The odds still look skewed toward a softer pace of expansion for fourth-quarter GDP, but an upgraded nowcast from the Atlanta Fed hints at the possibility for something stronger.

Macro Briefing: 4 December 2024

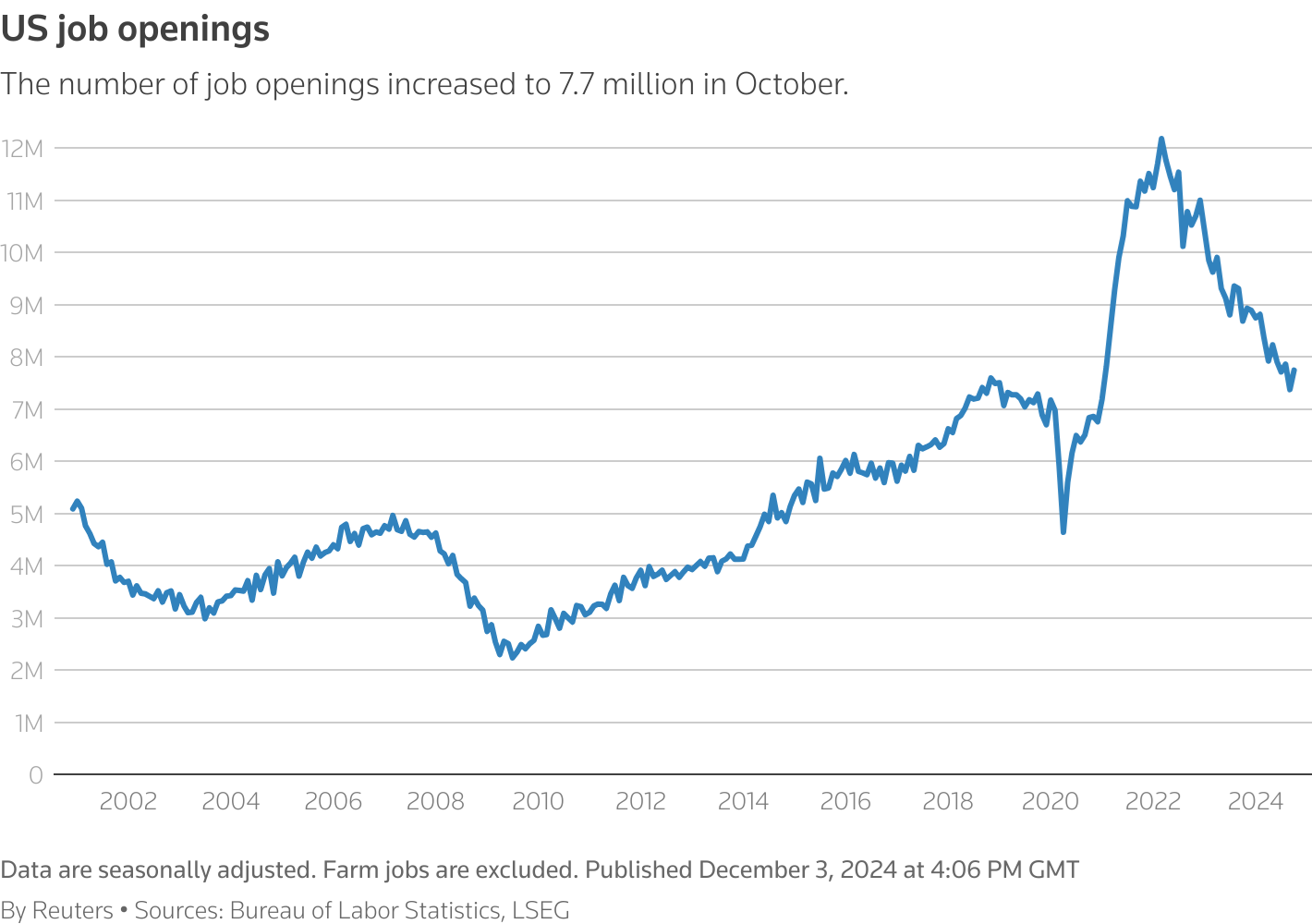

US job openings rose in October, rebounding from September, when new openings fell to a three-year low. Although the current reading is well below the April 2022 peak following the economy’s recovery from the pandemic, the October level is still above the pre-pandemic high point. “The report points to ongoing resilience and doesn’t flag major concerns about the economy,” says Oren Klachkin, financial market economist at Nationwide. “With policy still restrictive in its view, the Fed can probably push through with another rate cut before considering a pause next year.”

Total Return Forecasts: Major Asset Classes | 03 December 2024

The long-term performance forecast for the Global Market Index (GMI) continued to increase in November, marking a full reversal of the recent slide in ex ante data. Today’s estimate also marks the highest return outlook in recent history and is modestly above the previous month’s forecast.

Macro Briefing: 3 December 2024

US manufacturing contraction eased in November, according to the survey-based ISM Manufacturing Index. The 48.4 reading is the highest since June, but remains well below the neutral 50 mark.

Major Asset Classes | November 2024 | Performance Review

Global markets delivered mixed results in November. US stocks and real estate estate investment trusts led last month’s winners, rebounding with solid gains following October’s decline, based on a set of ETFs. Commodities and shares in emerging markets suffered the biggest losses in November.

Macro Briefing: 2 December 2024

US jobless claims fell for a third straight week, slipping to a 7-month low. The recent decline and relatively low level of new filings for unemployment benefits suggest that the labor market will remain resilient in the near term. “The underlying trend in first-time claims implies that firms continue to carefully manage their workforce amid an economy at full employment,” writes Joseph Brusuelas, chief economist at RSM US.

Happy Thanksgiving 2024

Revised US GDP Nowcast For Q4 Still Reflects Modest Slowdown

The US economy remains on track to end the year with a moderate increase in output, according to the median Q4 GDP estimate based on a set of nowcasts published by several sources. Recession risk, as a result, is still a low-probability risk for the near term. The question is whether a sharp change in US economic policy in 2025 will change the calculus?

Macro Briefing: 26 November 2024

Is a reflation problem brewing for the Federal Reserve in 2025? A TMC Research note highlights the potential factors aligning for 2025 that may trigger a course correction for monetary policy: “In the context of potentially reflationary factors brewing for 2025 from various sources, the outlook for ramping up money supply growth could be ill-timed for the central bank’s plans to manage inflation pressures.”

US Stocks Continue To Lead Markets By Wide Margin In 2024

As the final weeks of the trading year come into focus, American shares remain the odds-on favorite to dominate 2024 performance for the major asset classes.