The bond market is reeling from firmer reflation expectations, or at least some corners of the market are taking a hit. But in the reordered world of fixed income in 2021 there are also winners, based on year-to-date returns for a set of exchange traded funds through yesterday’s close (Feb. 23).

While Treasuries and investment-graded corporates have tumbled this year, the slide isn’t universal. Notably, junk bonds, short-term inflation-indexed Treasuries, bank loans and floating-rate securities are posting modest gains in 2021, according to our list of proxy funds.

The leading performer at the moment for a wide array of US bond ETFs: SPDR Bloomberg Barclays Short Term High Yield Bond (SJNK). The ETF is up 1.4% this year through Tuesday’s close. That’s a mild gain, but it’s also a world above the year’s biggest loss for these funds: iShares 20+ Year Treasury Bond (TLT) is down a hefty 10.0% so far in 2021.

In a sign of which way the wind is blowing this year for the US bond market generally, the benchmark for the asset class is off 2.3% year to date, based on Vanguard Total US Bond Market (BND), a broad portfolio of US investment-grade debt.

Bloomberg reports that the recent change in reflation expectations is triggering shifts in portfolio tilts among the biggest money managers:

The first signs of this shift have already emerged: These firms and others are moving money into loans and notes that offer floating interest rates. Unlike the fixed payments on most conventional bonds, those on floating-rate debt go up as benchmark rates do, helping preserve their value.

“We’ve had a long 35 to 40 years of rate decline that has been a big support behind fixed-income investing, a big support behind equity multiples expanding, and so for those of us that live and breathe investing, it’s been a wind at our back for a long time,” said Dwight Scott, global head of credit at Blackstone, which manages $145 billion of corporate debt. “I don’t think we have the wind at our back anymore, but we don’t have the wind in our face yet. This is what the conversation on inflation is really about.”

Perhaps, then, it’s no surprise that SPDR Bloomberg Barclays Investment Grade Floating Rate ETF (FLRN) is among the handful of year-to-date winners.

The case for a portfolio of securities that reset rates looks compelling this year. By contrast, the outlook for junk bonds is more problematic. The high-yield spread is about 3.4 percentage points, close to a record low, based on BofA US High Yield Index Option-Adjusted Spread since 1996. The junk bond market, in other words, is priced for perfection – a potentially risky state of affairs in a world that’s eyeing reflation and rising interest rates.

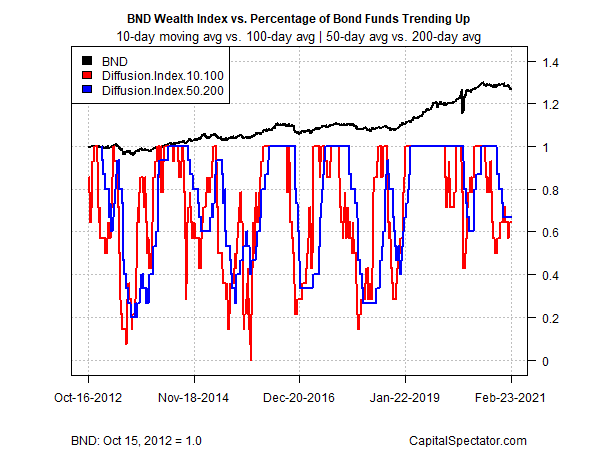

Despite the pockets of gains for some corners of fixed income this year, the asset class is stressed overall, based on profiling momentum with two sets of moving averages for all the funds listed above. The first measure compares the 10-day average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represent an intermediate measure of the trend (blue line). Using these indicators as a guide shows that a sharp change in sentiment has unfolded – a change that started coming into focus last autumn.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno