Is N. Korea planning a new hard-line anti-US policy? CNN

India’s Modi defends citizenship bill amid protests: BBC

China announces plans to cut import tariffs on wide range of goods: BBG

Russia vows to retaliate for US sanctions on new Russia-Germany pipeline: AP

Atlanta Fed’s GDPNow model estimates Q4 growth at +2.1%, matching Q3: AF

NY Fed’s Q4 GDP nowcast revised up to still-weak +1.3%: NYF

US GDP growth remains at +2.1% for revised Q3 data: CNBC

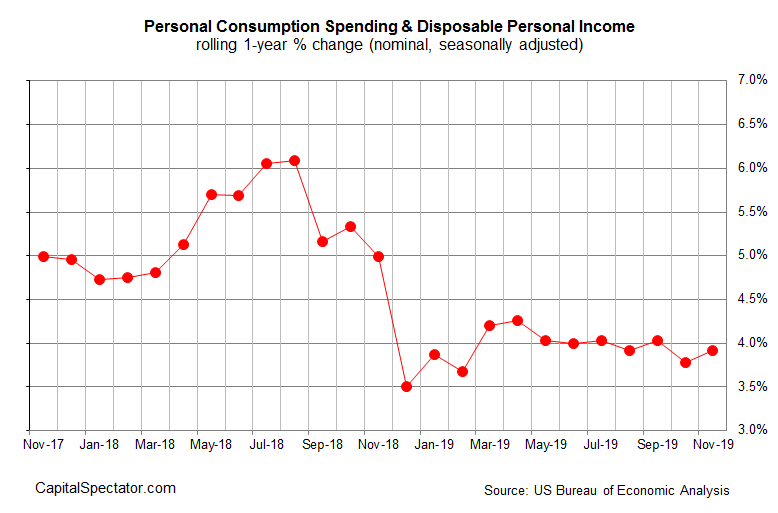

US consumer spending’s 1-year trend ticked up to moderate +3.9% in Nov:

Monthly Archives: December 2019

Best of Book Bits 2019 (Part I)

Another year over, which means it’s time for the annual look-back for The Capital Spectator’s weekly Book Bits column. In keeping with tradition, we’ll highlight ten titles that found their way to these pages over the course of 2019. The criteria that delivered the results below? Your editor found the books intriguing, entertaining and/or revealing for one reason or another. As usual, the short list will be carved into two equally digestible servings, starting with five today, followed with the balance next week. Happy reading!

Research Review | 20 December 2019 | Value Investing

Value Bubbles

Messaoud Chibane and Samuel Ouzan (Neoma Business School)

February 27, 2019

According to several extended behavioral theories, value profits should mirror momentum profits, and vary over time. We test these theories in the cross section of returns. Value returns depend on market states. From 1926 to 2018, following negative market return, the average so-called value premium is about three time its unconditional counterpart, whereas it appears to vanish following positive market return. Moreover, several short episodes of extreme losses in momentum strategy (momentum crashes) are contemporaneous with extreme value profits (value bubbles). Our results are robust to various time varying risk- based explanations.

Continue reading

Macro Briefing | 20 December 2019

House approves revised North American trade pact: WSJ

UK prime minister’s Brexit bill expected to pass in Parliament: CNBC

Diplomacy runs up against N. Korea’s Dec. 31 deadline for US talks: Reuters

US Leading Economic Index stabilized in Nov after falling for 3 months: CB

Existing home sales in US fell 1.7% in November: BH

Philly Fed Mfg Index: activity slowed in Dec to weakest growth in 6 months: PF

US jobless claims fell last week after spiking to 2-year high: MW

US Stocks Still On Track For World-Beating Performance In 2019

With only days left to the trading year, American shares look set to outperform the rest of the world’s major equity regions, based on a set of exchange-traded products listed in the US.

Continue reading

Macro Briefing | 19 December 2019

House impeaches Trump: Reuters

Pelosi may delay sending impeachment articles to Senate: Politico

Impeachment doesn’t worry investors: MW

Is North Korea preparing to test a long-range missile? CNBC

India detains thousands for defying ban on protests over citizenship act: BBC

Sweden’s Riksbank is first central bank to exit negative rates: RTE

Economists expect US expansion to continue in 2020 via new survey: WSJ

UK retail sales fell in Nov, 4th monthly decline–weakest run since 1996: BBG

10yr/2yr Treasury yld curve spread (via daily data) rises to 29bps, a 6mo high:

US Business Cycle Risk Report | 18 December 2019

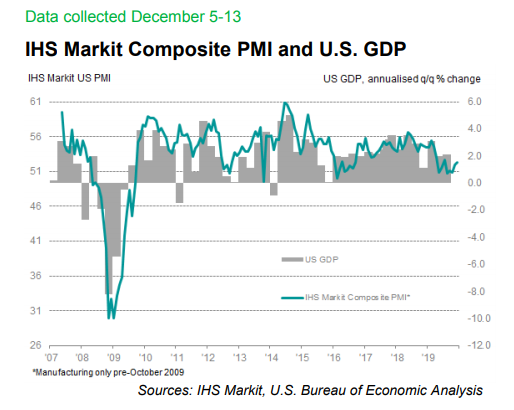

The US economy continues to reflect signs of stabilizing after a months-long period of downshifting. The possibility of a firmer expansion can’t be ruled out, but there are few convincing signs at this point. What is clear: recession risk remains low, as it has been all along (unless you cherry picked an indicator or two). As outlined below, reviewing a broad-minded data set still shows that output is increasing at a moderate pace and near-term projections for the US macro trend point to more of the same.

Continue reading

Macro Briefing | 18 December 2019

House set to vote on impeachment articles against Trump today: The Hill

Pondering Trump’s policy priorities if he’s re-elected: CNBC

German business sentiment improves in December: Ifo

Atlanta Fed’s Q4 GDP growth nowcast revised up to +2.3%: AF

US job openings rebounded in October after reaching 18-month low: Reuters

Industrial output in US rebounded sharply in November: MW

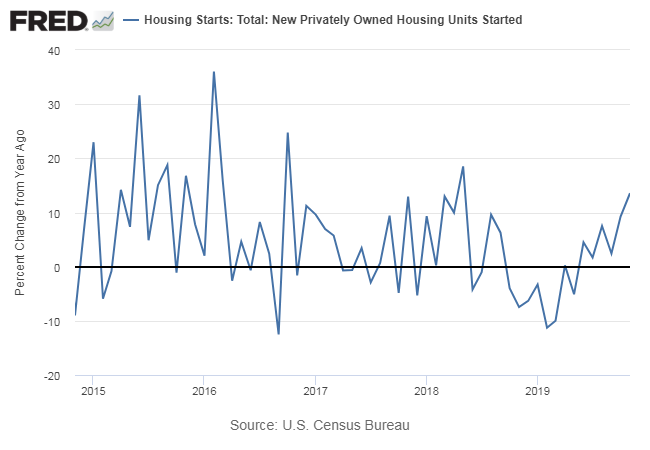

US housing starts’ 1-year gain accelerated to 1-1/2 year high in Nov: CNBC

Is The Treasury Market Transitioning For Reflation In 2020?

Amid signs that 2019’s slowdown in the US economy may be stabilizing, the US Treasury market appears to be flirting with firmer inflation expectations. It’s too early to know if the latest dance with reflation is noise or a preliminary signal, but the recent U-turns in the market’s implied inflation estimates deserve close monitoring in the weeks ahead.

Macro Briefing | 17 December 2019

Boeing will halt 737 Max production in January: CNBC

China and Russia seek to ease UN sanctions on N. Korea: Reuters

US budget proposal rises to $1.4 trillion: The Hill

Will slow job growth in Midwest threaten Trump’s re-election? NY Times

Is the US stock market poised for a ‘melt-up’ rally? MW

US homebuilder confidence jumps to 20-year high in December: CNBC

NY Fed Mfg Index continues to reflect soft growth in December: MW

US economy shows signs of strengthening in December: IHS Markit