Consumer spending in the retail sector fell 0.3% in March, well below expectations for a modest increase, the US Census Bureau reports. The news is just one data point and so all the obvious caveats apply. Nonetheless, taking the numbers du jour at face value sends a dark message, in part because the reversal in sales last month took a substantial bite out of the year-over-year trend.

Spending is still higher in March vs. the year-earlier level, but the sluggish annual gain is worrisome nonetheless. The question is whether the latest reversal marks a turning point for the business cycle—or is the latest release just noise? No one knows at this point and a convincing answer is probably weeks away at the earliest, courtesy of deeper context via the incoming data from other corners. Meantime, let’s dig a bit deeper into today’s report.

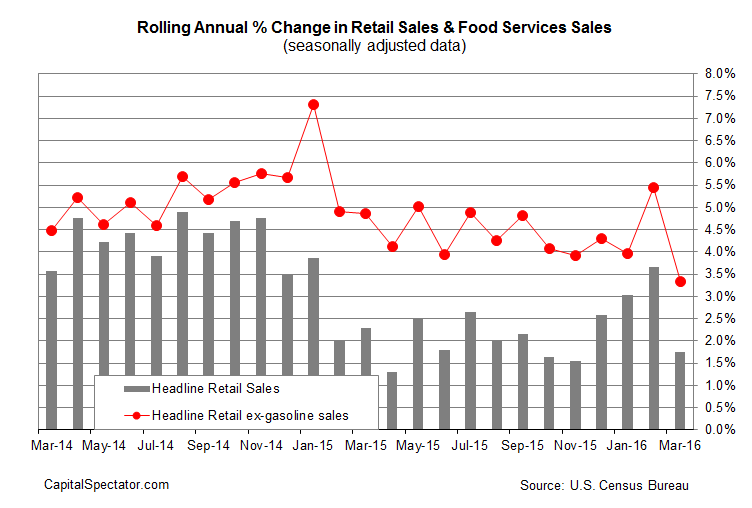

The soft data for March left the trend in retail sales close to its slowest growth rate since the recession ended in mid-2009. Spending advanced just 1.7% last month vs. the year-ago figure (seasonally adjusted data). The weak gain is troubling for several reasons. First, it’s a dramatic slowdown from the 3.6% year-over-year rate in the previous month. In addition, the 1.7% annual pace for March is uncomfortably close to the post-recession low of 1.3% (as of Apr. 2015). Note, too, that the current year-over-year rise is well south of the growth rate at the start of the last recession.

The main evidence for arguing that today’s disappointing sales data is noise is the firm growth in the labor market. Private payrolls in March posted the best annual gain in five months. Meantime, initial jobless claims continue to print near 40-year lows, based on numbers through the end of last month. As long as payrolls are advancing at a healthy clip and new filings for unemployment benefits stay low, there’s a good case for thinking that today’s soft retail sales report is a one-off event.

Note that a key reason for today’s weakness is the hefty retreat in auto sales. Stripping out this component (transactions at auto and parts dealers) reveals that headline spending rose 0.2% last month. Sales at general retail stores, such as Wal-Mart, were higher in March as well (+0.5%), which implies that the consumer appetite to spend is intact, excluding autos.

The bottom line: the jury’s out on what today’s numbers mean, if anything. But until (or if) we see convincing evidence to the contrary, it appears that the retail sector’s forward momentum has slowed. The big question is how the broad trend looks once this week’s numbers clear. The threat of a new recession remained low for the US as of the Apr. 10 edition of the US Business Cycle Risk Report. Will the upbeat tone survive with this weekend’s update of fresh data–including today’s retail figures? Probably, although it’s only Wednesday. Let’s see what the wind blows in for tomorrow’s weekly numbers on jobless claims and Friday’s monthly update on industrial production.

“We’re having a little bit of a soft patch here for the consumer, with no obvious rationale,” Michael Feroli, chief US economist at JPMorgan Chase, tells Bloomberg. “It’s definitely a softer start to the year. Provided job gains remain as strong as they’ve been, we expect consumer spending should be OK.”

Pingback: Consumer Spending Falls in March - TradingGods.net