* US considers sanctions targeting some Chinese banks supporting Russia

* US stock market decline has “further to go,” predicts JPMorgan analyst

* Tech sector looks frothy, says head of world’s largest sovereign wealth fund

* Eurozone economy growing again for first time since May 2023: PMI survey

* Risk-parity strategy takes a beating, persuading investors to bail

* US economic growth strengthened in March via Chicago Fed Nat’l Activity Index:

Will Commodities Continue To Outperform In 2024?

In December I wondered if commodities were poised to be the contrarian trade of 2024. Four months later, there’s no competition across the major asset classes: commodities are the upside outlier by a wide margin, based on a set of ETFs through Friday’s close (Apr. 19).

Macro Briefing: 22 April 2024

* Sticky inflation looks set for more confirmation in Friday’s PCE inflation data

* Oil prices fall on Monday as as Iran-Israel tensions ease

* China gold buying is a key reason for the metal’s recent rise

* The cost of owning a home in the US is the highest on record: Redfin

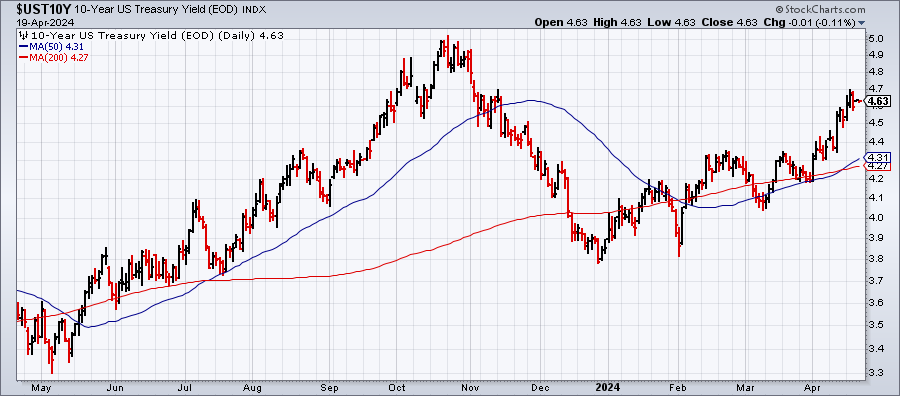

* US 10-year Treasury yield starts trading week near five-month high:

Book Bits: 20 April 2024

● Growth: A History And A Reckoning

● Growth: A History And A Reckoning

Daniel Susskind

Review via Financial Times

The book starts with a canter through centuries of muddled thinking. Thomas Malthus and his contemporaries thought that growth was inherently unsustainable, as a growing population would eventually run out of resources. Later, development economists at the World Bank sustained a “‘fetish’ for investment”, relying on models that saw physical capital — stuff that people could touch — as key for generating development.

Most recently, there are “degrowthers”, who include the likes of activist Greta Thunberg and anthropologist Jason Hickel. Although their views are (too) often vaguely defined, the basic fear is that more economic growth will gobble up the Earth’s resources, and so policymakers should seek less of it to prevent environmental catastrophe.

Is Israel’s Strike On Iran The End Or The Beginning?

Israel’s widely anticipated retaliatory military strike on Iran arrived earlier today, putting markets on edge as investors weigh the implications. The potential for wider conflict hangs in the balance. Early reports, however, hint at the possibility that Israel’s attack is limited in an effort to avoid a wider war with Iran.

Macro Briefing: 19 April 2024

* Israel launches a retaliatory strike against Iran

* Two Fed official say there’s no “urgency” to cut interest rates

* Leading Economic Index for US declined in March

* US existing home sales fell in March

* US jobless claims steady, continue to signal strong labor market:

Rate-Cut Forecast Now Seen For September At Earliest

The only aspect of consistency in the market’s outlook for rate cuts lately has been pushing the expected date forward. Recent history falls in line with this trend and September is now seen as the earliest date for policy easing.

Continue readingMacro Briefing: 18 April 2024

* Some economists now see rate cuts delayed until March 2025,

* Fed’s Beige Book reports steady economic growth but slim progress on inflation

* ‘Insatiable’ AI demand expected to lift Q2 sales for world’s biggest chipmaker

* Climate change bill may reach $38 trillion a year by 2049, study finds

* US dollar’s dominant reserve currency status likely to endure: Morgan Stanley

Higher-For-Longer Risk For Rates Drives Up Treasury Yields

Bowing to recent data, Federal Reserve Chairman Jerome Powell on Tuesday conceded that inflation progress has stalled and the case for rate cuts has weakened. The Treasury market has been effectively making the same case for weeks, but when the top central banker says it out loud the crowd notices.

Macro Briefing: 17 April 2024

* Fed Chair Powell says there’s been a ‘lack of further progress’ on inflation

* US expected to grow at double the rate of G7 peers in 2024, predicts IMF

* Free-market policies are fading around the world, and that worries economists

* US industrial output increased for second month in March

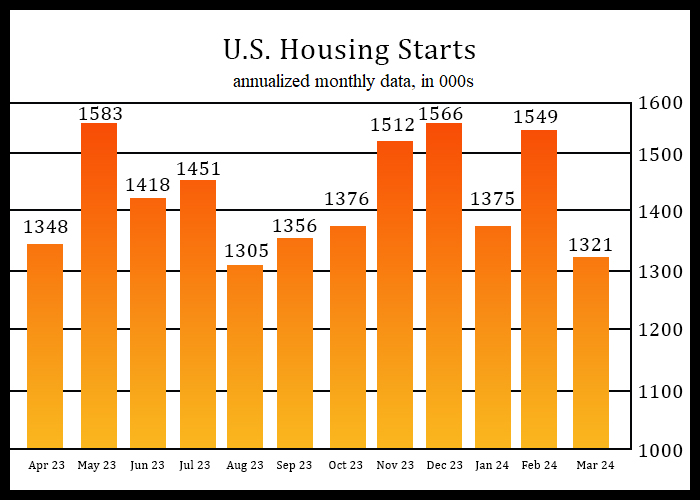

* US housing starts in March fall to slowest pace in seven months: