US growth in business activity strengthened in November, according to PMI survey data. The US PMI Composite Output Index, a GDP proxy, rose to 55.3, a 31-month high. “The business mood has brightened in November, with confidence about the year ahead hitting a two-and-a-half year high,” says , Chris Williamson, chief business economist at S&P Global Market Intelligence. “The prospect of lower interest rates and a more probusiness approach from the incoming administration has fueled greater optimism, in turn helping drive output and order book inflows higher in November.”

Book Bits: 23 November 2024

● Tech Agnostic: How Technology Became the World’s Most Powerful Religion, and Why It Desperately Needs a Reformation

● Tech Agnostic: How Technology Became the World’s Most Powerful Religion, and Why It Desperately Needs a Reformation

Greg M. Epstein

Q&A with author via The.ink

Q: How does it help us to frame “tech” — and that’s a thing distinct from “technology” as you put it in the book — as religion, and are there ways that analytic frame might hinder our understanding?

A: It helps us to understand how far removed from reality a lot of what we’re told about tech. I want people to really look at what we’re doing when we’re interfacing with what this mythical Silicon Valley and its people are doing. When we’re creating these fantasies of a kind of technological heaven, these terrifying scenarios of a technological hell, then we’re literally in the business of creating tech gods.

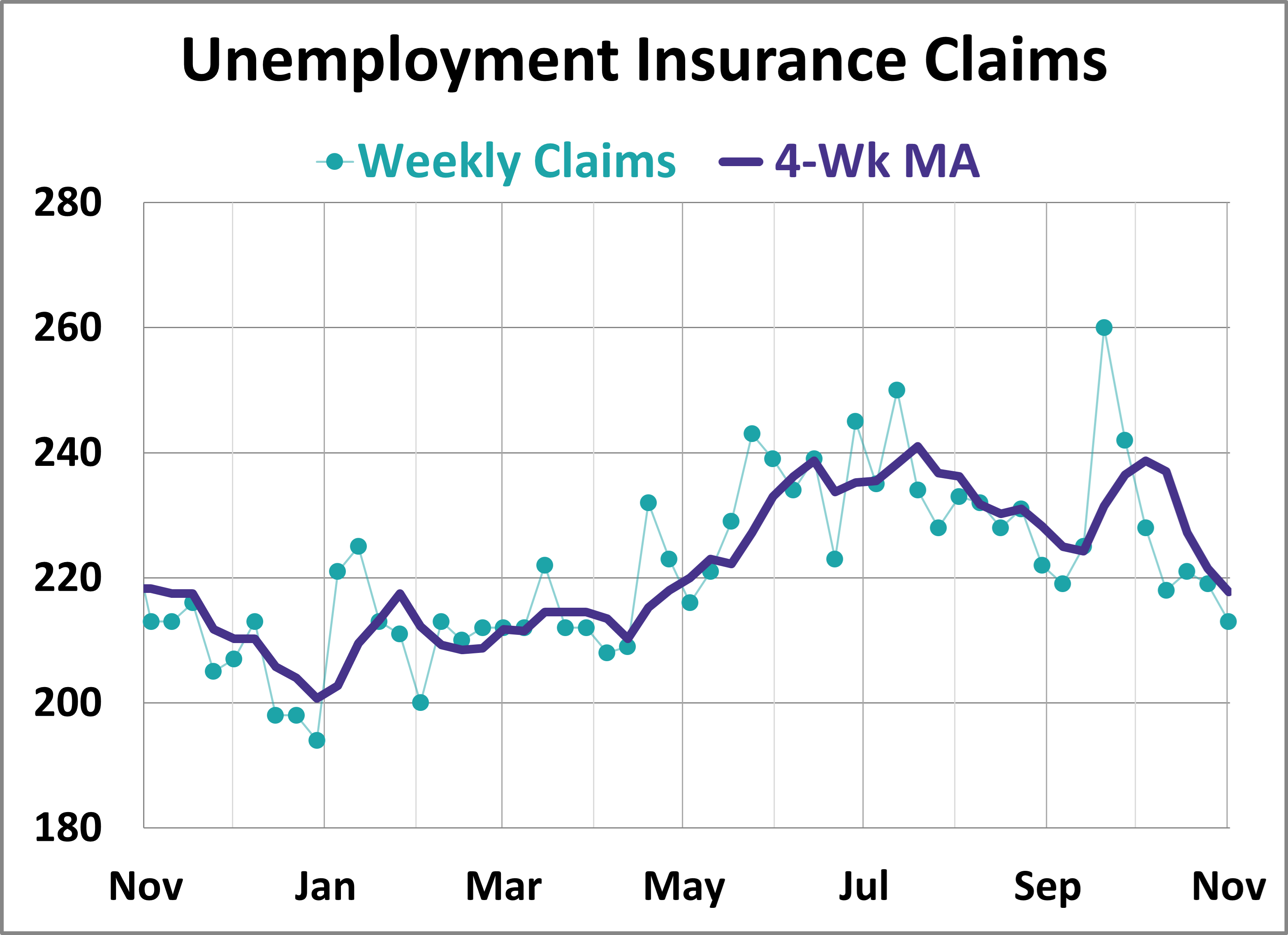

US Continuing Jobless Claims Rise To 3-Year High. Time To Worry?

The ongoing rise in continuing claims looks worrisome, but initial claims are telling a considerably more upbeat story. Which one’s the better measure? The positive spin via initial claims is probably the superior metric for assessing the near-term outlook for payrolls and, by extension, the economy. But let’s dig into this view for some perspective before signing off on the idea entirely.

Macro Briefing: 22 November 2024

US jobless claims fall to the lowest level since April. “The weekly claims report remains the best real-time monitor of labor market conditions,” Jefferies US economist Thomas Simons writes in a research note. “Right now, the data show that the labor market is trending sideways at a healthy level.”

Is The Relatively Weak Trend For US Private Payrolls A Warning?

If you could only track one economic indicator to monitor the economy the trend in payrolls would be a solid choice. Think of it as the fuel that powers consumer spending engine, which accounts for nearly 70% of economic activity. The good news is that the labor market still looks solid, based on several conventional metrics. But an alternative indicator your editor is watching introduces a degree of doubt about what may be in store for 2025.

Macro Briefing: 21 November 2024

Business inflation expectations in November remained “relatively unchanged at 2.2%, on average, according to the Atlanta Fed. The bank’s latest poll shows inflation expectations holding near the lowest level in 3-1/2 years.

Is Fed Policy Still Too Tight?

The next round of central bank decisions could rank among the most challenging in recent history, perhaps in decades. Policy hawks and doves can cite a fair amount of evidence for supporting their respective views. The deciding factor, as usual, will be the incoming data. But waiting for clear signs could risk the Fed’s success to date in taming inflation without damaging economic growth. On the other hand, one can argue that policy is still too tight for an economy that appears to be slowing, albeit modestly.

Macro Briefing: 20 November 2024

US housing starts fell in October, falling 3.1% from September and 4.0% below the year-ago level. “Hurricanes Helene and Milton are likely to have affected housing activity during October,” advises Haver Analytics. Christopher Rupkey, chief economist at FWDBONDS, notes: “Despite the weather impact on building down in the South, the recession in residential housing construction remains deep in the woods with no daylight seen for buyers facing supply shortages as they hunt for new single-family homes.”

Desperately Seeking Yield: 19 November 2024

There’s little about recent history that reflects stability, with at least one exception: the average trailing payout rate on a globally diversified portfolio.

Macro Briefing: 19 November 2024

US home builder sentiment rises for a third straight month in November, reaching the highest level since May but remains below the neutral 50 mark. “With the elections now in the rearview mirror, builders are expressing increasing confidence that Republicans gaining all the levers of power in Washington will result in significant regulatory relief for the industry that will lead to the construction of more homes and apartments,” says Carl Harris, chairman of NAHB, which publishes the data. “This is reflected in a huge jump in builder sales expectations over the next six months.”