Economists are expecting another decline in today’s June report on US personal income. That’s worrisome because this key indicator has been a relative laggard vs. the strong rebounds in employment, consumer spending and industrial production – collectively known in some circles as the Big Four economic indicators that capture the core of US macro activity.

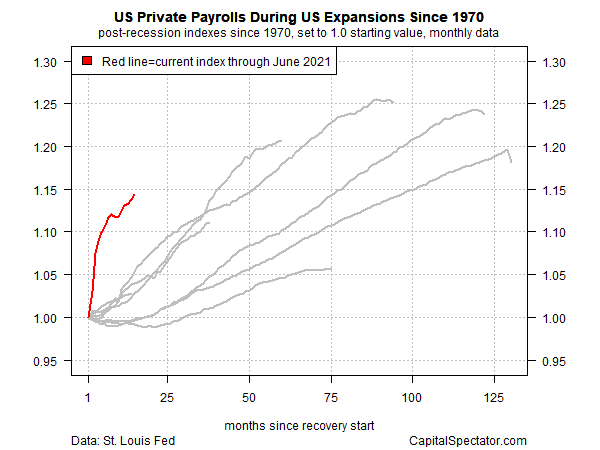

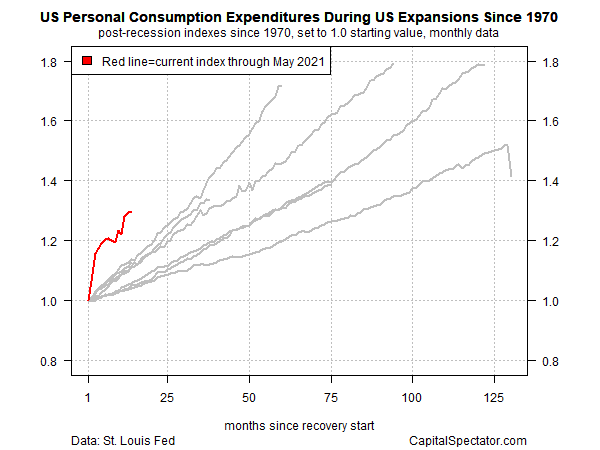

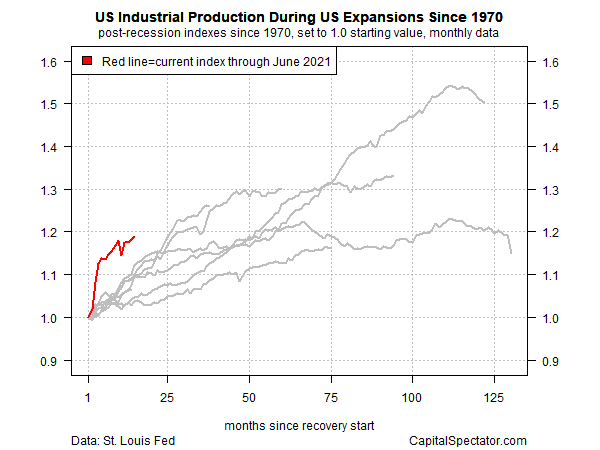

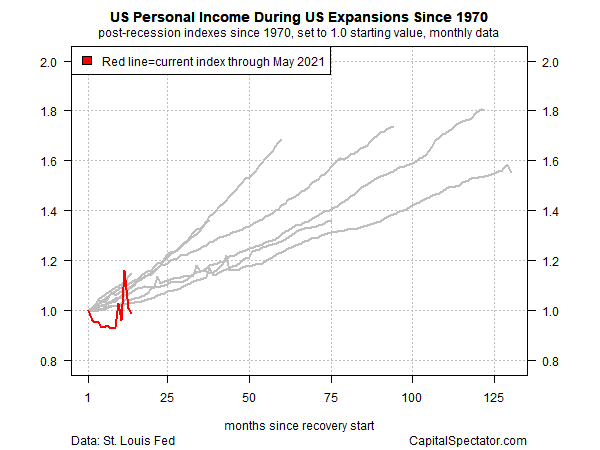

For perspective, let’s consider how each of these Big Four indicators has performed during the economic recoveries following each recession since 1970. There have been eight recessions over that span and so there are eight recovery periods, according to NBER. The current one began in May 2020 and in the charts below the numbers run through June 2021 for payrolls and industrial production. Personal income and spending data run through May 2021 — both indicators are due for a June update later this morning at 8:30 a.m. eastern.

Let’s start with private payrolls. As the first chart indicates, private employment has surged since the last recession ended (red line) — in absolute and relative terms. (All charts measure the relative change in expansions starting from trough of each recession, which is April 2021 for the most recent economic trough.)

Consumer spending and industrial production are also posting higher-than-normal rebounds in the current expansion.

The outlier on the downside is personal income. After an initial burst of growth (funded in no small part via government support), US personal income has stumbled. Relative to the end of the recession in April 2020, income has slipped modestly.

The weak trend in income can be attributed to the unusual nature of the last recession, which continues to linger on several fronts. In the modern era, a pandemic-triggered downturn is unprecedented. Apparently, so are the effects on personal income.

Since 1970, the weakness in income stands out as unusual and therefore represents a threat to otherwise strong economic expansion. It’s unclear how and when this weakness will affect economic conditions, but this much is clear: If personal income growth remains shaky, the anemic trend in this corner will eventually take a toll on consumer spending. As a result, the economic recovery appears to face stronger headwinds relative to “normal” recoveries.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

This is one of your best posts ever.

Richard, thank you for saying so. Yes, once I saw the divergence re: personal income, it hit me like a ton of bricks. Definitely worth watching. I’ll be posting updates.

–JP