Fourth-quarter economic output for the US looks set for another downshift, based on CapitalSpectator.com’s initial GDP nowcast. The estimate reflects the median for a set of nowcasts published by several sources.

Macro Briefing: 18 November 2024

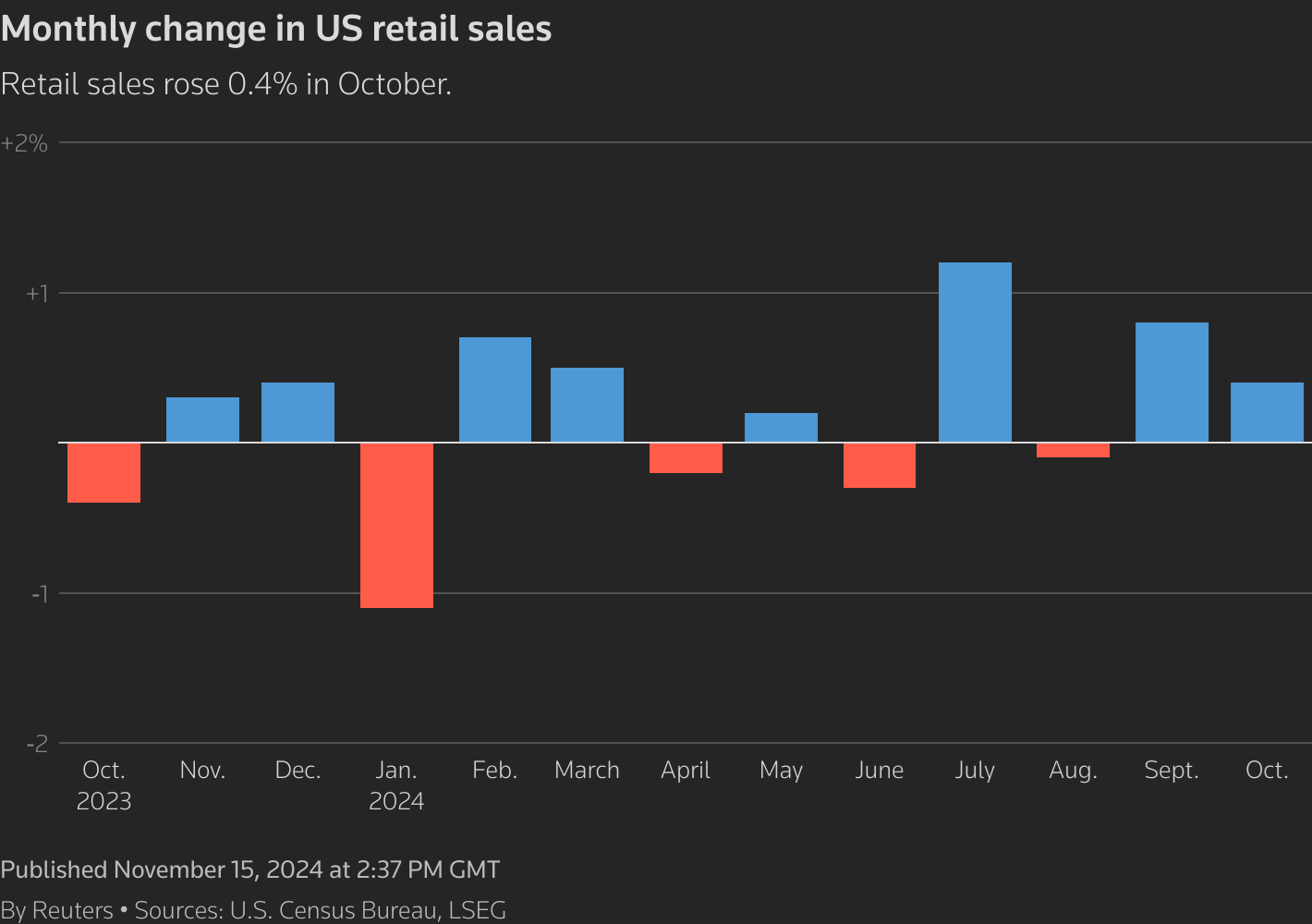

US retail sales rose more than expected in October, reviving doubts about the wisdom of additional rate cuts. “Retail sales data [in October] make many in the markets wonder if another rate cut at the December meeting is warranted at all,” says Christopher Rupkey, chief economist at FWDBONDS. “With fiscal policy expected to shift into high gear on the pro-growth stimulus side, perhaps the Fed’s monetary policy should not be putting another log on the fire to fuel growth by lowering rates, as it could lead to a return of inflation.”

Book Bits: 16 November 2024

● False Prophets of Economics Imperialism: The Limits of Mathematical Market Models

● False Prophets of Economics Imperialism: The Limits of Mathematical Market Models

Matthew Watson

Summary via publisher (Agenda publishing/Columbia U. Press)

This book studies the methodological revolution that has resulted in economists’ mathematical market models being exported across the social sciences. The ensuing process of economics imperialism has struck fear into subject specialists worried that their disciplinary knowledge will subsequently count for less. Yet even though mathematical market models facilitate important abstract thought experiments, they are no substitute for carefully contextualised empirical investigations of real social phenomena. The two exist on completely different ontological planes, producing very different types of explanation.

The Trump Factor Takes A Toll On Foreign Stocks

The election victory has fueled a strong rally in US equities, but Donald Trump’s comeback is seen as a new risk factor elsewhere as Washington prepares to pivot to new edition of an “America First” policy.

Macro Briefing: 15 November 2024

US jobless claims fell to a six-month low last week. “While many employment-related indicators point to a significant softening in labor market conditions this year, that change has not carried over to the unemployment insurance data thus far,” says Lou Crandall, chief economist at Wrightson ICAP. An economist at RSM, Tuan Nguyen, writes: “The continued drop in new filings for unemployment benefits, a proxy for layoffs, should suggest a strong rebound in payroll gains this month, which would reaffirm that the disappointing October jobs report was a one-time shock.”

10-Year US Treasury Yield ‘Fair Value’ Estimate: 14 November 2024

The market premium for the US 10-year Treasury yield rose in October relative to a “fair value” estimate calculated by CapitalSpectator.com. The increase marks the first time since April that the premium increased.

Macro Briefing: 14 November 2024

US consumer inflation edges up to 2.6%, marking first pickup in pricing pressure since March. The core reading of inflation (excluding energy and food) held steady at a 3.3% pace. “Progress on inflation has started to stall,” says Michael Pugliese, a senior economist at Wells Fargo. “The time is fast approaching when the Fed will signal that the pace of rate cuts will slow further, perhaps to an every-other-meeting pace starting in 2025.”

Rising Treasury Yields Raise Doubts About Another Fed Rate Cut

Fed funds futures are still leaning into expectations that the Federal Reserve will reduce its target rate next by a quarter point, but the related confidence of the forecast is slipping.

Macro Briefing: 13 November 2024

The US dollar index rose to a six-month high on Tuesday, fueled by expectations for rising inflation risk during a second Donald Trump presidency. The reasoning is related to the possibility that the Federal Reserve may curtail or perhaps reverse rate-cutting plans if inflation rebounds due to potentially reflationary policies driven by higher tariffs and other policy plans outlined by the president-elect. Higher interest rates tend to support a higher dollar relative to other currencies. The Fed would “continue to take a cautious tone going forward, especially in light of what we view as heightened inflation risks in a second Trump term,” predicts Win Thin, global head of markets strategy at Brown Brothers Harriman.

Communications, Financials Take Lead As Top Sector Performers

Defensives are out, animal spirits are in… again. Or so the latest rotation among US equity sectors suggests, based on a set of ETFs through Monday’s close (Nov. 11).