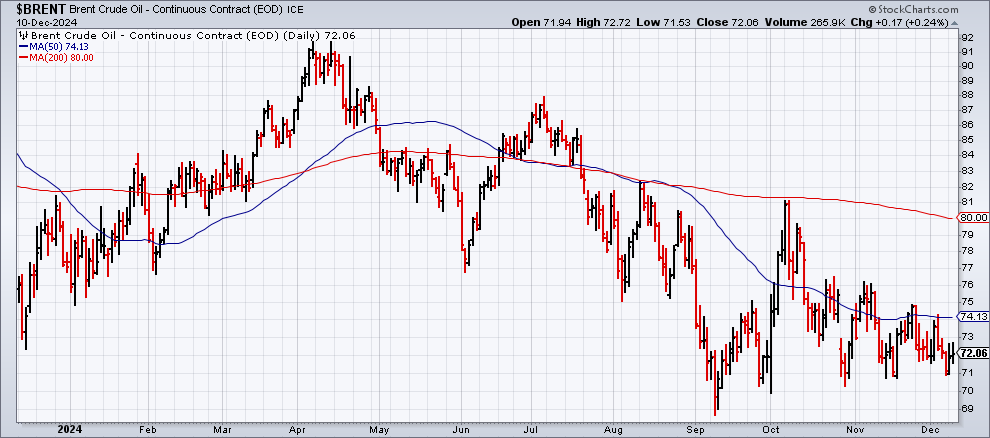

Saudi Arabia is struggling with its plan to keep crude oil prices elevated. “Rising US production and internal OPEC+ pressure limit the kingdom’s sway over prices,” reports The Wall Street Journal. Trump is a new source of uncertainty as US-based shale drillers may be embolded to lift output amid a push for deregulation. Meanwhile, the International Energy Agency estimates global supply will exceed demand by more than one million barrels a day next year without a production cut. Brent, the international oil benchmark, is down 6.5% this year.

Is The Downshift In US Inflation Stalling?

Disinflation has stalled recently, but economists are debating if this is a temporary blip that will soon give way to a softer trend. Tomorrow’s consumer price report for November will be widely read for an update.

Macro Briefing: 10 December 2024

US small business optimism rose sharply in November, according to NFIB’s survey. “The election results signal a major shift in economic policy, leading to a surge in optimism among small business owners,” says NFIB chief economist Bill Dunkelberg. “Main Street also became more certain about future business conditions following the election, breaking a nearly three-year streak of record high uncertainty.”

Syria’s Regime Change Reorders Geopolitical Risk For Middle East

It happened gradually, then suddenly. In a stunning development over the weekend, Syrian rebel groups overthrew the dictator Bashar al-Assad, who reportedly has fled to Russia. Although almost no one anticipated such a rapid power change, everyone agrees that the implications are far-reaching for the region and beyond.

Macro Briefing: 9 December 2024

The fall of Syria’s president over the weekend puts the nation on uncertain path and poses new risks for the Middle East and beyond. The overthrew of the government has resuffled the geostrategic chessboard on numerous fronts for Russia, Israel, Turkey and the US and other countries. “The Assad regime’s sudden collapse in Syria marks a profound and far-reaching geopolitical shift,” notes SpecialEurasia, a consultancy. “The rapid Syrian opposition military gains, spearheaded by Hayat Tahrir al-Sham (HTS), have significantly altered regional political and military conditions.” Qutaiba Idlbi, a senior fellow at the Atlantic Council advises: “The fall of the Assad regime presents an opportunity to address longstanding issues in Syria and the region. However, it is not a panacea and could lead to further instability if not carefully managed.”

Best Of Book Bits 2024: Part I

Has a year gone by already? My watch must be slow. In any case, it’s time once again to roll out our annual review of CapitalSpectator.com’s weekly Book Bits column and choose a few of the more intriguing titles from the archives. As usual, we’ll revisit ten books that appeared on these pages during the course of the year that’s rapidly winding down — titles that, for one reason or another, caught your editor’s eye and deserve another look before we put a fork in 2024. We’ll start with five today, followed by the balance in a week. Happy reading

● Slow Burn: The Hidden Costs of a Warming World

Robert Jisung Park

Review via International Monetary Fund

As the world warms, anxiety over the effects continues to rise. A survey conducted by the United Nations found two-thirds of the global population believe that climate change is a global emergency. Fears abound on the risks of triggering tipping points in the climate system, such as the melting of ice sheets or the release of underground methane. But alongside future risks of climate catastrophe, there are also slow-burning effects already being felt around the globe. In Slow Burn: The Hidden Costs of a Warming World, environmental and labor economist R. Jisung Park documents these effects, from the expected, like worsening inequality, to the unexpected, such as declining productivity and economic growth.

Research Review | 6 December 2024 | Index and Passive Investing

Limits to Diversification: Passive Investing and Market Risk

Lily H. Fang (INSEAD), et al.

September 2024

We show that the rise of passive investing leads to higher correlations among stocks and increased market volatility, thereby limiting the benefit of diversification. The extent to which a stock is held by passive funds (index mutual funds and ETFs) positively predicts its beta, correlation, and covariance with other stocks, but not its idiosyncratic volatility. During crisis periods, stocks with high passive holdings contribute more to market risk compared to before the crisis. Correlated trading by passive funds explains these results, which are further amplified by implicit indexing due to performance benchmarking.

Macro Briefing: 6 December 2024

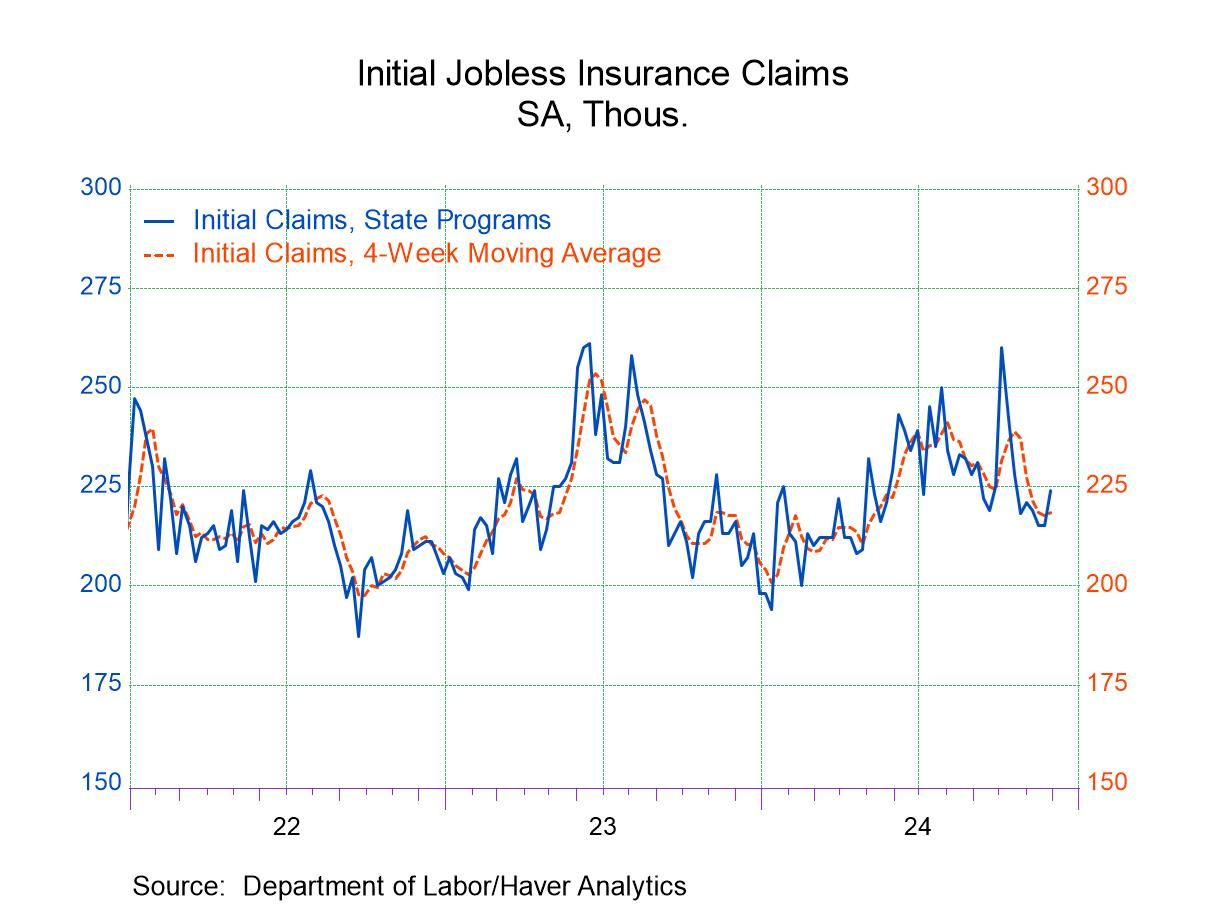

US jobless claims rose to a six-week high last week, but remain near the lows of recent history, which suggests the outlook for the labor market is still relatively upbeat. The number of Americans filing for unemployment benefits increased to 224,000 on a seasonally adjusted basis, the highest since mid-October.

Momentum, Large-Cap Growth Set To Top Factors Returns In 2024

The winners keep on winning. That sums up the horse race for much of this year based on a set of ETFs targeting the main US equity factor risk premiums. Going in to the home stretch for 2024, the momentum and large-cap growth factors continue to post a commanding lead over the rest of the field, based on trading through Wednesday’s close (Dec. 4).

Macro Briefing: 5 December 2024

US nonfarm private sector payrolls rose 146,000 in November, down from a 184,000 gain in the previous month, according to the ADP Employment Report. “While overall growth for the month was healthy, industry performance was mixed,” says Nela Richardson, chief economist at ADP. “Manufacturing was the weakest we’ve seen since spring. Financial services and leisure and hospitality were also soft.”