Yesterday’s sharp slide in US equities has refocused minds on a hardy perennial: the market can and does go down. Obvious, of course, but easy to overlook when prices are rising virtually non-stop, as they have been for much of the past six months—until now.

Macro Briefing: 16 April 2024

* Another round of Fed rate hikes is possible, advise UBS strategists

* China’s economy grew faster than expected in Q1, but…

* New home prices in China fall at fastest rate since 2015

* NY Fed Mfg Index continues to indicate contraction in April

* US home builder sentiment steady at modest growth level in April

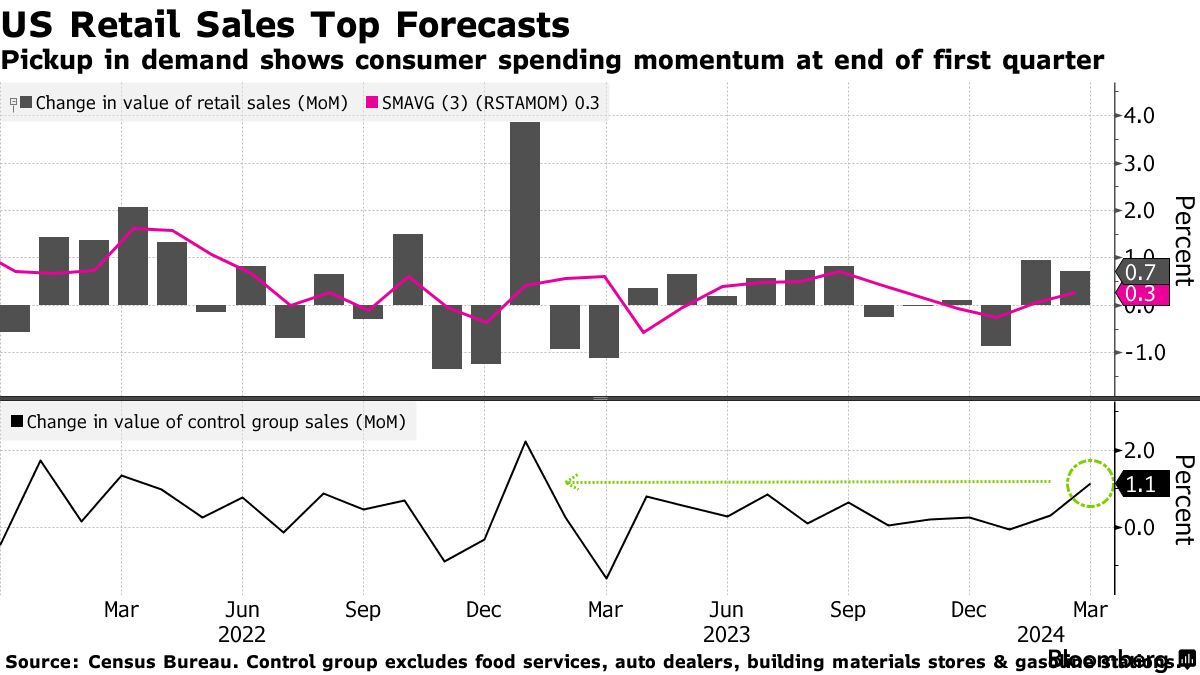

* US retail sales rose more than forecast in March:

Rate Cuts Off The Table For Near Term Outlook: Futures Market

In the wake of last week’s hotter-than-expected consumer inflation data for March, the implied forecast via Fed funds futures indicates that interest-rate cuts are unlikely in the months ahead.

Continue readingMacro Briefing: 15 April 2024

* Israel considers how to respond to Iranian missile attack

* Economists lift US growth forecasts in new Wall Street Journal survey

* German Chancellor Scholz in China to focus on tense economic ties

* US 10-year yield approaching 4.6% in early Monday trading

* Tesla laying off more than 10% of workforce after lackluster sales results

* US consumer sentiment “moved sideways for the fourth straight month” in April:

Book Bits: 13 April 2024

● Slow Burn: The Hidden Costs of a Warming World

Robert Jisung Park

Review via International Monetary Fund

As the world warms, anxiety over the effects continues to rise. A survey conducted by the United Nations found two-thirds of the global population believe that climate change is a global emergency. Fears abound on the risks of triggering tipping points in the climate system, such as the melting of ice sheets or the release of underground methane. But alongside future risks of climate catastrophe, there are also slow-burning effects already being felt around the globe. In Slow Burn: The Hidden Costs of a Warming World, environmental and labor economist R. Jisung Park documents these effects, from the expected, like worsening inequality, to the unexpected, such as declining productivity and economic growth.

Research Review | 12 April 2024 | Equity Risk Premium

Macroeconomic Announcement Premium

Hengjie Ai (University of Wisconsin-Madison), et al.

November 2023

The paper reviews the evidence on the macroeconomic announcement premium and its implications on equilibrium asset pricing models. Empirically, a large fraction of the equity market risk premium is realized on a small number of trading days with significant macroeconomic announcements. We review the literature that demonstrates that the existence of the macroeconomic announcement premium implies that investors’ preferences must satisfy generalized risk sensitivity. We show how this conclusion generalizes to environments with heterogeneous investors and demonstrate how incorporating generalized risk sensitivity affects economic analysis in dynamic setups with uncertainty.

Macro Briefing: 12 April 2024

* Biden urged to ban imports of Chinese-made electric cars to US

* IMF chief warns central banks against cutting interest rates too soon

* Gold rallies above $2400/oz.

* China’s exports fell sharply in March in US dollar terms

* US jobless claims fell last week, holding near multi-decade low

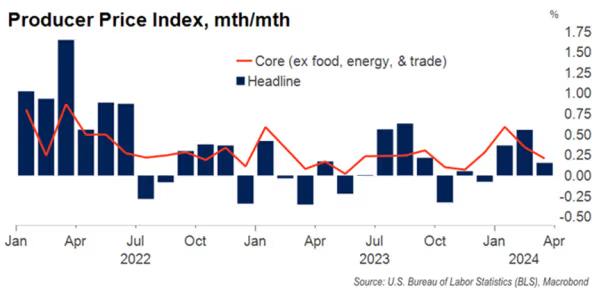

* US producer price inflation rises less than expected in March:

10-Year US Treasury Yield ‘Fair Value’ Estimate: 11 April 2024

The market continues to price the US 10-year Treasury yield well above its estimated “fair value,” based on the average of three models run by CapitalSpectator.com.

Macro Briefing: 11 April 2024

* Investors adapt to a year that may witness no rate cuts

* Former Treasury Sec. Larry Summers says Fed may raise interest rates

* Has the business cycle been tamed? Some analysts are cautiously optimistic

* Rising oil prices could soon approach $100/bbl, BoA analyst predicts

* China’s consumer price inflation slowed more than expected in March

* US headline consumer inflation rises more than expected in March:

Momentum Remains Top-Equities-Factor Performer In 2024

Most slices of the US equity market continue to enjoy solid gains so far in 2024, but the momentum risk factor is still the upside outlier, based on a set of ETFs through Tuesday’s close (Apr. 9).