All the world’s major equity regions continue to post year-to-date gains, but stocks in Eastern Europe/Russia, followed closely by US shares, are in the lead by a healthy margin, based on a set of exchanged-listed funds.

Monthly Archives: October 2019

Macro Briefing | 31 October 2019

Chinese officials raise new doubts about a trade deal with the US: Bloomberg

China’s official manufacturing PMI dips deeper into recession in Oct: CNBC

House set for first floor vote on impeachment today: The Hill

Federal Reserve cuts its target rate 1/4 point to 1.5%-1.75% range: Bloomberg

Fed rate cut prompts dissents from two Fed officials: WSJ

US GDP growth in Q3 eased slightly to modest 1.9% gain: MW

US private employment’s 1-year growth trend slips to 8-year low in October: ADP

Tracking Macro Factors In Portfolio Strategies

Earlier this month I briefly reviewed a recent BlackRock report that highlighted that macroeconomic factors are typically driving investment strategy results. As a follow-up, let’s take a quick look at a basic real-world example of analyzing portfolios through a macroeconomic lens.

Macro Briefing | 30 October 2019

Democrats outline impeachment procedures: The Hill

UK to hold general election in Dec, perhaps breaking Brexit deadlock: Reuters

Fed expected to cut interest rates again today: CNBC

Key points to watch in today’s Q3 GDP report: MW

US pending home sales rose in Sep, marking 3rd gain in past 4 months: MW

Consumer Confidence Index for US slipped in Oct but still reflects optimism: CB

US home prices rose 3.2% in Aug vs. year-ago level, up from 3.1% in July: CNBC

US 10yr-3mo Treasury yield curve rises to 7-month high of +0.20%:

US Q3 GDP Growth Expected To Tick Lower In October 30 Update

Tomorrow’s preliminary estimate for third-quarter economic activity in the US is on track to edge lower, based on the median estimate for a set of nowcasts. The government’s first round of Q3 data (due on Oct. 30) will likely show a modest pace of growth. The report also looks set to show that the economic trend decelerated, if only slightly, for a second straight quarter.

Macro Briefing | 29 October 2019

White House official to testify on Trump re: nat’l security and Ukraine: Politico

House set to vote this week to formalize Trump impeachment: Fox

US stock market (S&P 500) closed at record high on Monday: CNBC

China’s slowdown appears to continue in early read on Oct data: Bloomberg

Oil market expected to face excess supply in 2020, IEA forecasts: CNBC

Is the economy’s influence fading as a factor in elections? NY Times

US imports and exports fell in September as trade deficit narrowed: Bloomberg

Texas mfg growth decelerated in October: Dallas Fed

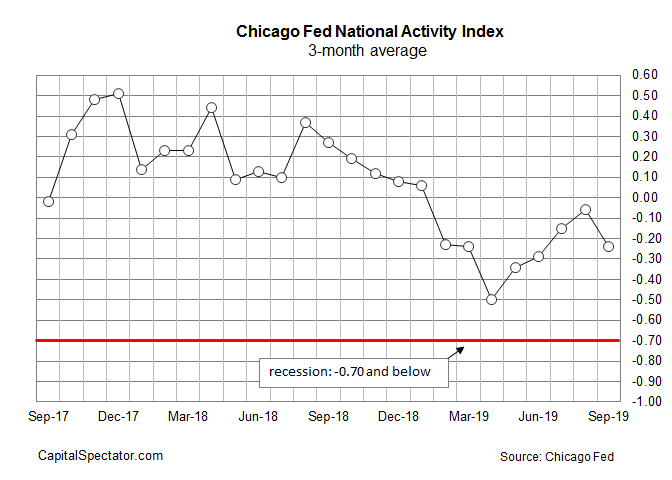

US growth, already at below-trend pace, eased further in Sep: Chicago Fed

Commodities And Global Equities Topped Market Gains Last Week

Commodities posted the strongest gain for the major asset classes last week, based on a set of exchange-traded funds. Equities generally were also in positive terrain for the trading week through Friday, Oct. 25.

Continue reading

Macro Briefing | 28 October 2019

ISIS leader is killed in US military raid in northwest Syria: The Hill

European Union grants UK a Brexit extension to January 31: Reuters

Bank lending to eurozone companies plunged in September: Reuters

Center-left Alberto Fernández wins Argentina’s presidential election: BBC

US Consumer Sentiment Index shows Americans remain optimistic: MW

NABE survey of economists: US business hiring falls to 7-year low: Fox

US budget deficit widens in 2019 to nearly $1 trillion, biggest gap since 2015: WaPo

Book Bits | 26 October 2019

● Overdoing Democracy: Why We Must Put Politics in its Place

By Robert B. Talisse

Summary via publisher (Oxford U. Press)

We live in an age of political polarization. As political beliefs on the left and the right have been pulled closer to the extremes, so have our social environments: we seldom interact with those with whom we don’t see eye to eye. Making matters worse, we are being appealed to–by companies, products, and teams, for example–based on our deep-seated, polarized beliefs. Our choice of Starbucks or Dunkin’ Donuts, Costco or Sam’s Club, soccer or football, New York Times vs. Wall Street Journal is an expression of our beliefs and a reinforcement of our choice to stay within the confines of our self-selected political community, making us even more polarized. Letting it bleed into these choices in every corner of our lives, we take democracy too far and it ends up keeping us apart. We overdo democracy.

Continue reading

The Revival In The US Equity Value Factor Rolls On

In mid-September I wondered if the nascent rebound in value stocks was more than a flash in the pan. A month later, this long-challenged corner of the equity market continues to show encouraging signs that a renaissance is intact, based on analysis of a set of exchange traded funds. It’s still a tentative recovery, but for the moment, at least, it seems that the value factor has a tailwind.