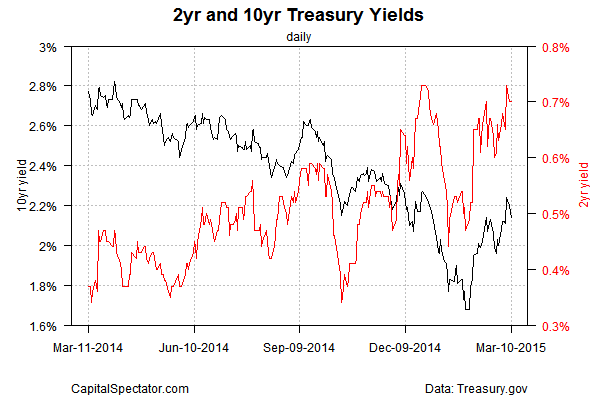

The possibility that the Federal Reserve may start raising interest rates in the near future continues to resonate among investors and in the news media. But the view remains nuanced from the vantage of yields in the Treasury market. Although market rates have bounced higher off the lows in late-January/early February, yields have backed off their recent highs, suggesting that there’s still uncertainty about the timing for a change in Fed policy.

The case for expecting a rate hike sooner rather later draws heavily on the stronger pace of growth in the US labor market in recent months. Total nonfarm payrolls increased 2.4% on a year-over-year basis through February, the strongest pace in 15 years. But wage growth remains tepid and inflation remains well below the Fed’s 2% target, inspiring forecasts that the central bank will be slow to unleash a tighter monetary policy.

The main question now is whether we’re likely to see accelerating wage growth in the near term? June has been widely reported as the earliest possibility for the first rate hike. What are the odds that we’ll see stronger wages by this year’s midpoint? Economist and veteran Fed watcher Tim Duy has doubts, “although I should keep in mind we still have three more employment reports before that meeting,” he writes. “Note, however, low wage growth does not preclude a rate hike. The Fed hiked rates in 1994 in a weak wage growth environment.”

Meanwhile, Strategas Research Partners notes via Bloomberg the recent firming in plans to raise wages at small firms, according to survey data from the National Federation of Small Business. There’s also the striking news that job openings inched up to a 14-year high, according to yesterday’s Labor Department update for January. By some accounts, this news suggests that the foundation is in place for stronger wage growth in the months ahead.

As for inflation, the weakness in the headline data is largely due to the sharp fall in energy prices. As it turns out, that weakness will start to fade by the summer, when the year-over-year comparisons begin dropping the bear-market trend that began last June. In turn, we’ll probably see some firming in the headline pricing numbers in the months ahead. Even so, core inflation–i.e., less energy and food–remains muted so the odds that inflation will remain soft by historical standards still looks like a good bet.

The Treasury market, however, continues to reflect a mixed view on whether a rate hike will be sooner vs. later. The two-year yield—considered the most sensitive spot on the yield curve for rate expectations—is bumping up against recent highs around the 0.70% mark, but pulled back a bit in yesterday’s session. A decisive and sustained rise above 0.70% would be a signal that the crowd’s feeling more confident that an early rate is a stronger possibility.

Meantime, the Treasury market’s inflation forecast—the yield spread on a nominal Treasury less its inflation-indexed counterpart—has also softened lately after running higher in previous weeks. Using the 10-year Notes as benchmarks, the implied inflation outlook is currently 1.73% as of yesterday’s close (Mar. 10), which is moderately below the recent high of 1.87% from earlier this month. In other words, the market’s not convinced that inflation is about to firm much above the levels we’ve seen lately.

The next major test for guesstimating the timing of the first rate hike arrives with two key data points in tomorrow’s releases (Mar. 12): weekly jobless claims and monthly retail sales for February. New filings for unemployment benefits have been rising lately, reaching a 10-month high in the last release, and so it’ll be useful to see if this trend continues. Meanwhile, retail spending has been wobbly in recent months, although arguably due to a harsh winter. But upbeat news is expected on both counts in tomorrow’s data, according to Econoday.com’s consensus forecasts. If the predictions hold, the case will strengthen a bit for anticipating an early rate hike.

Pingback: When Will the Fed Raise Interest Rates?