Today’s payrolls report from Washington is ugly. The crowd was expecting that today’s jobs report from the Labor Department would show that US companies added 200,000 positions in September. Instead, the release shows that private payrolls increased by a weak 118,000. The good news is that the year-over-year trend is still ahead by a healthy 2.2% through last month. Unfortunately, the annual pace continues to decelerate. Does this add up to a recession signal for the US? No, not yet, but today’s update doesn’t help boost confidence that the worst will be avoided. As I’ve been discussing for the past month or so, macro risk for the US has been rising lately, even if it still falls short of a clear and reliable signal that the business cycle has turned negative (see here and here, for instance). Today’s employment report tips the scales a bit further toward a bearish outlook for the economy.

Monthly changes can be noisy, but it’s clear that the growth trend for US employment continues to slide. That’s a worrisome development and one that deserves close attention in the months ahead. The 2.21% rise in private employment last month vs. the year-earlier level is still a solid pace—if it holds. Unfortunately, the downside momentum of late suggests that even lesser rates of annual growth are coming. Meantime, last month’s year-over-year rise in private-sector jobs is the lowest gain since May 2014 and well below the cyclical peak of 2.71% in Feb. 2015.

Adding insult to injury, the initially reported August rise of 140,000 for private payrolls was revised sharply lower to a tepid 100,000 advance. As a result, the aggregate gain in private-sector employment for August and September is a soft 218,000—the smallest two-month increase in over three years.

Despite today’s disappointing numbers, September is unlikely to dispense a clear signal of a new recession for the US. The deceleration in growth for payrolls and other indicators certainly raise questions about how the macro trend will fare in the final quarter of the year. But for the moment, slower growth hasn’t crossed the line into recession, even if the risk of trouble is edging higher.

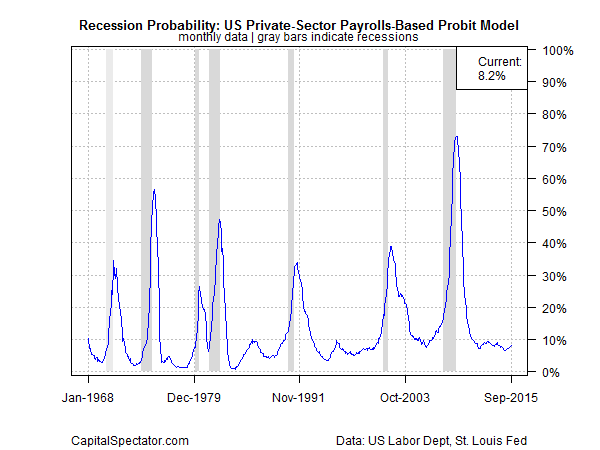

As one example, consider how year-over-year changes in private-sector US employment stacks up as a lone indicator for estimating recession risk via a probit model. As the chart below shows, the current probability estimate that September was the start of a new recession is still low— below 10%.

The caveat is that employment data tends to be a lagging indicator and so waiting for a clear signal with these numbers alone is asking for trouble. But there’s still a case for mild optimism from other corners, including initial jobless claims, which continue to align with a relatively upbeat outlook for the labor market and the economy overall (see yesterday’s post for details).

Meantime, a broad review of economic and financial indicators still points to modest growth for the US. But let’s be clear: even an optimistic view of the near-term must recognize that growth is slowing. That’s not in doubt. The mystery is whether the deceleration continues. If it does, a clear recession signal is lurking, probably at some point in the fourth quarter. We’re not there yet in terms of the September profile, but the US is flirting with the possibility that a contraction could start soon.

September almost certainly cleared the hurdle in terms of an NBER-based definition of recession. But we’re on high alert for signs that the trend is slipping over to the dark side, perhaps as early as October. Keep in mind that revision risk is now a threat, i.e., recent data that looks fine suddenly turns ugly with revised numbers.

Skirting a formal recession may turn out to be a close call, but this much is obvious: macro analysis for the US is going to be a white-knuckle ride in the remaining months of the year (and beyond?). For guidance on what’s coming, lets turn to Bette Davis’ character in the 1950 movie “All About Eve” and her famous response to the proverbial question: “Is it over or is it just beginning?” Rather than answering directly, she finishes her drink, walks up the stairs, turns and recommends to the crowd that it’s time to “fasten your seat belts. It’s going to be a bumpy night fourth quarter.”

Pingback: Payrolls Report Misses Expectations