The US stock market’s strong year-to-date gain so far in 2024 has enjoyed wide support among equity sectors. The two glaring downside exceptions: consumer discretionary and real estate shares, based on a set of ETFs through Monday’s close (June 10).

Macro Briefing: 11 June 2024

* Fed appears set to leave interest rates unchanged tomorrow

* Three Democratic senators urge Fed to cut rates at this week’s FOMC meeting

* Median inflation expectations for 1-year horizon tick down to 3.2% in May

* EU expected to impose tariffs on Chinese electric vehicles

* Oil companies are reporting record profits

* US small business sentiment index ticks up but remains near multi-year low:

Resilient US Labor Market Blurs Outlook For Rate Cuts

Ahead of Friday’s payrolls data for May the crowd was newly confident, again, that the Fed would soon start cutting interest rates. Treasury yields were sliding and expectations were rising that policy easing was near. But the May jobs report flipped the script with news of stronger-than-expected hiring.

Macro Briefing: 10 June 2024

* This week’s US inflation data will be closely watched re: Fed’s policy decisions

* Far-right parties gain seats in European Union election

* Mexico’s political left dominance after election worries investors

* Investors brace for new Fed estimates for rate-policy outlook

* US credit card delinquencies rise to highest level in over a decade

* US private payrolls steady for 1-year trend, rising 1.6% through May:

Book Bits: 8 June 2024

● The Last Human Job: The Work of Connecting in a Disconnected World

● The Last Human Job: The Work of Connecting in a Disconnected World

Allison Pugh

Summary via publisher (Princeton U. Press)

With the rapid development of artificial intelligence and labor-saving technologies like self-checkouts and automated factories, the future of work has never been more uncertain, and even jobs requiring high levels of human interaction are no longer safe. The Last Human Job explores the human connections that underlie our work, arguing that what people do for each other in these settings is valuable and worth preserving.

US Q2 GDP Nowcast Eases, But Modest Pickup Over Q1 Is Expected

Recent economic estimates suggest US growth has slowed compared with previous estimates, but today’s revised GDP nowcast for the second quarter still points to a modest pickup in output over Q1.

Macro Briefing: 7 June 2024

* The number of zombie companies (debt-laden firms) in the world has surged

* The US debt problem may be less threatening than it appears

* China exports rise sharply in May amid increasing trade tensions

* ECB cuts interest rates for first time since 2019

* US jobless claims edged higher last week but remain low

* US trade deficit widened in April

* US 10-year Treasury yield stabilizes after 5 days of sharp declines:

Is The US Bond Market Poised For Recovery?

The sharp drop in Treasury yields in recent days has revived chatter that the worst for the bond market may be over. It’s still early to confidently forecast that scenario, but the odds for recovery are looking better these days after a two-year bear market for much of the asset class following the start of Federal Reserve rate hikes in early 2022.

Macro Briefing: 6 June 2024

* Financial distress in commercial real estate continues to rise

* New solar generation capacity installations in US rose to record high in Q1

* Nvidia overtakes Apple to become 2nd largest public firm in US

* US firms trim hiring in May to slowest rise since January, ADP reports

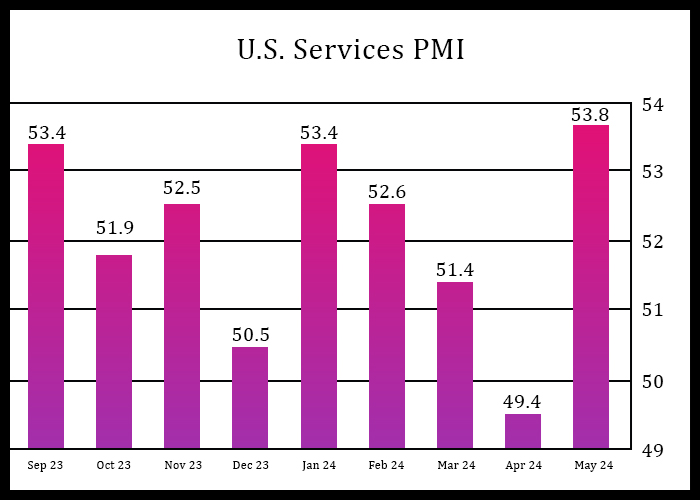

* US ISM Services Index rebounds sharply in May to 9-month high:

Is The Bond Market Rethinking The Outlook For Rate Cuts?

Here we go again. After yesterday’s news that US job openings fell to a three-year low in April, the data fueled the incentive for the bond market to reassess the view that the Federal Reserve will keep interest rates higher for longer.