Earlier this month I discussed the possibility that the US stock market’s year-to-date performance would slip to second place as Africa shares rallied. Nearly two weeks later, the switch is complete, based on a set of proxy ETFs.

Macro Briefing: 26 August 2024

* Oil prices expected to remain elevated amid risk of wider Middle East war

* US 10yr yield falls to 3.80% after Fed’s Powell talks of rate cuts

* Gold holds near record high after Powell’s dovish policy comments

* German business sentiment falls for third consecutive month in August

* US new home sales in July rise to highest level in over a year:

Book Bits: 24 August 2024

● The Corporate Life Cycle: Business, Investment, and Management Implications

● The Corporate Life Cycle: Business, Investment, and Management Implications

Aswath Damodaran

Summary via publisher (Portfolio/Penguin Random House)

Throughout his storied career, Aswath Damodaran has searched for the universal key to demystify corporate finance and valuation. Now, at last, he offers the groundbreaking answer to readers everywhere. It turns out there is a corporate lifecycle very much like our own — with unique stages of growth and decline. And just as we must learn to act our age, so too must companies. By better understanding how corporations age and the characteristics of each stage of their lifecycle, we can unlock the secrets behind any businesses behavior and optimize our management and investment decisions accordingly.

Is The Housing Market Poised For A Rebound?

The real estate market has had a rough ride since the Federal Reserve began raising interest rates in March 2022. But as expectations strengthen that the central bank will start cutting next month, the outlook is rebounding for property shares.

Macro Briefing: 23 August 2024

* Markets will focus on today’s speech by Fed Chairman Powell at Jackson Hole

* US existing home sales rise in July–first monthly gain in 5 months

* Canada government ends rail strike, ordering arbitration for labor dispute

* July economic output slowed: Chicago Fed Nat’l Activity Index

* US jobless claims up slightly, remain middling vs. recent history

* US economic activity eases in August but still points to 2%-plus growth: PMI

Two Rounds Of Key Economic Reports To Go Ahead Of US Election

The economy isn’t always decisive in US presidential elections, except when it is. Think Herbert Hoover in 1932 and George H.W. Bush in 1992. Each lost the presidency to a challenger primarily because of the economy. Current conditions are far less extreme, of course. In fact, by a number of metrics, the economy looks relatively solid. But there are also plenty of challenges brewing and so it’s debatable how much the economy will influence the results of Nov. 5 and which candidate will benefit the most.

Macro Briefing: 22 August 2024

* Fed minutes highlight a “likely” rate cut in September

* Fannie Mae economists lower expectations for 2024 home sales

* Business inflation expectations fall to 2.2% in August: Atlanta Fed survey

* Eurozone business activity rises at faster pace in August: PMI survey

* US payrolls growth revised down by 818,000 for year through March 2024:

Bond Market Momentum Firmly Bullish Ahead Of Fed Conference

Fixed income as an asset class is looking bullish as Fed Chairman Powell prepares to give a widely anticipated speech this Friday (Aug. 23). The central banker is expected to drop clues about the outlook for monetary policy for the rest of the year — clues that are forecast to favor higher bond prices and lower yields.

Macro Briefing: 21 August 2024

* Markets prepare for today’s revision of US employment statistics

* Slowing US jobs market will be topical for central bankers at Jackson Hole

* FAA orders inspections of Boeing 787s after midair dive

* Berkshire Hathaway reduces stake in Bank of America

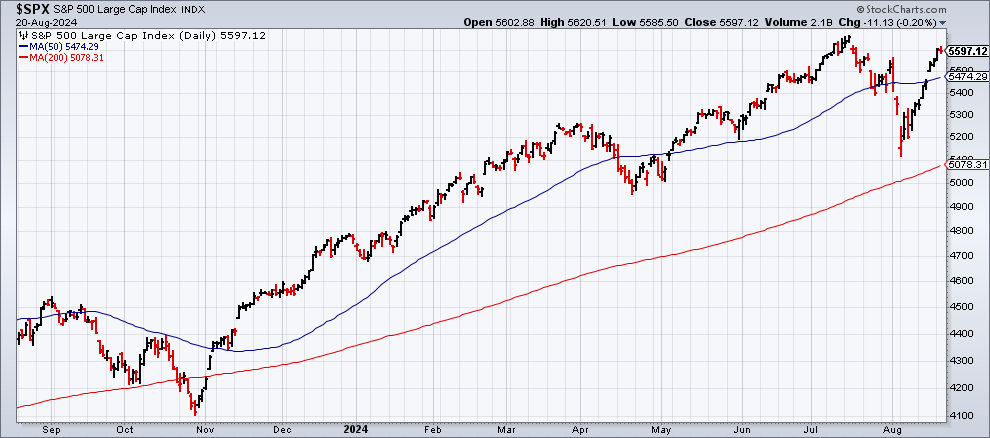

* US stocks slip on Tuesday, breaking 8-day winning streak:

Are Utilities The New Must-Own Equity Sector?

Recent stock market turbulence has left two equity sectors outperforming this year: communications services and utilities, based on set of ETFs through Monday’s close (Aug. 19). The remaining sectors are trailing the broad market, albeit with positive results.

The top performer in 2024: Communication Services ETF (XLC), which is up 20.7%, moderately ahead of the 18.5% rise for US shares overall via SPDR S&P 500 (SPY).