* US 10-year Treasury yield drops sharply for fourth straight day

* Eurozone economy grows at fastest rate in a year: PMI survey data

* China services sector grows at fastest pace in 10 months

* US factory orders rose for a third straight month in April

* US job openings fell in April to lowest level in over 3 years:

Total Return Forecasts: Major Asset Classes | 4 June 2024

The performance outlook for the Global Market Index (GMI) ticked higher again in May. For the fourth straight month, GMI’s long-term forecast edged up, rising to an annualized 7.1% pace, which is fractionally above the estimate in the previous month, based on the average of three models (defined below). GMI is an unmanaged benchmark that holds all the major asset classes (except cash), according to market weights via a set of ETF proxies.

Macro Briefing: 4 June 2024

* US Q2 GDP nowcast revised down, again, to +1.8% via Altanta Fed’s model

* Global manufacturing activity improves in May, rising to 22-month high

* Weak US construction spending trend continues in April

* Warren Buffett’s Berkshire Hathaway owns 3% of the US Treasury bill market

* US manufacturing activity contracts for second month in May:

Major Asset Classes | May 2024 | Performance Review

Global markets rebounded sharply in May, with the exception of commodities, based on a set of ETF proxies. Otherwise, gains dominated the major asset classes after April’s widespread pummeling.

Macro Briefing: 3 June 2024

* European Central Bank expected to announce rate cut this week

* Opec announces extension of oil-production cuts into next year

* Eurozone factory output close to stabilizing in May via PMI survey data

* China manufacturing activity surges in May, survey data show

* Chicago PMI plunges to 4-year low in May

* US PCE inflation held steady at 2.7% year-over-year pace in April

* US consumer spending and income growth slow in April:

Book Bits: 1 June 2024

● The Hamilton Scheme: An Epic Tale of Money and Power in the American Founding

● The Hamilton Scheme: An Epic Tale of Money and Power in the American Founding

William Hogeland

Summary via publisher (Macmillan)

Forgotten founder” no more, Alexander Hamilton has become a global celebrity. Millions know his name. Millions imagine knowing the man. But what did he really want for the country? What risks did he run in pursuing those vaulting ambitions? Who tried to stop him? How did they fight? It’s ironic that the Hamilton revival has obscured the man’s most dramatic battles and hardest-won achievements—as well as downplaying unsettling aspects of his legacy. Thrilling to the romance of becoming the one-man inventor of a modern nation, our first Treasury secretary fostered growth by engineering an ingenious dynamo—banking, public debt, manufacturing—for concentrating national wealth in the hands of a government-connected elite. Seeking American prosperity, he built American oligarchy. Hence his animus and mutual sense of betrayal with Jefferson and Madison—and his career-long fight to suppress a rowdy egalitarian movement little remembered today: the eighteenth-century white working class.

US Q1 GDP Revised Down, But Q2 Nowcasts See Firmer Growth

US economic growth rose a modest 1.3% in the first quarter, a softer increase vs. the government’s initial 1.6% estimate. The revised data reflects a sluggish pace of growth and the second straight quarterly downshift. But the current nowcast for Q2 suggests that output will stabilize if not strengthen, based on the median for a set of estimates compiled by CapitalSpectator.com.

Macro Briefing: 31 May 2024

* Opec set to meet amid cartel’s limited influence on oil market

* Senate Democrats call for Big-Oil probe over price fixing

* AI-related data centers may use 9% of US electric supply by 2030, study finds

* Pending home sales in US slump to lowest level since pandemic’s start

* US jobless claims edged up last week but remain low

* US Q1 GDP growth revised down a sluggish 1.3%:

Will Fed’s Preferred Inflation Gauge Tick Lower In Friday’s Update?

Tomorrow’s update on US inflation for April looks set to tick lower, although the odds aren’t trivial that pricing pressure will remains sticky, according to various forecasts and a review of pricing trends published to date. Disinflation is still intact, based on numbers in hand, but the report scheduled for Friday, May 31, will probably show limited progress on taming inflation.

Macro Briefing: 30 May 2024

* US economy continues expanding, Fed’s Beige Book reports

* Extreme heat will slow US growth, San Francisco Fed study predicts

* Lingering inflation pressures are preventing Fed from cutting rates

* German inflation rises more than forecast ahead of ECB rate decision

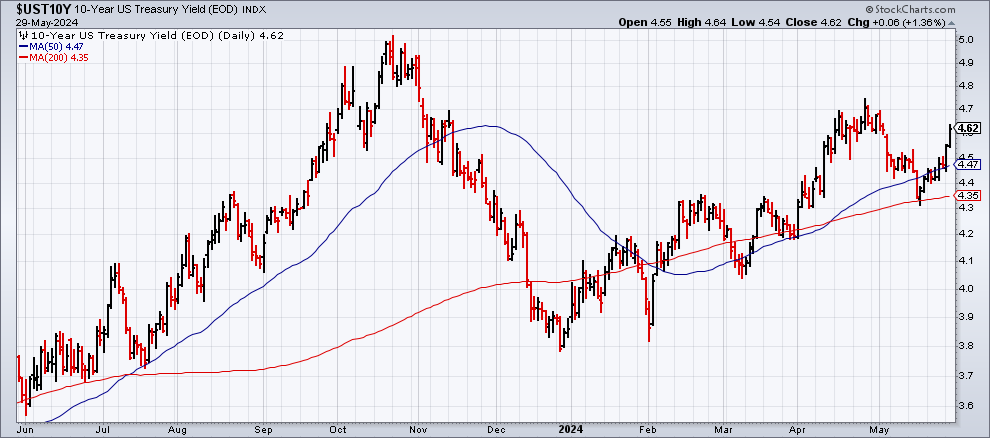

* US 10yr yield rises above 4.6% for first time in over a month: