Democrats score first electoral wins in Trump era: Politico

Trump’s agenda for his two-day China visit: trade and N. Korea: AP

China’s trade surplus with US narrows in Oct: Reuters

N. Korea dismisses Trump’s diplomatic outreach: CNN

Job openings in US remain strong in Sep: CNBC

Consumer credit rises in Sep, touching 10-month high: ABA Banking Journal

US economic growth has defied forecasts by the left: RCP

Economic confidence in US remains positive in Oct: Gallup

Replicating Indexes In R (Part III): Socially Responsible Investing

In previous installments of replicating indexes I profiled the style-analysis methodology and presented an example using a hedge fund index. Now let’s turn to a strategy of replicating the S&P 500 Index with a handful of stocks that are considered socially responsible investments (SRI).

Continue reading

Macro Briefing: 7 November 2017

Trump in S. Korea talks of using military force if necessary: Reuters

Rising energy stocks help lift markets in Europe and Asia on Tuesday: WSJ

Is a war brewing between Saudi Arabia and Lebanon? Reuters

Global growth rate ticks up in October, according to survey data: IHS Markit

Eurozone growth is strong at start to Q4; job pace at decade high: IHS Markit

Hedge funds are a key force driving Bitcoin to a record $7400: NY Times

Crude oil rises to two-year high: Bloomberg

Commodities Lead Markets For Second Week In A Row

Broadly defined commodities posted the strongest gain for the major asset classes last week, based on a set of exchange-traded products. The advance marks the second time in as many weeks that commodities topped the performance list.

Continue reading

Macro Briefing: 6 November 2017

More than two dozen killed in church shooting in Texas: CNN

Saudi prince with hefty US investments is arrested: LA Times

Trump in Asia says Japan is “winning” with free trade: USA Today

US commerce secretary kept investments linked to Russia, Putin: NY Times

US job growth rebounds in Oct but wage growth slows: Reuters

ISM Non-Mfg Index edges up to 9-year high in Oct: CNBC

US Services PMI in Oct points to “strong” growth: IHS Markit

Factory orders in US rise 1.4% in Sep: ABC News

Sep US trade deficit widens; 2017 on track to exceed 2016: Politico

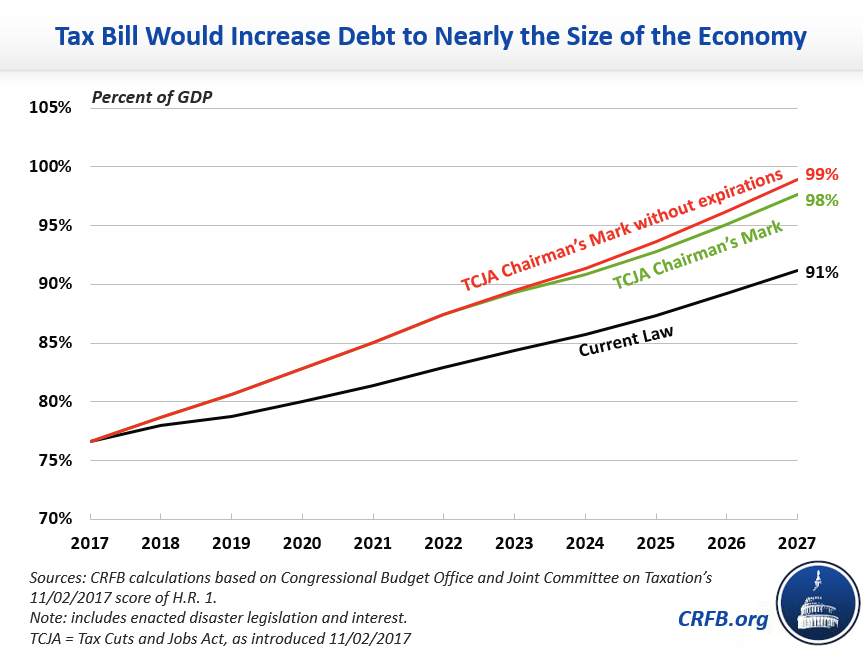

House tax bill expected to add $2 trillion-plus in US debt: CRFB

Book Bits | 4 November 2017

● The Myth of Millionaire Tax Flight: How Place Still Matters for the Rich

By Cristobal Young

Summary via publisher (Stanford University Press)

In this age of globalization, many countries and U.S. states are worried about the tax flight of the rich. As income inequality grows and U.S. states consider raising taxes on their wealthiest residents, there is a palpable concern that these high rollers will board their private jets and fly away, taking their wealth with them. Many assume that the importance of location to a person’s success is at an all-time low. Cristobal Young, however, makes the surprising argument that location is very important to the world’s richest people. Frequently, he says, place has a great deal to do with how they make their millions.

Continue reading

Payrolls Rebound Sharply In October

Private payrolls in the US posted a solid gain last month, marking a dramatic improvement after September’s nearly flat increase. Companies added 252,000 workers in October, according to this morning’s release from the Labor Department – a robust revival vs. the trivial 15,000 rise in the previous month.

Continue reading

The Global Risk-Free Rate Recently Fell To An 800-Year Low

It’s no secret that global interest rates have been low in recent years, but a recent study by the Bank of England (BoE) finds that the decline exceeds records going back to the 13th century. Piecing together a new dataset, the research advises that the latest bond bull market that’s driven yields down is even more extraordinary than previously known.

Continue reading

Macro Briefing: 3 November 2017

Trump picks Jerome Powell to head Federal Reserve: NY Times

House Republicans roll out tax-cut plan: CBS News

Will the new tax plan boost economic growth? CSM

US jobless claims fell last week, close to a 44-1/2 year low: Reuters

Job cut announcements by US firms continue to trend down: Challenger Gray

Economists expect US Q4 GDP growth of 2.9%, down from Q3’s 3.0%: CNBC

US productivity beats expectations; rises 3.0% in Q3: RTT

Global Mfg PMI ticks up in Oct to 6-1/2 year high: IHS Markit

Risk Premia Forecasts: Major Asset Classes | 2 November 2017

The Global Market Index (GMI) — an unmanaged, market-value weighted portfolio comprised of the major asset classes — is expected to earn an annualized 4.8% risk premium (return over the “risk-free” rate) in the long run, based on analysis of data through Oct. 2017.

Continue reading