Ahead of the Federal Reserve’s annual conference in Jackson, Wyoming, which starts on Thursday (Aug. 21), the topic of inflation will dominate discussions. Although the latest updates on prices were mixed, there are several metrics that raise questions about the wisdom of cutting interest rates at next month’s policy meeting, which has become the consensus view of late.

Macro Briefing: 18 August 2025

US retail sales rose for a second month in July, highlighting consumer resilience. The news eased concerns that consumer spending is vulnerable to tariff-induced inflation. “As long as consumer spending holds up and companies are able to retain workers because of that robust spending, the flywheel can continue to spin, pushing corporate profits and stock prices higher,” Chris Zaccarelli, chief investment officer at Northlight Asset Management, said in commentary issued Friday.

Book Bits: 16 August 2025

● The Price of Money: A Guide to the Past, Present, and Future of the Natural Rate of Interest

● The Price of Money: A Guide to the Past, Present, and Future of the Natural Rate of Interest

Edited by Jamie Rush, et al.

Summary via publisher (Oxford U. Press)

An accessible guide to the natural rate of interest, why it is likely going up, and what that means for the future of the global economy and markets. Ask most people who sets interest rates, and they’ll say it’s the central bank. At a fundamental level, though, decisions by the Federal Reserve, European Central Bank, and their peers around the world are constrained by the natural rate of interest. The natural rate – the interest rate that balances supply of saving and demand for investment, whilst keeping inflation low and employment high – has moved from academic obscurity to a central role in monetary policy, and the operation of the economy and financial markets.

Research Review | 15 August 2025 | Forecasting

Partisan Bias in Professional Macroeconomic Forecasts

Benjamin S. Kay (Federal Reserve), et al.

June 2025

Using a novel dataset linking professional forecasters in the Wall Street Journal Economic Forecasting Survey to their political affiliations, we document a partisan bias in GDP growth forecasts. Republican-affiliated forecasters project 0.3-0.4 percentage points higher growth when Republicans hold the presidency, relative to Democratic-affiliated forecasters. Forecast accuracy shows a similar partisan pattern: Republican-affiliated forecasters are less accurate under Republican presidents, indicating that partisan optimism impairs predictive performance. This bias appears uniquely in GDP forecasts and does not extend to inflation, unemployment, or interest rates. We explain these findings with a model where forecasters combine noisy signals with politically-influenced priors: because GDP data are relatively more uncertain, priors carry more weight, letting ideology shape growth projections while leaving easier-to-forecast variables unaffected. Noisy information therefore amplifies, rather than substitutes for, heterogeneous political priors, implying that expectation models should account for both information rigidities and belief heterogeneity. Finally, we show that Republican forecasters become more optimistic when tax cuts are salient in public discourse, suggesting that partisan differences reflect divergent beliefs about the economic effects of fiscal policy.

Macro Briefing: 15 August 2025

US wholesale inflation accelerated in July, rising the most in three years. The data indicates that prices rose faster for producers than consumers. The implication: importers are absorbing the cost of tariffs rather than passing them on to customers. “It will only be a matter of time before producers pass their higher tariff-related costs onto the backs of inflation-weary consumers,” wrote Christopher Rupkey, chief economist at fwdbonds, a financial markets research firm.

Momentum And High-Beta Equity Factors Lead Market This Year

The dominance of the momentum factor roars on. At nearly every step this year, this risk factor has outperformed the broad stock market, based on a set of ETFs through yesterday’s close (Aug. 13). The recent rebound in so-called high-beta stocks has lifted this factor to a strong second-place performer so far in 2025.

Macro Briefing: 14 August 2025

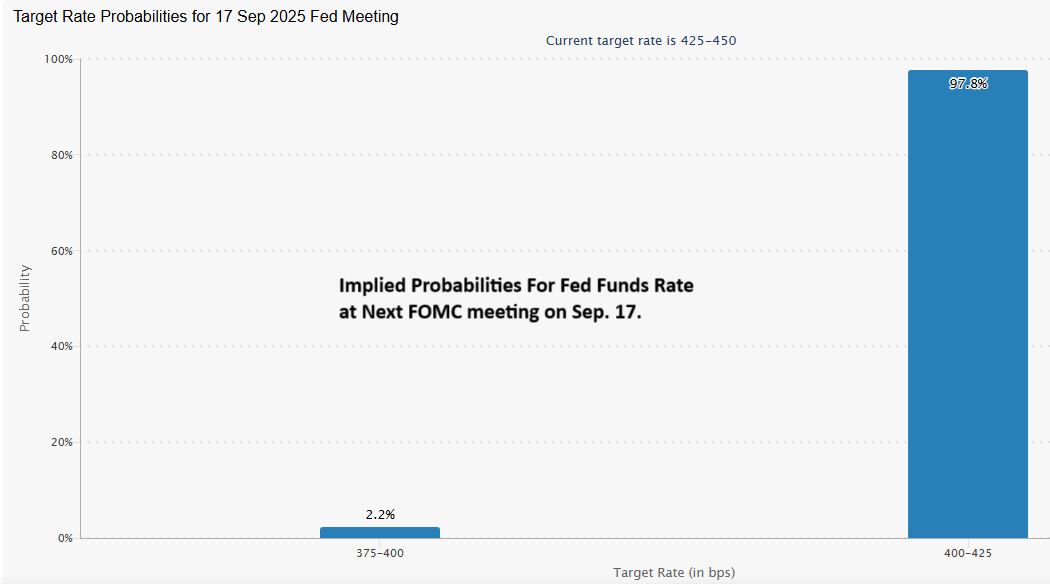

Fed funds futures are pricing in a near certainty of a rate cut at the next FOMC meeting on Sep. 17. The market expects a 1/4-point cut, which would reduce the current 4.25%-4.50% target range to 4.0%-4.25%. “The Fed has a difficult balancing act,” said Derek Horstmeyer, a finance professor at George Mason University’s Costello College of Business. “They have to weigh an expectation of slower job growth against an expectation of inflation. I think they’re weighing all of it.”

10-Year US Treasury Yield ‘Fair Value’ Estimate Steady In July

The “fair value” estimate for the 10-year US Treasury yield was basically unchanged in July, based on the average for three models run by CapitalSpectator.com. The market premium – the actual yield less the fair-value estimate — was also steady last month, holding a moderate spread.

Macro Briefing: 13 August 2025

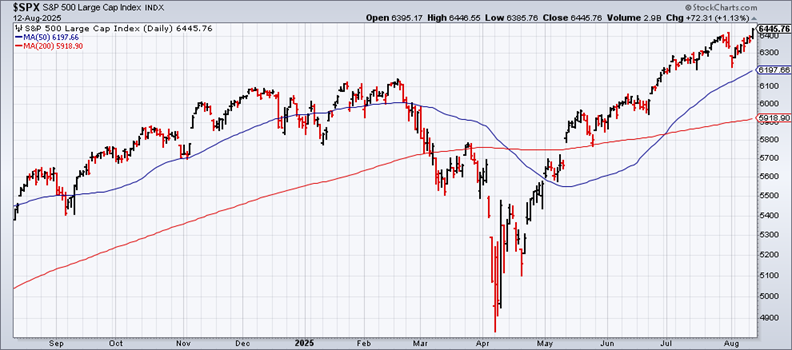

US stock market closes at another record high. The S&P 500 Index on Tuesday rallied 1.1%, marking a new all-time peak.

US Business Cycle Profile Shows Mixed Picture For Key Indicators

Using the US stock market as a guide suggests that business-cycle conditions remain strong in terms of the recovery since the current economic expansion began in May 2020. The rebound in equities is still one of the sharpest since 1970. But the stock market is not the economy, as the saying goes, and that’s where the analysis turns complicated, as suggested by a review of key economic indicators.