● What Went Wrong with Capitalism

● What Went Wrong with Capitalism

Ruchir Sharma

Essay by author via Financial Times

Many observers think the era of easy money ended with the recent return of inflation, because it forced central banks to raise interest rates. But this era was not defined only by low rates and did not begin only in 2008; it encompasses the suite of habits — borrow, bail out, regulate, stimulate — that have been building for a century. It is not over until old habits change.

What Does The Bank of England’s Delayed Rate Cut Imply For US?

If the Bank of England’s decision on Thursday to leave interest rates unchanged is a guide, the outlook for the start date for a US rate cut may be further down the line than generally assumed.

Macro Briefing: 21 June 2024

* Eurozone recovery in June slows for first time in 4 months: PMI survey

* Citigroup predicts banking sector will suffer the most with AI-related job losses

* Bank of England leaves rates unchanged despite inflation falling to 2% target

* Electric vehicle sales slump in Europe, driven by demand slide in Germany

* US jobless claims eased last week after three straight weekly increases

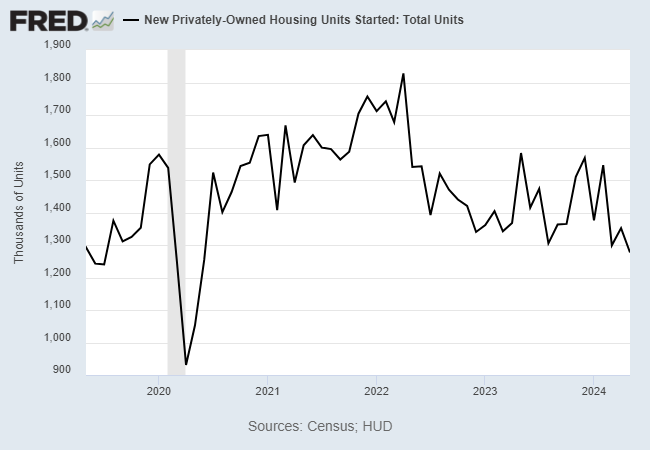

* US housing starts drop to four-year low in May:

The Case For Portfolio Rebalancing Looks Compelling

By nearly any measure you cite, US equities are enjoying a stellar run. Despite numerous global risks, investor sentiment for American shares is resilient. The question, as always, is when is it timely to take some of the winnings and redeploy to other assets classes?

Macro Briefing: 20 June 2024

* US average monthly residential power bill expected to rise 3% vs. year ago: EIA

* Nearly half of Americans struggling financially, poll reports

* Most AI stocks promoted as winners have fallen this year

* Swiss rate cut highlights divergence in monetary policy for major economies

* US home builder sentiment falls for second month, dipping to 6-month low:

Is US Recession Risk Rising? Warning Signs Are Starting To Emerge

Recession talk for the US is on the march again. Although there’s still room for debate on the near-term business-cycle outlook, some indicators are highlighting decelerating growth that could be the start of trouble in the second half of the year into early 2025.

Macro Briefing: 19 June 2024

* Fed risks recession by delaying cut rates, predicts economist Claudia Sahm

* US industrial output posts strong rebound in May

* US debt as percent of GDP on track to top WWII-related peak in 2027: CBO

* Nvidia becomes most valuable public firm, overtaking Microsoft

* US retail sales rise less than expected in May:

10-Year US Treasury Yield ‘Fair Value’ Estimate: 18 June 2024

The US 10-year Treasury yield continues to defy The Capital Spectator’s ‘fair-value’ estimate by trading at a premium to this model, but the relatively wide gap still appears to be a constraint to the upside for this key market rate.

Macro Briefing: 18 June 2024

* US stocks (S&P 500) close at another record high on Monday (June 17)

* AI optimism persuades 3 Wall Street banks to lift stock market forecasts

* Central banks expected to boost gold holdings due to US dollar pessimism

* China’s housing slump deepened in May, prompting calls for more gov’t action

* California-based electric-vehicle maker Fisker files for bankruptcy

* NY Fed Mfg Index indicates contraction in June–seventh straight decline: