Hiring at US companies accelerated in February, rising 287,000, the biggest monthly advance in nearly two years, according to the Labor Department. The faster increase translates into the strongest year-over-year rise since last August. The upbeat data gives the Federal Reserve another excuse to raise interest rates at the March 20-21 monetary policy meeting.

Continue reading

5 Questions For James Rosseau On Legal Shield’s Economic Indexes

Interest in alternative data sets has exploded in recent years as investors scour the world for relatively obscure numbers that may offer insights overlooked in standard economic releases. Some of these figures are genuinely useful for developing an edge in trading and portfolio design, but there’s plenty of junk, too. Accordingly, caveat emptor applies when it comes to new and often untested economic and financial indicators. One intriguing set of benchmarks that’s caught our attention comes by way of LegalShield, which sells legal services products. The firm also publishes several alternative economic data sets, including the LegalShield Real Estate Index. In early February, the company issued a press release that noted that this so-called leading indicator was predicting weakness for existing home sales. A few weeks later, the official January sales report did in fact reflect a decline, according to the National Association of Realtors. One accurate forecast could be luck, of course, but Legal Shield’s data is certainly worthy of a closer look as a potential source of deeper perspective on economic trends. For some context, The Capital Spectator posed five questions to James Rosseau, Legal Shield’s chief commercial officer, about the firm’s alternative economic benchmarks.

Continue reading

Macro Briefing: 9 March 2018

Trump agrees to meet with N. Korea’s Kim Jong Un: CNN

US-N. Korea summit may bring progress, but Asia also sees risks: NY Times

Trump OKs steel & aluminum tariffs, with exemptions for Mexico, Canada: Reuters

China warns of “strong” reaction to Trump’s tariffs: Fortune

GOP faces possibility of embarassing loss in special Penn. election: Bloomberg

European Central Bank takes another step away from stimulus: Reuters

Jobless claims in US jump after dipping to near-50-year low: MarketWatch

US employers announce 20% fewer job cuts in Feb vs. Jan: CG&C

US leads the world for imposing protectionist measures: Washington Post

Treasury Market’s Inflation Forecast At Highest Level In Five Years

The implied inflation outlook via 5-year Treasuries ticked up to the 2.10% mark this week for the first time since 2013. The increase matches the forecast for 10-year Notes, which have been estimating future inflation at or above the 2.10% mark since mid-February. The forecasts are based on the yield spreads for the nominal rates less their inflation-indexed counterparts.

Continue reading

Macro Briefing: 8 March 2018

Trump plans to impose steel tariffs despite threats of retaliation: Bloomberg

China has “necessary response” to new US trade tariffs: Guardian

Europe plans to retaliate if US imposes trade tariffs: NY Times

A wary US considers N. Korea’s offer of detente: Reuters

S. Korean officials head to US to brief Trump on N. Korea meeting: CNN

ADP: US private sector added a strong 235,000 jobs in Feb: USA Today

Consumer credit growth slows to four-month low: Bloomberg

US trade deficit widens to deepest gap in over 9 years: WSJ

Fed Beige Book: growth still positive as inflation picking up: MarketWatch

SEC says cryptocurrency exchanges must be registered: LA Times

US productivity flat in Q4 as pace of labor costs tick higher: MarketWatch

Fed funds futures continue to price in high probability of rate hike on Mar 21: CME

Profiling Asset Allocation Strategies With Style Analysis

In a series of recent articles I reviewed how style analysis can be used to replicate investment strategies and indexes using only historical returns (see here, here, and here). That’s a powerful application, but it only scratches the surface for productive uses of style analysis. What else can you do? Monitoring asset weights via a broad set of asset allocation funds is one possibility.

Continue reading

Macro Briefing: 7 March 2018

N. Korea’s offer to suspend nuclear tests is greeted with suspicion: Reuters

Gary Cohn, Trump’s top economic adviser, will resign: NY Times

Some analysts see deeper chaos in White House after Cohn’s departure: Politico

US weighs new limits on Chinese imports and investments: Bloomberg

The US-China rivalry is increasingly about technology: NY Times

Which US industries, companies will take a hit in a trade war? CBS

US factory orders declined in Jan–first monthly slide in 6 months: Reuters

The rise in China’s debt boom is almost without precedent: FT Alphaville

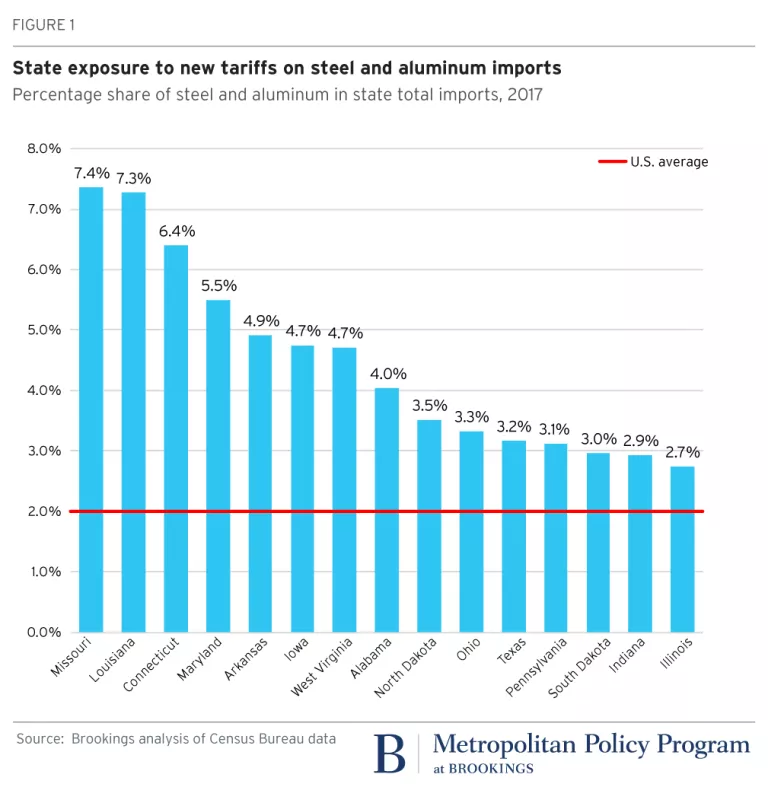

Ranking the potential blowback from Trump’s tariffs on US states: Brookings

Momentum Factor Still Leads After Surge In Market Volatility

The US stock market this year has taken investors on a white-knuckled ride, but the momentum factor’s performance leadership has remained a constant in the US equity factor space, based on a set of proxy ETFs.

Continue reading

Macro Briefing: 6 March 2018

EU proposes 25% retaliatory tariff on US goods: Bloomberg

Republican lawmakers pressure Trump to abandon trade tariffs: The Hill

N. Korea announces “agreement” with S. Korea to advance dialogue: Reuters

Washington is first state to pass net neutrality protections: Medium

ISM Non-Mfg Index edges lower in Feb: RTT

PMI: US services sector econ activity accelerates to 6-mo high in Feb: IHS Markit

Critics bemoan Fidelity’s decision to raise equity risk in target date funds: Reuters

An aging rail tunnel into Manhattan is a key risk factor for US economy: Bloomberg

Global All-Industry Output Index ticks up to 41-month high in Feb: IHS Markit

Most Asset Classes Fell Last Week

Last week’s trading ended in the red for all but one of the major asset classes, based on a set of exchange-traded products. US inflation-linked Treasuries edged higher over the five trading days through Mar. 2 while losses weighed on everything else.

Continue reading