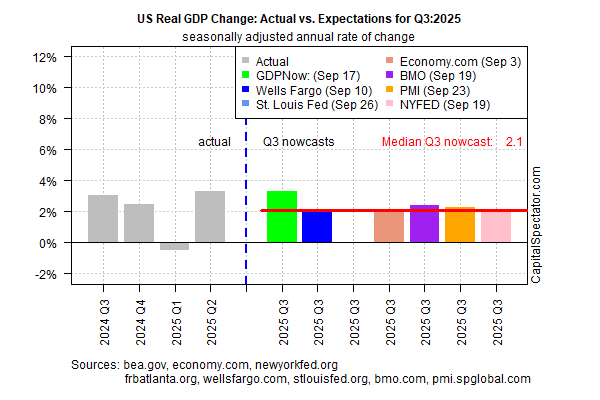

US economic growth is still on track to expand at a moderate pace in the third quarter, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com. The upbeat outlook follows last week’s decision by the Federal Reserve to cut its target interest rate to address concerns that the labor market is cooling.

Economic growth is projected to increase at an annualized 2.1% pace for the July-through-September period, according to the median nowcast. The estimate marks a substantially softer rise compared with the strong 3.3% increase reported for Q2. The Bureau of Economic Analysis is scheduled to publish its initial Q3 GDP report on October 30. Today’s update of the median estimate is unchanged from the previous estimate, published Sep. 16.

The Atlanta Fed’s widely-followed GDPNow estimate, one of the components of the median estimate, is the upside outlier, indicating a strong 3.3% increase for Q3 (as of Sep. 17) – matching the pace in Q2. Assuming the GDPNow data is correct, the Fed rate cut last week looks premature for an economy that’s still expanding robustly.

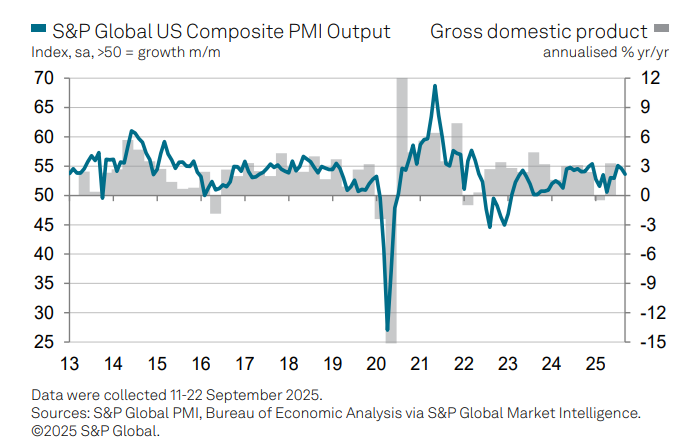

By contrast, yesterday’s release of PMI data, another input for the median estimate, suggests economic activity is cooling in September. Although the pace downshifted for a second month, “Further robust growth of output in September rounds off the best quarter so far this year for US businesses,” says Chris Williamson, chief business economist at S&P Global Market Intelligence.

Although there’s a fair amount of divergence among the individual nowcasts, the prevailing feature for most (per the median estimate): recession risk still looks low via the expected Q3 economic profile in GDP terms.