Global equities in developed markets ex-US led continued to lead the major asset classes in August, based on a set of ETFs. Last month’s rally strengthened the year-to-date leadership for these stocks, which continue outperform the rest of the field by a wide margin.

Macro Briefing: 2 September 2025

US PCE inflation was steady in July at a 2.6% year-over-year pace as core PCE ticked up to 2.9%, the highest since February. “The Fed opened the door to rate cuts, but the size of that opening is going to depend on whether labor-market weakness continues to look like a bigger risk than rising inflation,” said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management. “Today’s in-line PCE Price Index will keep the focus on the jobs market. For now, the odds still favor a September cut.”

Labor Day Weekend 2025

Markets Continue To Expect Fed Will Cut Rates Next Month

Is it because of President Trump’s pressure campaign on the central bank to lower rates? Or perhaps it’s all about concerns that economic growth is slowing and receding expectations that tariff will raise inflation. Maybe it’s a combination of all of the above. Whatever the reasoning, markets are confident that the Federal Reserve will trim its target rate at the Sep. 17 policy meeting.

Macro Briefing: 28 August 2025

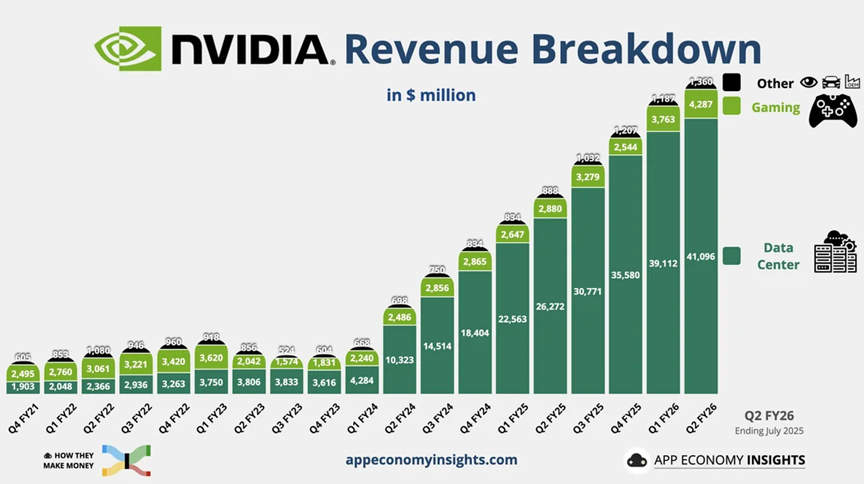

Chipmaker Nvidia reported better-than-expected earnings and revenue on Wednesday, a sign that AI-related investing remains strong. “The company is still growing over 50% [year on year] on their guidance at a $50B quarterly revenue run rate – that’s remarkable, even for the current valuation,” said David Wagner, head of equity at Aptus Capital Advisors. Matt Orton, head of advisory solutions at Raymond James Investment Management, said: “If anything, this just highlights that there’s a lot of durability to this (AI) trade… The businesses of these hyperscalers can continue to accelerate, and you’re not seeing any sort of sign of a slowdown being reflected in the results of Nvidia.”

Is The Sharp Rise In Electricity Prices An Early Inflation Warning?

Multiple factors are driving up prices for electricity at a time when inflation anxiety is mounting. Next month’s consumer inflation report for August, just days ahead of the Federal Reserve’s policy meeting on interest rates, will be closely read for deciding if tariffs are starting to drive up pricing pressure.

Macro Briefing: 27 August 2025

US durable goods orders fell sharply in July, led by a plunge in transportation equipment. But orders for non-defense capital goods excluding aircraft, a proxy for business spending, rebounded 1.1% in July after falling by 0.6% in June.

Trump Policies Will Test Limits Of US Economic Resilience

The economy isn’t in recession, and isn’t likely to go negative in the immediate future, but the mounting pressure via White House policies will test US resiliency in the months ahead.

Macro Briefing: 26 August 2025

Chicago Fed National Activity Index indicates sluggish US economic activity for fourth month in July. The monthly index posted a below-trend reading last month, with three of the four broad categories reflecting negative contributions.

US Bond Market Continues To Trail Foreign Fixed Income

Tilting toward foreign bonds remains a winning strategy for US investors this year, based on a set of ETFs through Friday’s close (Aug. 22). The modest gain for a benchmark of US government and investment-grade securities has been no match for offshore bond markets in US-dollar terms.