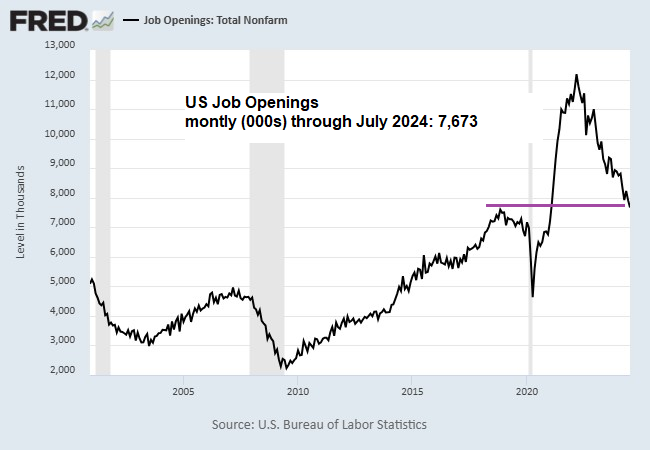

US job openings in July fell to the lowest level since January 2021, the Labor Department reports. The slide highlights concerns that the labor market’s recent slowdown will continue. The report also strengthens the view that the Federal Reserve will cut interest rates at next week’s policy meeting (Sep. 18). “The labor market is no longer cooling down to its pre-pandemic temperature, it’s dropped past it,” says Nick Bunker, head of economic research at the Indeed Hiring Lab. “Nobody, and certainly not policymakers at the Federal Reserve, should want the labor market to get any cooler at this point.”

Total Return Forecasts: Major Asset Classes | 04 September 2024

A revised long-term performance forecast for the Global Market Index (GMI) fell again in August. The downshift marks a second straight decline in expected return for GMI, an unmanaged benchmark that holds all the major asset classes (except cash) according to market weights via a set of ETF proxies.

Macro Briefing: 4 September 2024

US manufacturing activity continued to contract in August, according to survey data released for the ISM Manufacturing Index. The benchmark ticked higher last month but reflected contraction for the fifth straight month and for the 21st time in the last 22 months. The report also showed that manufacturers continue to pay higher prices for inputs. “Input price pressures moved up modestly to the highest in three months, but they are not so high in our judgment to threaten continued slow disinflation,” says Conrad DeQuadros, senior economic advisor at Brean Capital. “No bar to a September rate cut here but nothing to push the Fed to a half-point cut either.”

Major Asset Classes | August 2024 | Performance Review

US real estate investment trusts led global markets higher for a second straight month in August, based on set of ETFs representing the major asset classes. Another performance redux: commodities were the outlier, posting the only monthly loss, echoing the setback in July.

Macro Briefing: 3 September 2024

US consumer sentiment ticked up in August, marking the first rise after four straight monthly declines, according to the University of Michigan’s survey. “Consumers’ short- and long-run economic outlook improved, with both figures reaching their most favorable levels since April 2024 and a particularly sizable 10% improvement for long-run expectations that was seen across age and income groups,” writes Surveys of Consumers Director Joanne Hsu.

The improvement follows a stronger rise in US personal consumption expenditures in July, the Bureau of Economic Analysis reports. Consumer spending increased 0.5%, picking up from June’s 0.3% advance.

Continue reading

The Workers Have Left The Building

Momentum And Large-Cap Growth Still Lead Equity Factor Returns

Betting against the hottest equity risk factors this year has been a painful strategy, if only in relative terms. But no matter how you slice the numbers, momentum and large-cap growth continue to outperform in 2024, based on a set of ETFs through yesterday’s close (Aug. 27).

Macro Briefing: 28 August 2024

* US home prices rose 5.4% in June vs year-ago level–faster than inflation

* AI bellwether Nvidia set to report earnings today after closing bell

* Across-the-board tariffs for US may be coming. Here’s what to expect

* 3 contrarian strategies worth a fresh look: EM stocks, value and small caps

* US consumer confidence rises to a six-month high in August:

US Recession Risk Is Still Low Via Q3 GDP Nowcasts

If a recession in the US has started, or is imminent, the threat has yet to show up in the latest run of nowcasts for third-quarter GDP. That’s no guarantee that the economy will continue expanding, but it’s an encouraging sign.

Macro Briefing: 27 August 2024

* Exxon forecasts fossil fuels to dominate energy use through 2050

* IBM is latest tech firm to downsize in China

* UBS Wealth Management sees US recession risk odds ticking up to 25%

* Texas factory activity exhibited little growth in August: Dallas Fed survey

* US durable goods orders surge in July due to transport equipment orders: