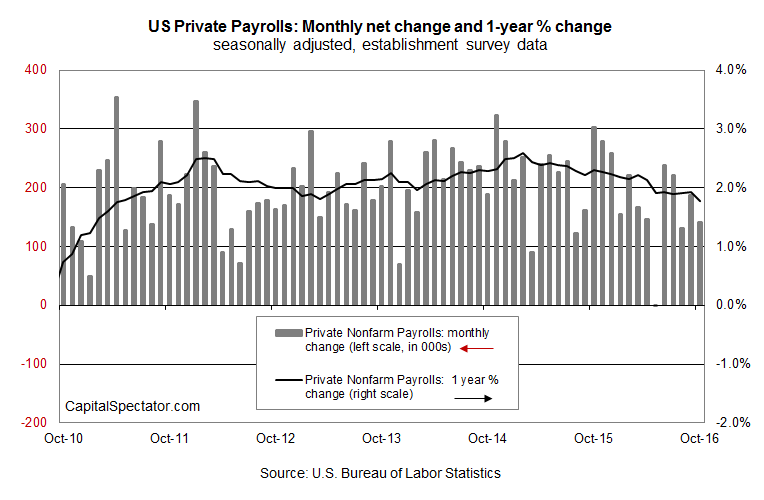

Today’s report on US employment reaffirms that slow and slower growth has taken root in the labor market. Companies added a modest 142,000 workers in October, down from an upwardly revised increase of 188,000 in September, according to this morning’s update from the Bureau of Labor Statistics. But the main event in today’s release is the year-over-year advance, which slipped to the softest pace since 2011.

Private payrolls increased 1.78% last month vs. the year-earlier level, marking the first dip below the 1.80% mark since May 2011. The sight of deceleration at this late date hardly comes as a surprise. Private employment growth in annual terms peaked in early 2015 at nearly 2.60% and has been generally ticking lower ever since.

But let’s put a positive spin on today’s data and note that the last key economic report before next Tuesday’s presidential election continues to show a healthy improvement in job growth. The only glitch: the generally upbeat profile is showing signs of age. That doesn’t mean that economic trouble is near. In fact, some economists argue that the generally slow growth in the economy overall may extend the business cycle for an unusually lengthy run.

In any case, the headlines this morning are focused elsewhere in today’s release, namely: the improvement in private-sector hourly earnings, which increased 2.8% in annual terms, the highest since the recession; and the dip in the jobless rate to 4.9%, which is close to lowest level since the recovery began.

Good news, of course, but the question is whether the trend in job growth will continue to slow? Recent history seems to lie firmly in the “yes” column.

The good news is that a 1.78% year-over-year increase still leaves plenty of room for more downshifting before entering the danger zone. Although every recession is different, the last three downturns suggest that annual growth for private employment that slips below the 1% mark is a sign that a new contraction is near if it hasn’t already started.

By that standard, the current report offers a cushion of nearly 80 basis points before a tipping point is reached. Conservatively, one can argue that the cycle has at least another year to run. In other words, the outlook is still mildly sunny, at least from the vantage of the employment trend. But gravity takes its toll eventually and it appears that we may be in the very early stages of deterioration—early enough so that the casual observer (and investor) can safely ignore such analysis.

Nonetheless, with the trend in job growth ticking down to a five-year low in a recovery that’s one of the longest on record, the economy may be increasingly vulnerable to shocks in the months ahead… including rate hikes.

“Today’s jobs report shows continued progress and strengthens the argument of Fed hawks who think it’s time to raise interest rates,” says Tony Bedikian, managing director of global markets at Citizens Bank.

Students of economic history will note that the Fed funds rate has been known to rise during periods when annual employment growth is slowing, which usually creates fertile ground for a new recession. Is this time different? Perhaps. Much has changed in macro and monteary realms since the Great Recession and so it would be naïve to assume that history is destined to repeat like clockwork. But no one really knows, which leaves us with the only option among mere mortals: watch the incoming data… closely.

Predicting recessions is a mug’s game, but nowcasting/backcasting the business cycle offers a degree of defense for managing risk (financial and otherwise) in real time. There’s no guarantee, of course, but in a world of bad options, it’s the only game in town.

Pingback: Slower Growth in the Labor Market - TradingGods.net