North and South Korea set date for talks at border: NY Times

China warns US not to open “Pandora’s box” of trade war: Reuters

German unemployment dips to record low in March: Bloomberg

Reports point to renewed oil-production cuts for OPEC: Reuters

US Q4 GDP growth revised up to 2.9% from 2.5%: MarketWatch

For 6th straight month, US trade deficit in goods widened in Feb: FreightWaves

Pending home sales in US increased 3.1% in February: HousingWire

Low risk is a predictor of financial crises: Vox EU

10yr-2yr Treasury yield spread falls below 50 basis points for first time since 2007:

Losses Dominate Year-To-Date Performances For US Equity Sectors

The revival of volatility in the US stock market this year has taken a toll on most equity sectors. Only two out of 11 sectors – consumer discretionary and technology – are posting year-to-date gains at the moment, based on a set of ETFs.

Continue reading

Macro Briefing: 28 March 2018

China: N. Korea’s Kim pledges to denuclearize and meet US officials: Reuters

US and South Korea revise trade deal: Reuters

US Consumer Confidence Index dips in Mar after 18yr high in Feb: CNBC

Home prices increase in all top-20 US cities in Jan: HousingWire

Mfg activity in Fed’s 5th district expands at slower pace in Mar: Richmond Fed

Eurozone economic sentiment falls to 6-month low in March: RTT

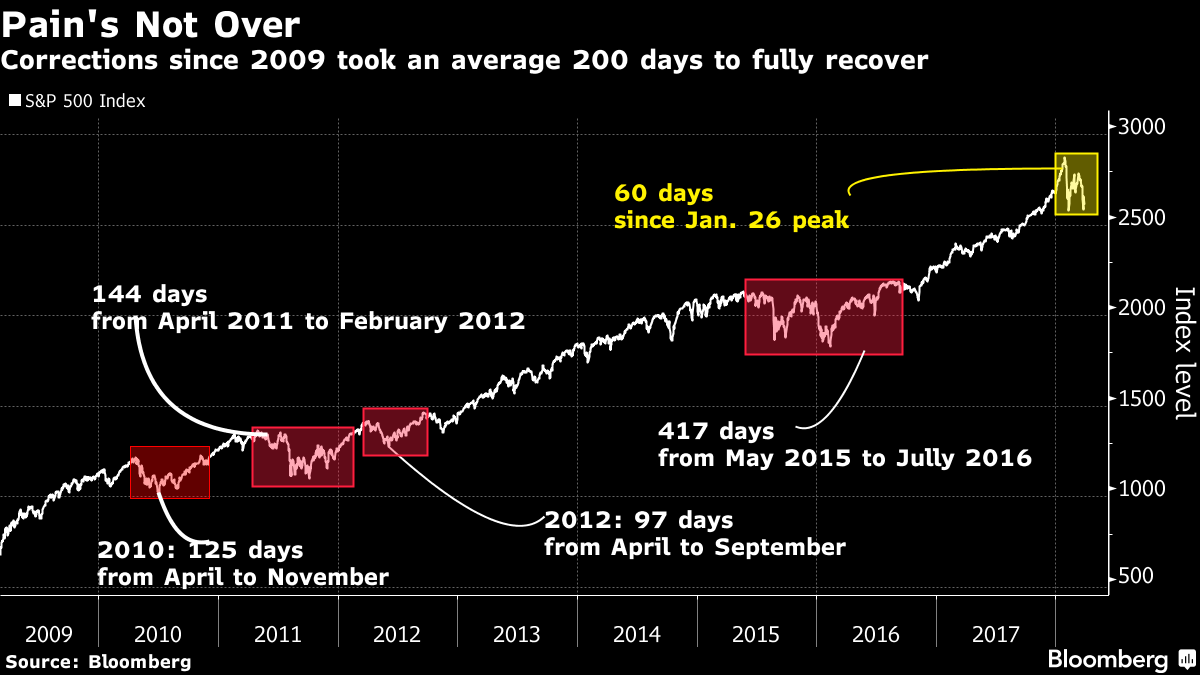

Analyst: stock mkt corrections since 2009 took avg 200 days to recover: Bloomberg

Another Fed Official Questions The Value Of Yield-Curve Signal

Cleveland Federal Reserve President Loretta Mester on Monday said that the recent flattening of the yield curve isn’t a sign that the US economy is weakening. Her comment follows a similar observation by Fed Chairman Jerome Powell, who suggested last week that low inflation in recent years has reduced the value of monitoring recession risk based on differences between long and short Treasury yields.

Continue reading

Macro Briefing: 27 March 2018

US and European Union plan to expel 100-plus Russian diplomats: Reuters

Russia vows retaliation for the mass explusion of its diplomats: CNN

N. Korea’s Kim reportedly visits China: Bloomberg

US and foreign stock markets rebound sharply as trade-war fears fade: BBC

Progressive groups press for a NY Fed chief who reflects diversity: NY Times

Cleveland Fed president supports rate hikes, says trade tensions are a risk: MW

Mfg growth slows in Dallas Fed’s district: Dallas Fed

US economic activity strengthens in February: Chicago Fed

Foreign Bond Markets Rallied Last Week On Trade-War Fears

Stock markets around the world tumbled last week over concerns about a possible trade war between the US and China. The risk-off posture generated renewed demand for bonds, particularly foreign bonds, which delivered the only gains last week for the major asset classes, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 26 March 2018

Taiwan sends jets to shadow China’s air force drills near island: Reuters

US Treasury Secretary looking for ways to lower US-China trade risk: Bloomberg

European Union’s competition minister considers breaking up Google: Telegraph

World stocks rise on Monday on reports of US-China trade negotiations: Reuters

San Francisco Fed chief may be next leader at NY Fed: WSJ

US and S. Korea agree to revise trade agreement: Bloomberg

US durable goods orders post a strong rebound in February: MarketWatch

S&P 500 Index closes on Friday just above widely followed 200-day average:

Book Bits | 24 March 2018

● Meltdown: Why Our Systems Fail and What We Can Do About It

By Chris Clearfield and Andras Tilcsik

Excerpt via Big Think

We can’t turn back the clock and return to a simpler world. Airlines shouldn’t switch back to paper tickets and traders shouldn’t abandon computers. Instead, we need to figure out how to manage these new systems. Fortunately, an emerging body of research reveals how we can overcome these challenges.

The first step is to recognize that the world has changed. But that’s a surprisingly hard thing to do, even in an era where businesses seem to celebrate new technologies like blockchain and AI. When we interviewed the former CEO of Knight Capital years after the firm’s technological meltdown, he said, “We weren’t a technology company—we were a broker that used technology.” Thinking of technology as a support function, rather than the core of a company, has worked for years. But it doesn’t anymore.

Continue reading

US Business Cycle Risk Report | 23 March 2018

Fears of a global trade war are rattling stock markets around the world after President Trump imposed tariffs on China on Thursday. China’s commerce ministry responded immediately with tariffs on US imports. If trade restrictions escalate, there will be a price to pay in economic growth and so this evolving news story deserves close attention for monitoring macro risk. For the moment, however, using data published to date, US recession risk remains virtually nil.

Continue reading

Macro Briefing: 23 March 2018

Hawkish makeover of US foreign policy rolls on with Bolton appointment: Atlantic

Trump OKs new China tariffs and stocks tumble on fears of trade war: Reuters

China threatens to respond to US tariffs with trade limits on imports: WaPo

Senate passes $1.3 trillion spending bill, averts gov’t shutdown: Bloomberg

US Leading Economic Index increased 0.6% in Feb–fourth straight gain: CNBC

US jobless claims ticked up but still near lowest levels since 1970: MarketWatch

US Composite PMI for Feb points to moderate 2.5% GDP growth for Q1: IHS Markit

FHFA Index: US house prices up 7.3% year over year in Jan: Builder

Manufacturing activity still strong in Fed’s 10th district: Wichita Business Journal

S&P 500 Index tumbled 2.5% on Thursday, closing at lowest level since February 9: