The US government shut down last week, and markets barely noticed. If the closing of federal agencies, which is delaying key economic reports, is a risk factor, it’s not obvious on Wall Street. All the major asset classes continued to rally through for the trading week through Friday, Oct. 3, based on a set of ETFs.

Washington’s political stalemate continues today, and so federal agencies look set to stay closed in the days ahead. Will it matter for markets? Or will the promise of artificial intelligence keep the bulls focused on business opportunities and relegate political risk to a minor distraction?

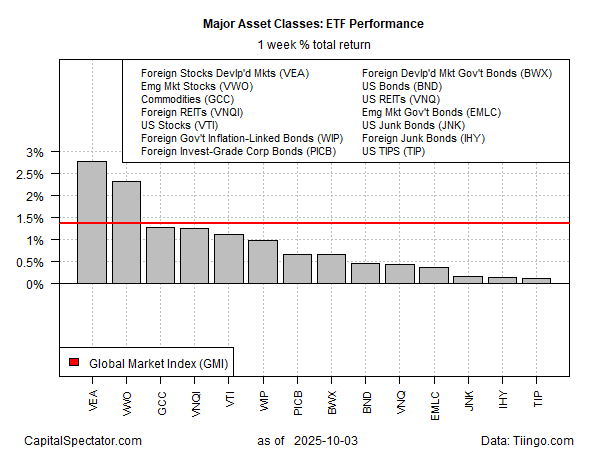

Foreign stocks in developed markets led last week’s rally. Vanguard FTSE Developed Markets ETF (VEA) rose 2.8%. Stocks in emerging markets (VWO) were a close runner-up performer, jumping 2.3%. US shares (VTI) also increased, advancing 1.3%.

The Global Market Index (GMI) participated in the party, too, and rose 1.4% last week. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for globally diversified multi-asset-class portfolio strategies.

Last week’s gains are all the more impressive when you consider that all the major asset classes continue to post gains for the year so far. For some observers, the everything rally suggests a degree of disconnect from reality:

“There’s a certain amount of nihilism,” Steve Sosnick, chief strategist at Interactive Brokers, told Yahoo Finance on Friday. “All news is good news, and no news matters. By not getting this [jobs report, which was postponed due to the shutdown], that’s one less impediment in the market’s relentless rise.”

Another chance for break in the political stalemate is scheduled this afternoon when the Senate is scheduled to reconvene and voted on a bill supported by Democrats to continue government appropriations. Republicans oppose the bill, which includes an extension of health care provisions.

For the moment, a solution to the impasse isn’t obvious. A key question for the week ahead: Will markets care, one way or the other?