It’s premature to rule out the possibility that US inflation will peak in the months ahead, but recent projections that the peaking is imminent and will reflect a sharp decline in pricing pressure now looks unlikely.

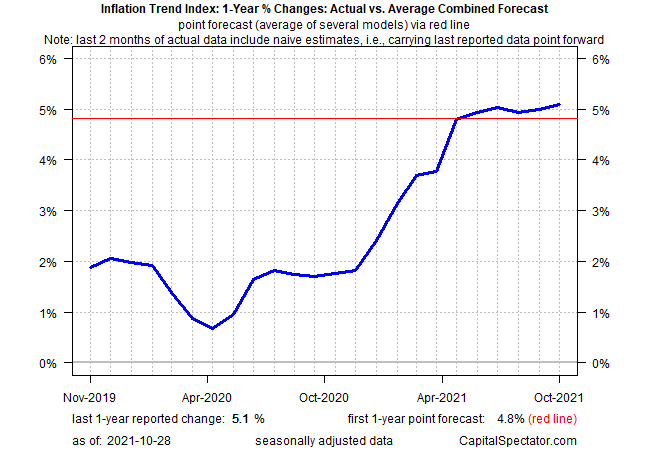

Today’s update of CapitalSpectator.com’s Inflation Trend Index (ITI), a multi-factor profile of pricing behavior that attempts to model real-time trending activity, suggests that the peaking process will extend for longer than recently expected. Also, ITI is now showing that the peak may be a bit higher than anticipated in the previous update, published earlier this month.

For context, let’s begin with the actual data via the Consumer Price Index (CPI), which rose 5.4% year over year through September at headline level — slightly higher than the 5.3% annual increase in the previous month. Core CPI, which removes food and energy prices and is thought to be a better measure of the trend, held steady at a lower 4.0% rate. That’s below June’s 4.5% peak, but core inflation is still running close to the highest pace in three decades.

ITI attempts to estimate how current and near-term pricing behavior is evolving in real time, based on the latest numbers for a range of data sets. Note that ITI is not a proxy for the government’s CPI; rather, ITI offers some forward guidance on how the upcoming CPI annual change may shift. On that basis, ITI is projecting that October’s CPI one-trend will hold steady or possibly tick higher before retreating modestly in November.

ITI’s new estimate for October is slightly higher than the Oct. 14 update and serves as a reminder that the inflation trend continues to show signs of holding steady if not edging higher.

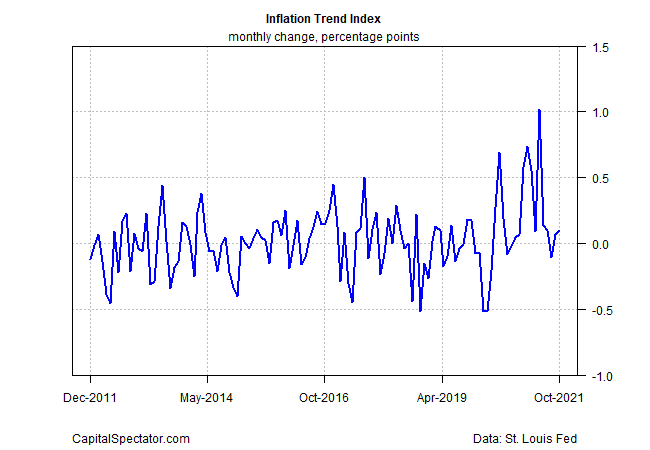

Monthly changes for ITI through October still indicate a relatively contained, stable profile after the surges recorded earlier in the year. But today’s revision shows a slight increase for this month vs. the flat performance previously reported.

The key takeaway is that elevated inflation is still expected to persist. The good news is that a further acceleration in CPI’s one-year trend appears to be a low-probability scenario, based on available data. On that basis, the upcoming October CPI report (scheduled for Nov. 10) is expected to post a one-year change that’s more or less in line with September’s update.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report