mojo.”

Continue reading

Macro Briefing: 15 August 2018

A hodgepodge of results for Dems and GOP in Tuesday’s primaries: Politico

Turkey raises tariffs on US imports as banking authorities support lira: Reuters

US warns of more tariffs for Turkey if pastor isn’t freed: Reuters

Democrats and Republicans shunning capitalism: Yahoo Finance

Are US trade tariffs on China part of a grander strategic policy? SCMP

Be wary of using one indicator for factor analysis: ETF.com

US stock market rise is close to longest bull market on record: LPL

US small business optimism in July edged up to 2nd highest level in 45 years: NFIB

Active management’s death has been greatly exaggerated: Barry Ritholtz

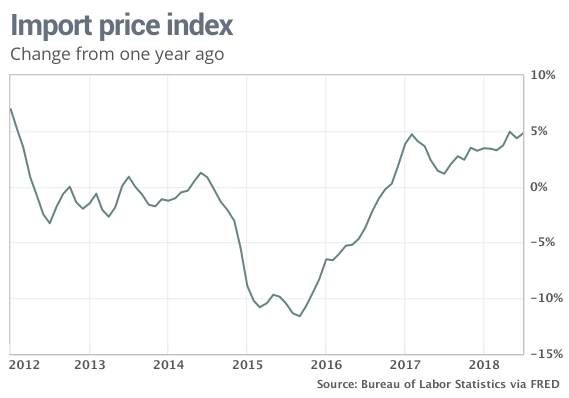

US y-o-y import prices tick up to 6-1/2-year high in July: MarketWatch

Early Estimates See Slower-But-Still-Strong Growth For US Q3 GDP

The first official third-quarter report on US GDP is more than two months away, but the preliminary nowcasts point to a softer-but-still-solid gain, based on several estimates compiled by The Capital Spectator. The question is whether escalating trade-war tension and Turkey’s financial crisis that’s roiling emerging markets will take a bite out of the rosy projections for the US?

Continue reading

Macro Briefing: 14 August 2018

Fed expected to keep raise rates despite economic turmoil in Turkey: Bloomberg

European banks remain under pressure amid Turkey’s currency crisis: Reuters

Strategists outline four paths to resolve Turkey’s financial crisis: MarketWatch

Slower credit growth in China raises economic concern: Bloomberg

US passed a new law that strengthens govt’s hand in foreign business deals: BBC

W. Virginia lawmakers vote to impeach 4 justices on state’s highest court: The Hill

Congressional Budget Office trims forecast for US economic growth: CBO

Vanguard FTSE Emg Markets ETF (VWO) near 1yr low as Turkey’s crisis deepens:

Widespread Selling Weighed On Major Asset Classes Last Week

US investment-grade bonds were spared losses last week. Otherwise, red ink spilled across the major asset classes, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 13 August 2018

World equity markets drop to 1-month low amid Turkish currency crisis: Reuters

Turkey begins to bolster financial system after currency plunge: Bloomberg

North and South Korean leaders agree to meet for 3rd time: CNN

Euro falls to 13-month low: Reuters

Indian rupee traded at record low vs. dollar on Monday: CNBC

Vanguard sees US recession risk rising: NY Times

US core inflation up by the most in July in 10 years: Bloomberg

Rising concerns about trade tariffs transcend political parties in US: UoM

Book Bits | 11 August 2018

● Dopesick: Dealers, Doctors, and the Drug Company that Addicted America

By Beth Macy

Review via The Seattle Times

The numbers are overwhelming: 63,632 Americans died of a drug overdose in 2016, according to the Centers for Disease Control and Prevention. Almost two-thirds of those deaths were from a prescription or illicit opioid, and the government report was unusually blunt: “America’s overdose epidemic is spreading geographically and increasing across demographic groups.” Drug overdose, Macy writes, “is now the leading cause of death for Americans under the age of fifty, killing more people than guns or car accidents, at a rate higher than the HIV epidemic at its peak.”

Continue reading

Are Low Equity Sector Correlations A Warning Sign For Stocks?

James Paulsen, chief investment strategist at Leuthold Group, sees trouble brewing in the growing disconnect between US equity sectors. He told CNBC earlier this week that correlations among US equities is unusually low and flashing a warning signal. That’s an especially dangerous sign when the stock market’s valuation is so high. Let’s dig deeper into the topic by crunching correlations on the major sector ETFs along with a broad equity market fund.

Continue reading