After flirting with an upside breakout for months, the US 10-year Treasury yield moved decisively to the upside in recent weeks and broke through a level that appeared to be a ceiling for much of the previous year.

Driving the benchmark yield higher: a combination of elevated inflation that remains persistent to date and rising confidence in markets that the Federal Reserve will start raising interest rates at its March 16 policy meeting. Reflecting these drivers, the 10-year rate closed at 2.03% yesterday (Feb. 16), fractionally below a 2-1/2 year high.

Notably, the 10-year rate is now trading above the 2% mark, which marks what is arguably a decisive move above the rate’s previous ceiling. If the ~2% level continues to hold in the days and weeks ahead, the shift will provide a stronger indication that pandemic-era lows have ended, at least for the foreseeable future.

What might derail this outlook? Two possibilities are on the short list. Demand for Treasuries could surge if the Russia-Ukraine crisis turns into a shooting war. Surprisingly weak US economic data could also trigger a resumption of the safe-haven trade that pulls yields down. But aside from those scenarios, a 2%-plus 10-year rate looks like a higher probability scenario for the near term.

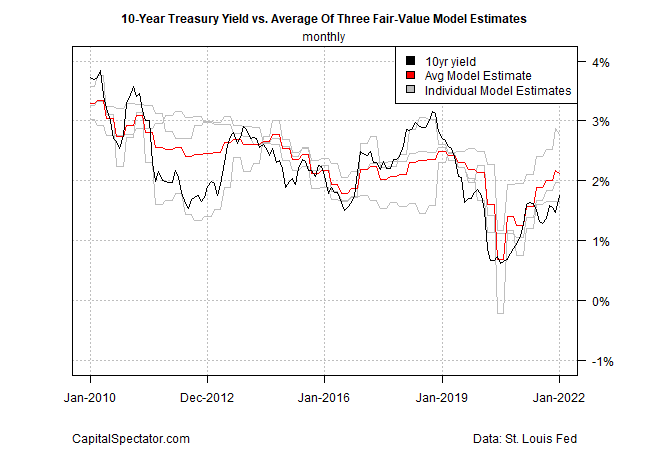

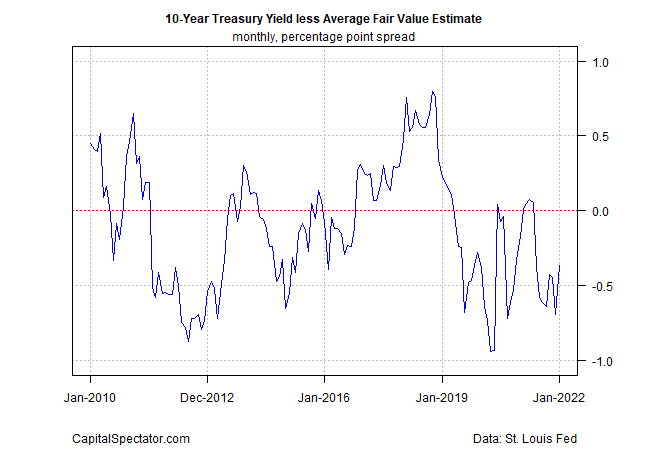

Another factor for expecting the 2%-plus level to hold is the CapitalSpectator.com’s average fair-value estimate for the 10-year yield (based on three models), which continues to reflect a moderate gap between the actual and modeled rate – a gap that still suggests an upside bias for the market rate.

Today’s January estimate marks the eighth straight month that the market-based 10-year yield traded below our fair value estimate. Last month’s negative 37-basis-point negative gap implies a flat to moderately higher 10-year rate for the near term, echoing the outlook in last month’s update.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report