Real estate shares surged last week, in the US and abroad, posting the strongest gains for the major asset classes, based on a set of exchange-traded funds.

Leading the rally: US real estate investment trusts (REITs), which surged last week. Vanguard US Real Estate (VNQ) rose 6.9% by the close of trading on Friday, Nov. 13, ending near its highest level since the coronavirus crash in March.

Foreign property shares were last week’s second-best performer. Vanguard Global ex-US Real Estate (VNQI) jumped 4.5%, extending the previous week’s rally and closing near the best level since early March.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

What triggered the sharp gains for real estate shares? One narrative is that last week’s upbeat vaccine news from Pfizer boosted confidence that economic activity and workplace habits will return to normal next year. In turn, the challenged economics of commercial properties will improve in 2021 as employees return to a regular office schedule.

“If everything continues to go well, we will start to deliver the vaccine end of this year, beginning (of) next year,” says Professor Ugur Sahin, co-founder and chief executive of BioNTech, which has partnered with Pfizer. “Our goal is to deliver more than 300 million of vaccine doses until April next year, which could allow us to already start to make an impact.”

Encouraging, but one REIT analyst still recommends caution for property shares, advising that the vaccine news doesn’t alter the market’s outlook for this sector. “Most investors were expecting widespread distribution of the vaccine in the middle of next year,” says John Kim, a REIT analyst at BMO Capital Markets. “It’s going to be a pretty tough next couple quarters, at least.”

Last week’s losses for the major asset classes were limited to bonds. The deepest setback was in foreign government fixed-income securities issued in developed markets. SPDR Bloomberg Barclays International Treasury Bond (BWX) eased 1.0%, cutting into the ETF’s sharp rally in the previous week.

The Global Markets Index (GMI.F) posted its second straight weekly advance. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, rose 1.8%.

For the one-year trend, US stocks continue to lead. Vanguard Total US Stock Market (VTI) is up 18.8% (including distributions) vs. the year-ago level (based on trailing 252 trading days).

Despite the recent rally, foreign property shares are still posting the worst one-year performance for the major asset classes: VNQI is down 5.9% for the trailing 12-month window.

GMI.F, however, continues to post a solid one-year gain and is currently up 12.4% as of Friday’s close.

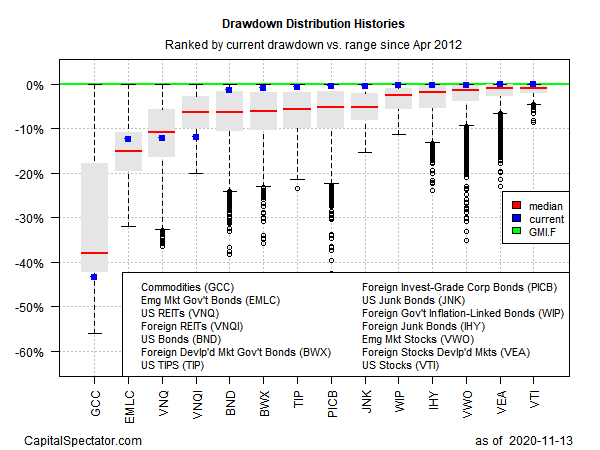

Looking at global markets through the lens of current drawdown, broadly defined commodities (GCC) are still deep in the hole with a drawdown in excess of -40%.

On the flip side, several corners of the global markets are posting virtually nil drawdowns, led by US stocks: VTI is just slightly below a record close.

GMI.F’s current drawdown is zero.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report