AI’s influence on tech stocks, and the market overall, will be in focus this week ahead of chipmaker Nvidia’s earnings report on Wednesday. The company, the world’s largest and an AI belwether, is outperforming the tech sector (XLK) this year by a wide margin: 33% vs. 13%.

Book Bits: 23 August 2025

● Here Comes the Sun: A Last Chance for the Climate and a Fresh Chance for Civilization

● Here Comes the Sun: A Last Chance for the Climate and a Fresh Chance for Civilization

Bill McKibben

Review via The New Atlantis

Some years ago, my colleagues and I used to joke that after the revolution, all essays about climate change would be written by Bill McKibben. This was during the final years of the Obama administration and the first Trump administration, when McKibben was ubiquitous in the mainstream media. In every year between 2015 and 2021, he published at least two and up to as many as six articles in the New York Times. At the same time, he was writing a regular column at the New Yorker while also publishing in virtually every leading center-left publication in the country: the New Republic, Rolling Stone, the Washington Post, the Nation. No major legacy publication, it seemed, was exempt.

McKibben’s revolution, though, is looking tenuous these days.

US GDP Nowcasts Continue To Indicate Slower Q3 Growth

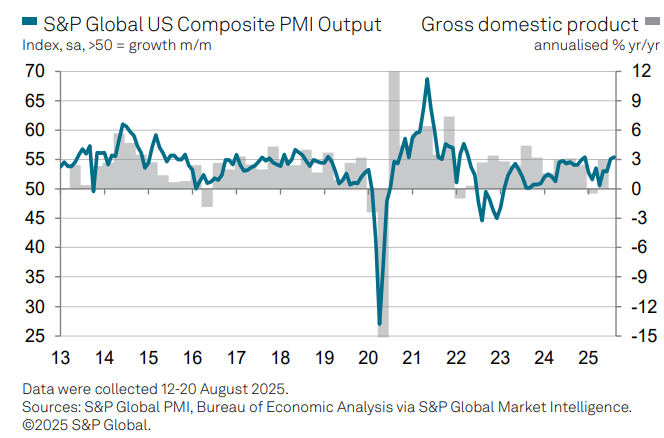

The latest nowcasts for US economic activity continue to point to a moderate downshift for the third quarter, based on the median for a set of estimates compiled by CapitalSpectator.com. Recession risk remains low, based on today’s update, but growth is still on track to ease substantially relative to the strong gain reported for Q2.

Macro Briefing: 22 August 2025

US business activity accelerated in August, growing at the fastest rate of the year, according to the Composite PMI Output Index, a survey-based GDP proxy. “A strong flash PMI reading for August adds to signs that US businesses have enjoyed a strong third quarter so far,” says Chris Williamson, chief business economist at S&P Global Market Intelligence.

Bond Market Awaits Powell’s Speech For Hints on Rate Cuts

The bond market has been in a holding pattern this month, looking for new catalysts for clues on assessing the outlook for interest rate cuts. On one side of the ledger: ongoing concerns that tariffs will raise inflation and convince the Fed to keep policy steady. But with signs of slowing economic growth, the case for trimming rates is building.

Macro Briefing: 22 August 2025

Chipmaker Nvidia’s earnings report next week could be a major factor for market sentiment. “On a relative basis, Nvidia’s earnings is the largest event for the S&P 500 for the next month,” said Stuart Kaiser, an equity strategist at Citi. Nvidia’s share of the S&P 500’s market value has surged in recent years and is currently around 8%.

Homebuilder Stocks Are Rallying. Is The Optimism Premature?

It’s been a rough year for the residential property market, but the tide is turning favorable again, or so the recent rally in homebuilder shares suggest. A closer look, however, reminds that uncertainty about several key factors for real estate remain in flux, including the outlook for mortgage rates and the health of the economy.

Macro Briefing: 20 August 2025

US housing starts rose to a five-month high in July, led by construction of multi-family units. Newly issued permits for housing construction, however, fell to a five-year low, suggesting that the outlook for residential building is still bearish.

Risk Appetite Stays Resilient For Global Strategies

Whether its folly or prescience, markets continue to climb a wall of worry, effectively looking through tariffs and other risk factors that could threaten the bullish trend. But based on several sets of ETFs to measure the risk appetite through Monday’s close (Aug. 18), the broad trend from a global perspective remains positive.

Macro Briefing: 19 August 2025

US home builder sentiment turned lower in August, returning to the lowest level since 2022, according to monthly polling by the National Association of Home Builders (NAHB). “Affordability continues to be the top challenge for the housing market and buyers are waiting for mortgage rates to drop to move forward,” said NAHB Chairman Buddy Hughes.